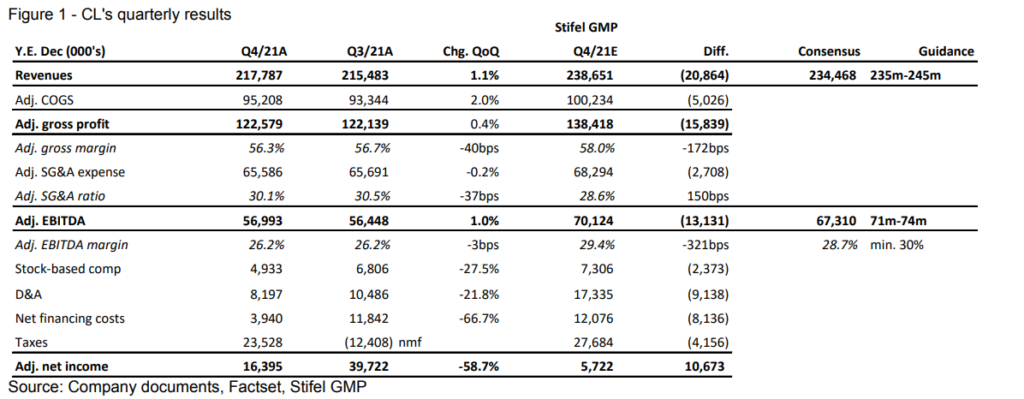

On March 23rd, Cresco Labs (CSE: CL) announced its fourth-quarter financial results, which disappointed many investors as the company put up less than stellar earnings. The company announced fourth quarter revenues grew from $215.48 million in Q3 to $218 million this quarter, putting it at one of the slowest revenue growth rates in the space. The $218 million in revenues came in way below the street consensus of $234.7 million.

The company reported adjusted EBITDA of $57 million for the quarter, or 26% of the company’s total revenue, while they maintained a strong gross profit margin of 50.5%. Cresco noted that it saw a little over $100 million in wholesale revenue, which puts it at the #1 seller “of branded cannabis products in the U.S. with leading share in the flower, concentrates, and vape categories.” It also reported that retail revenues increased 10% sequentially and same-store sales grew 28% year over year.

Lastly, the company reported positive cash flow from operations of $38 million, and as of December 31st the company had $224 million of cash and equivalents on its books.

But before the company released its financial results, it announced that it would be acquiring Columbia Care (NEO: CCHW) in an all-stock deal valued at approximately US$2 billion to create “the New Leader in Cannabis.” The combined entity would have a footprint of 18 different states with a #1 market share in Illinois, Pennsylvania, Colorado, and Virginia, with a #2 market share in Massachusetts, and would boast a pro-forma revenue estimate of over $1.4 billion, making it the highest revenue-generating public cannabis company.

Cresco Labs anticipates that the deal will close by the end of this year. Columbia Care shareholders will receive 0.5579 Cresco shares per Columbia Care share, which roughly equates to US$3.64 per share, or a 16% premium to the current share price. There is a $65 million break fee payable to Cresco Labs in cash.

A number of analysts lowered their 12-month price target on Cresco Labs, dragging the 12-month consensus price target down from C$22.38 to C$19.27, or a 154% upside to the current stock price. Cresco Labs has 17 analysts covering the stock with 5 analysts having strong buy ratings, 10 analysts have buy ratings and 2 have hold ratings on the stock. The street high sits at C$40, or a 430% upside to the current stock price.

Stifel-GMP sent out a harsh note to investors, wherein they downgrade Cresco Labs from a buy to hold rating and absolutely gut their 12-month price target, bringing it down to C$8 from C$30 previously. They are obviously taking a more cautious approach after the company’s less-than-stellar fourth quarter results and believe there is a chance the Columbia Care deal does not close.

On the results, Stifel-GMP was expecting revenues to come in at $238.7 million, missing the estimate by almost $21 million. The same thing goes for adjusted EBITDA, which Stifel-GMP expected to be $70.1 million, the actual result came in $13 million below their estimate. Though, they said the company’s SG&A was impressive and a “bright spot” to the results as it’s been stable for the last three quarters “despite closing four acquisitions representing over $380m in transaction value at the announcement during that period.”

Stifel-GMP commented, “Limited visibility of benefits to greater West Coast exposure,” as they believe that the company has historically had a large exposure to California, only until recently when the company pivoted away due to headwinds in the state. They write, “it seems CL is refocusing on CA in addition to adding CO, another mature and competitive West Coast market with less attractive margin profiles.”

Onto Stifel’s thoughts on the acquisition of Columbia Care. To start, they believe the main rationale behind this deal is that Cresco Labs will gain “greater scale in existing markets and defend margins while widening exposure to new markets for capture growth opportunities.”

Now for the bad parts. Stifel believes that there are risks on the sides of both companies for the deal to not close. They say that Columbia Care’s initial support is only 25% of the company quite low. They write, “Given share performance and our discussions with investors thus far, we believe there is a risk of not meeting the required threshold.” They also believe the regulatory tape around this deal, in which Cresco Labs needs approval in 17 jurisdictions, which include some states that are “likely overloaded,” could result in a material delay in the closing time. The last point they make is that there is no termination fee payable to Columbia Care, they view this as a risk for the deal to close given Cresco Labs’ recent M&A track record, which includes 3 terminated deals and $300 million in impairments stemming from the closed acquisitions.

Lastly, they say that introducing new execution risk during such a “pivotal” time in the industry is a large no-no. They believe that Cresco Labs now has “a formidable task of closing and integrating CCHW.” Though, this is not the only company it will be potentially integrating, as it still needs to integrate 5 other companies. They write “we believe this environment creates

competing priorities for management which will likely be challenging.” They expect that this could lead to Cresco Labs not being able to fully capitalize on its opportunities until these transactions get digested.

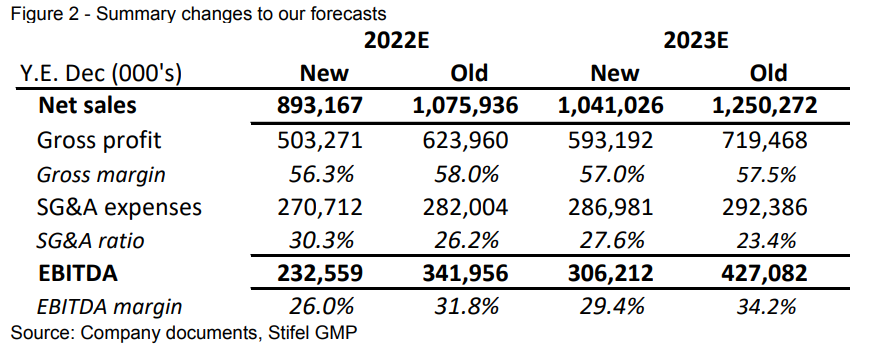

Below you can see Stifel-GMP’s updated full-year 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.