On August 10, Nuvei Corporation (TSX: NVEI) reported its second quarter financial results. The company reported revenues of $178 million, which grew over 100% since last year. The company reported a gross profit of $145.1 million, also growing over 100%. The company had a gross margin of 81.4% The firm also posted a net income of $38 million and earnings per share of $0.26.

More than half of the 12 analysts covering the name raised their 12-month price targets on Nuvei, bringing the analyst consensus to $109.69, up from the prior $88.29 consensus price target. Out of the 12 analysts, 3 have strong buy ratings, 7 have buy ratings, and 2 analysts have hold ratings. The street high sits at $134.40 from Cowen and Company while the lowest target comes in at $84.

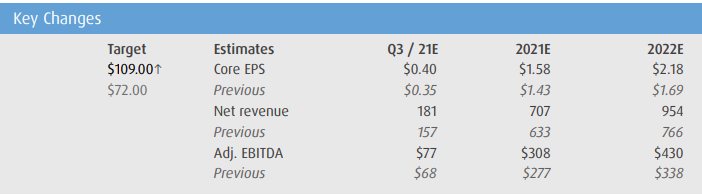

BMO Capital Markets was one of the firms to increase their price target. They increased their target to $109 from $72 and reiterated their market perform rating, saying that the company is growing revenue faster than expected.

BMO had a $0.36 earnings per share estimate and the consensus was $0.34, while revenue grew over 100% which was primarily driven by higher volumes and better take rates. They also say that the Nuvei updated guidance is extremely bullish, with them expecting $88-91 billion in volume, and $690-705 million in revenue.

Below you can see BMO’s updated third quarter, 2021, and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.