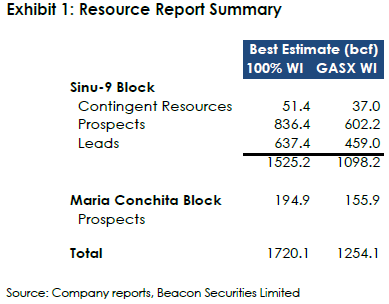

On March 18th, NG Energy (TSXV: GASX) released an updated estimate for their natural gas properties in Colombia. The Sinu-9 block saw Contingent Resources of 51.4 BCF, best estimate unrisked Prospective Resources of 836.4 BCF for Prospects and 637.4 BCF for Leads. In addition, NG Energy confirmed the best estimate unrisked Prospective Resources of 194.9 BCF and 2P Reserves of 34.6 BCF at its Maria Conchita block.

Beacon Securities, the only investment bank to have coverage on NG Energy, raised its 12-month price target on the company from C$2.60 to C$3 and reiterated its buy rating. Kirk Wilson, their analyst, headlines, “Resource Report Confirms Massive Natural Gas Potential.” Wilson adds that this report provides the company with considerably more upside than previously known.

These estimates have come in higher than eexpected. For Maria Conchita, the firms result came in at 195 bcf of perspective resources, which came in significantly higher than Beacon’s 165 bcf estimate. Meanhile Sinu-9 total resource potential is estimated by the company at 1.5 tcf, while Beacon’s estimate was just 1.0 tcf.

Wilson writes, “2P reserves and Contingent Resources underpin GASX’ value.” He notes that these two categories have the highest confidence, they should be the first two to be realized through the companies E&D efforts. Wilson comments further, “By applying the same $/mcf value to the contingent resources at Sinu-9 as Petrotech assigns to the Maria Conchita reserves results in potential value of C$143 million compared to the EV for GASX of C$158 million.”

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive has been compensated to provide coverage on this company. The company has been compensated to cover this story on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.