NVIDIA (Nasdaq: NVDA) announced Wednesday its financial results for the fiscal first quarter of 2024, ended April 30, 2023. The report highlights a topline revenue figure of $7.19 billion, an uptick from Q4 2023’s revenue of $6.05 billion but a decline from Q1 2023’s revenue of $8.29 billion.

Refinitiv consensus estimates for the quarter put the firm’s revenue at $6.52 billion.

The gross margin increased to 64.6% this quarter coming from 63.3% last quarter but a decline from 65.5% last year. The firm also recorded $2.14 billion in operating income, up from both last quarter’s $1.26 billion and last year’s $1.87 billion.

Further down the financials, net income also jumped during the quarter to $2.04 billion compared to $1.41 billion last quarter and $1.62 billion last year. The quarterly income translates to $0.82 earnings per diluted share.

Adjusted for financial calibrations, non-GAAP net income came in at $2.71 billion, up from last quarter’s $2.17 billion but still down from last year’s $3.44 billion. Non-GAAP earnings also translated to $1.09 per diluted share, beating estimates of $0.92 earnings per share.

But what took the headlines away is the firm’s revenue guidance for the next quarter. Nvidia is calling for record revenue of $11 billion for the fiscal second quarter, plus or minus 2%. The guidance beats the street estimate of $7.15 billion.

The bullish revenue prediction seems to be stemming from the firm’s bet on the evolving AI industry.

“The computer industry is going through two simultaneous transitions — accelerated computing and generative AI,” said CEO Jensen Huang. “A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.”

Huang added that the firm is significantly increasing its supply, with the entire data center family of products in production, to meet surging demand for them.

Continuing the guidance, the tech firm anticipates gross margin to land at 68.6% in the next quarter, 70.0% on a non-GAAP basis vis-a-vis the 66.8% it posted in Q2. Operating expenses, which came in at $2.51 billion this quarter, is expected to increase to $2.71 billion next quarter.

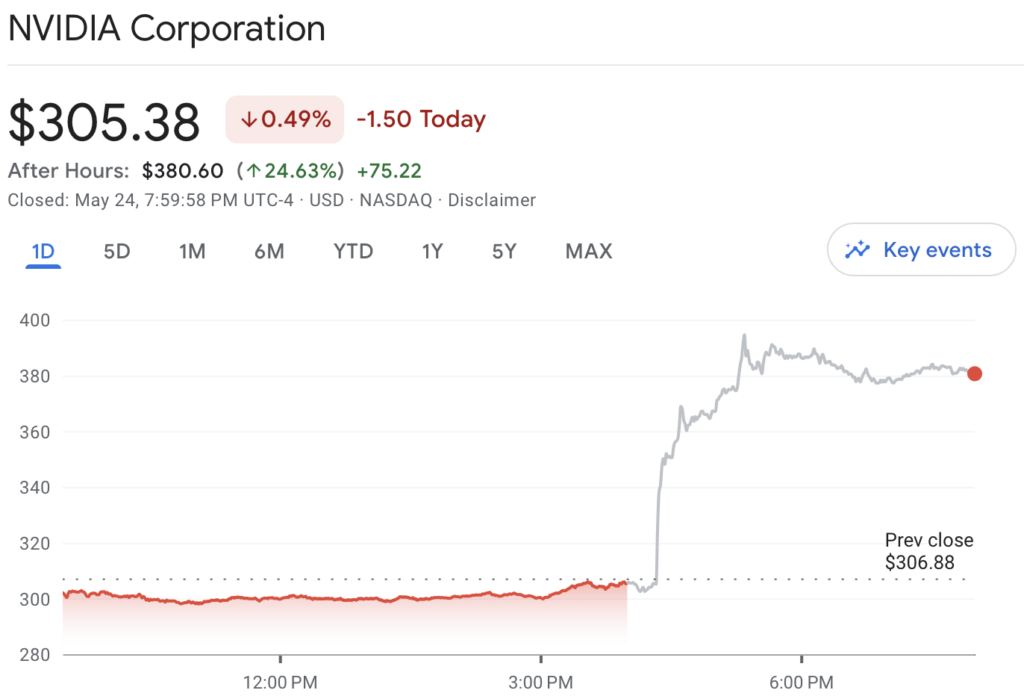

Following the release, the firm’s stock soared nearly 25% after hours, hitting an all-time high record.

To figure out what $Nvda is worth we simply take the $4b revenue beat, annualize it, assume 100% incremental margins, and apply 100x earnings to the multiple and that’s how the stock is up 20% AH.

— The Great Pivot Pythia (@PythiaR) May 24, 2023

Easy.

Crazy stat: $NVDA's post-market gain > nearly all of the revenue its generated since the company's inception. $NVDA

— Not Tiger Global (@NotChaseColeman) May 24, 2023

Nvidia’s data center segment reported $4.28 billion in sales, compared to $3.9 billion expected, a 14% rise year on year. Demand for Nvidia GPU chips from cloud suppliers as well as significant consumer internet companies, who utilize Nvidia processors to train and deploy generative AI applications like OpenAI’s ChatGPT, Nvidia said, drove performance.

The firm’s strong data center performance demonstrates that AI processors are becoming increasingly crucial for cloud providers and other businesses that manage huge numbers of servers.

However, Nvidia’s gaming sector, which includes the company’s graphics cards for PC sales, reported a 38% reduction in revenue to $2.24 billion, compared to $1.98 billion expected. Nvidia attributed the drop to a slowing macroeconomic backdrop as well as the ramp-up of the company’s latest GPUs for gaming.

Nvidia’s automotive branch, which includes processors and software for developing self-driving cars, climbed 114% year over year but remained modest, with sales of less than $300 million for the quarter.

Operating cash flow generated during the quarter came in at $2.91 billion while free cash flow ended at $2.64 billion. These compare to last quarter’s $2.25 billion operating cash flow and $1.74 billion free cash flow, and last year’s $1.73 billion OCF and $1.35 FCF.

The firm ended the quarter with a $5.08 billion cash and cash equivalents balance from a starting balance of $3.39 billion. The company’s current assets balance ended at $24.88 billion while current liabilities came in at $7.26 billion.

NVIDIA last traded at $305.38 on the Nasdaq.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.