Elon Musk has seemingly found himself in a pickle when it comes to funding his purchase of Twitter (NYSE: TWTR). The much publicized acquisition has seen pundits across the financial world opine on the matter, with the latest theory being that Musk can simply walk from the deal by paying a $1.0 billion break fee.

Quite simply, it’s not that easy.

As Twitter user @chancery_daily has highlighted several times on her feed, there is a narrow area within the merger agreement that allows for termination of the agreement. Within the document, Article 8, Section 8.1 applies to the potential termination of the deal.

ok, ok, ok, we're doing this again. we're really doing this again.

— The Chancery Daily (@chancery_daily) October 5, 2022

we're doing the why it's not OK to still believe that "elON cAn jUst pAY $1b AnD WaLK" again.

1/ pic.twitter.com/oz3t9EieqU

Let’s walk through it.

For reference, Parent refers to Musk’s X Holdings and related firms, while Company refers to Twitter.

The first portion, section 8.1(a) indicates that termination could come about by mutual written agreement of each of Parent and the Company, which plainly is not the current situation that Musk finds himself in.

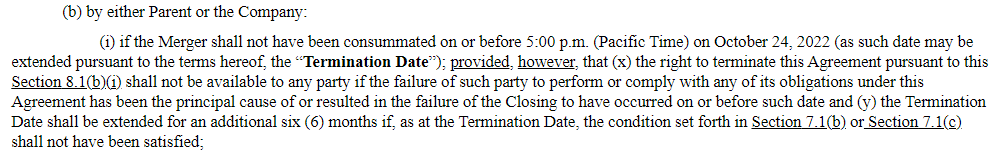

Section 8.1(b) meanwhile states that the agreement may be terminated by either Parent or the Company (i) if the merger has not been closed by October 24, 2022, provided that either party has not failed to comply or perform under the agreement – which again excludes this option for Musk, given his repeated attempts to cancel the arrangement.

Part (ii) of this section applies to governmental authorities blocking the deal, which again does not apply, while part (iii) applies to the failure of Twitter to secure shareholder approval for the transaction, which does not apply as shareholders voted to approve the deal in September.

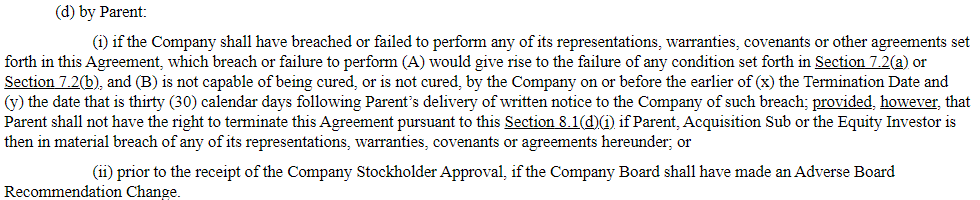

The ability of Musk and his companies to actually terminate the deal are rather quite narrow, and are outlined under section 8.1(d). Two options exist here for Musk.

Under section (i), he may terminate the deal if Twitter was found to have breached or failed to perform any of its representations, warranties, covenants or other agreements set out in the agreement. This option remains unavailable to him, given that it is the clause he attempted to execute upon already, resulting in the ongoing lawsuit which lead to him resuming the transaction.

And finally under section (ii), Musk can terminate the deal if “prior to the receipt of the Company Stockholder Approval, if the Company Board shall have made an Adverse Board Recommendation Change.” This again does not apply, as again, Twitter has received stockholder approval to proceed with the transaction. The board has also not made an adverse board recommendation change, again nullifying this option for Musk.

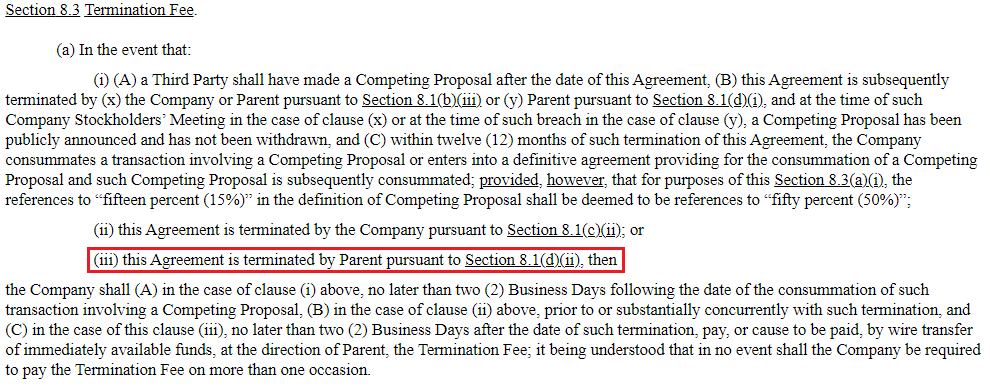

Given that Musk has no way out, Section 8.3, which applies to the termination fee payable, does not apply. This however is where pundits are identifying that Musk could simply walk from paying the fee. Under section 8.3(a)(iii), Musk can only pay this fee based on a termination under 8.1(d)(ii), which pertains to an adverse board recommendation change.

In short: Musk seemingly has no easy way out of the merger arrangement. Perhaps that’s why due diligence is typically done before signing on the dotted line in merger agreements.

There is, of course, the potential for Twitter and Elon to come to a mutual agreement outside of the arrangement, as suggested by Bloomberg contributor Matt Levine.

It's cute that you still think Elon can walk away for a $1b fee.

— SmallCapSteve (@smallcapsteve) October 7, 2022

Your ghostwriters should read the merger agreement.

The termination fee only applies to 8.1(d)(ii) – which of course, requires Twitter's board to have an adverse board recommendation. https://t.co/yjU4kP0mR2 pic.twitter.com/Y6W3BlYfhD

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Her feed. Chancery Daily is a lady. 🙂

Thanks for the correction.