On June 21st, Nutrien (TSX: NTR) raised their first half 2021 earnings per share guidance by $0.30 to $2.30 to $2.50 and announced that since the potash market has continued to tighten, they have upgraded capacity. They expect an additional half-million tonnes of potash of production output, after the June 7th half million tonne increase. These increases bring their expected potash sales volume to 13.3 – 13.8 million tonnes.

Off this news, a few analysts raised their 12-month price target on Nutrien, bringing their consensus 12-month price target to $66.71, up from $64.89, based on 20 analysts. Of those 20, three analysts have strong buy ratings, 13 have buy ratings, three have hold ratings and one analyst has a sell rating. The street high comes from Raymond James with an $82 price target and the lowest sits at $58 from Atlantic Equities.

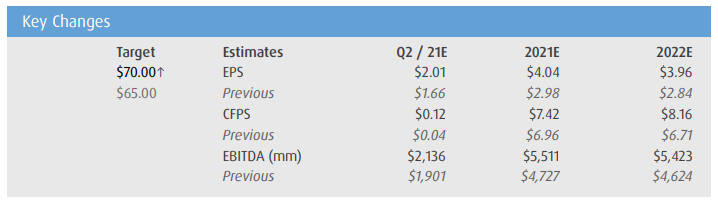

BMO Capital Markets raised their 12-month price target to $70, from $65, and reiterated their outperform rating, calling this the dream scenario for Nutrien. The main reason for the raise is BMO marking-to-market their model for the recent fertilizer price surges and increased volume guidance by Nutrien. They believe that the average price now sits between $25-$70 per tonne but writes, “While we don’t see spot Brazil potash, NOLA urea, and Tampa DAP holding $500/t, $450/st or $660/t (all decade highs), we see prices still ending 2021E strong with Q4E averages of $425/t, $330/st and $520/t respectively.”

BMO believes that Nutrien can fill the gap for sanctions against Belarusian potash. They write, “We surmise NTR wants to make sure stakeholders understand NTR has much excess capacity in case the EU wants to really target Lukashenko.”

Below you can see BMO’s updated second quarter, 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.