This morning, Noram Ventures (TSXV: NRM) provided an update on the status of its Zeus lithium claystone project located in central Nevada. The company is currently planning for a drill program to be conducted in the second half of the year, along with a preliminary economic assessment that will follow.

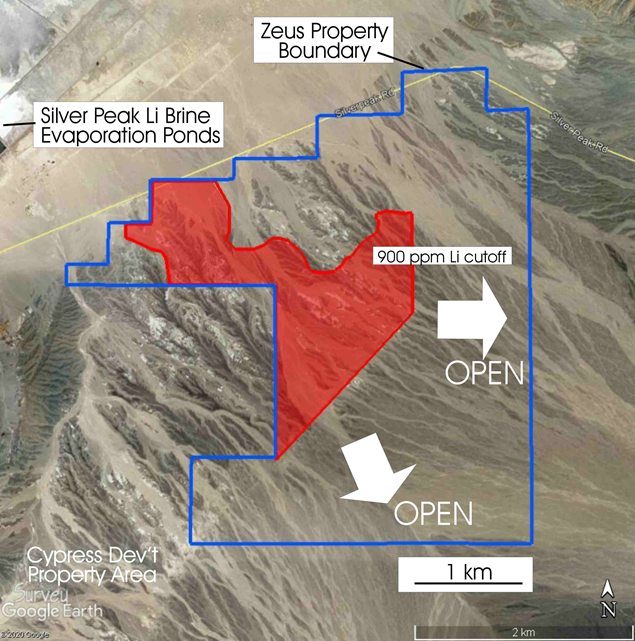

The drill program, as previously released, is currently slated to consist of 1440 metres of drilling. Each hole is expected to be 120 metres deep, with a total of 12 holes to be drilled. The stated depth is a result of the claystone known to extend to depths of up to 120 meters across much of the property. The intent of the program is to upgrade the indicated and inferred resources into measured and indicated, while also extending the deposit to the south and east of the current resource.

In terms of a current resource, the Zeus lithium deposit has 124 million tonnes at 1136 parts per million (ppm) lithium as indicated resource, and a further 77 million tonnes lithium at 1045 ppm as inferred resources, which is at a base case of 900 ppm cut off. This results in 749,421 tonnes and 427,653 tonnes of lithium carbonate equivalent respectively.

Furthermore, this resource estimate does not currently include over two square kilometres of claims owned by Noram Ventures that has yet to be drill tested, providing ample further opportunity to increase the resource estimate.

Nearby, Cypress Developments, whom is adjacent to the Zeus property, has a similar lithium claystone deposit within the same formation in the Clayton Valley. A preliminary economic assessment conducted on that property revealed all-in operating costs less than US$4 per kilogram of lithium carbonate. Given the proximity to Zeus and the same geological formation, it is expected that results are to be similar for Noram – which suggests a significant operating margin as a result of lithium carbonate prices being nearly double at US$7.25 per kilogram.

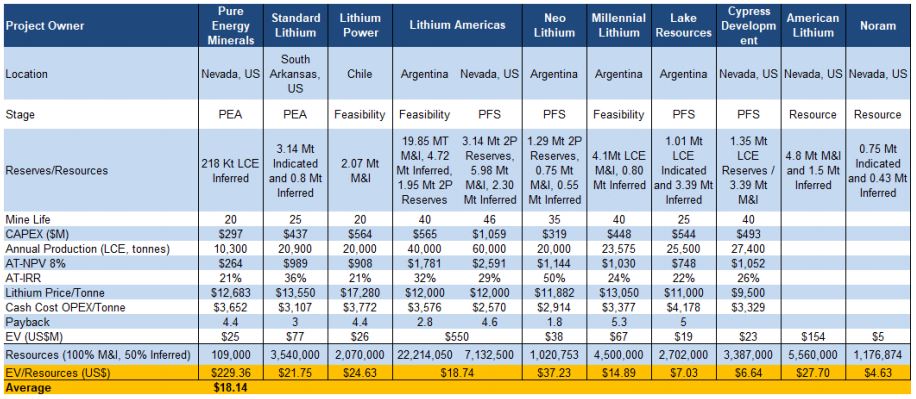

Recently, Fundamental Research Corp published a research report on Noram, indicating that it is undervalued relative to its peers. On a comparable basis, the company is valued at under US$5 per tonne, while comparable juniors tend to trade in the range of US$18 per tonne. Additionally, Cypress Developments, its next door neighbour, trades at roughly US$7 per tonne. The full report can be found here.

Noram Ventures last traded at $0.20 on the TSX Venture.

FULL DISCLOSURE: Noram Ventures is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Noram Ventures on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.