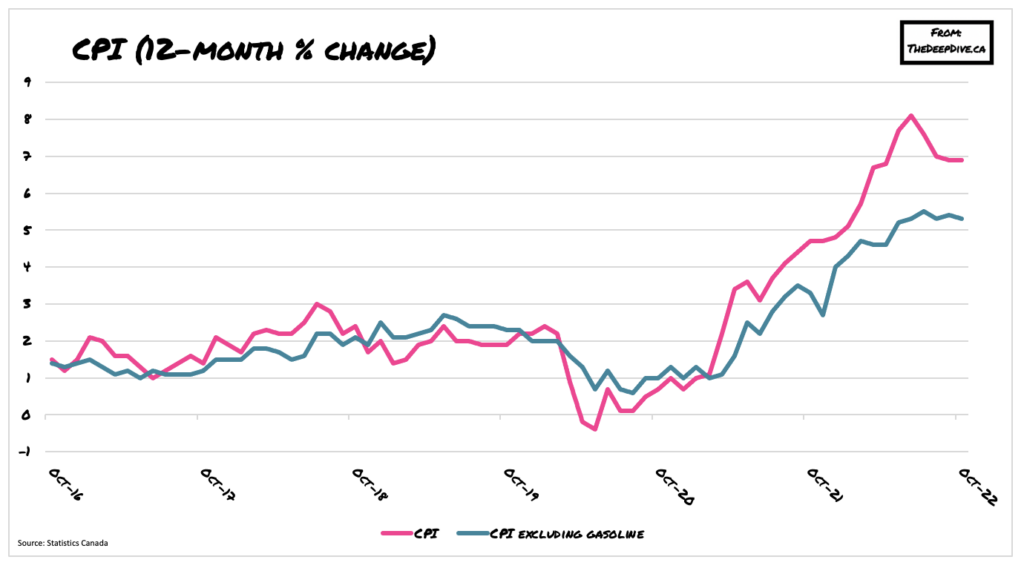

Consumer prices remained historically elevated in October, thanks to ongoing increases in gasoline prices and mortgage costs.

Canadians continued to pay 6.9% more for goods and services compared to October 2021, after the CPI jumped 0.7% month-over-month— the largest such gain since June 2022. Core CPI, which does not account for food and energy, rose 5.3% annually following a 5.4% increase in September.

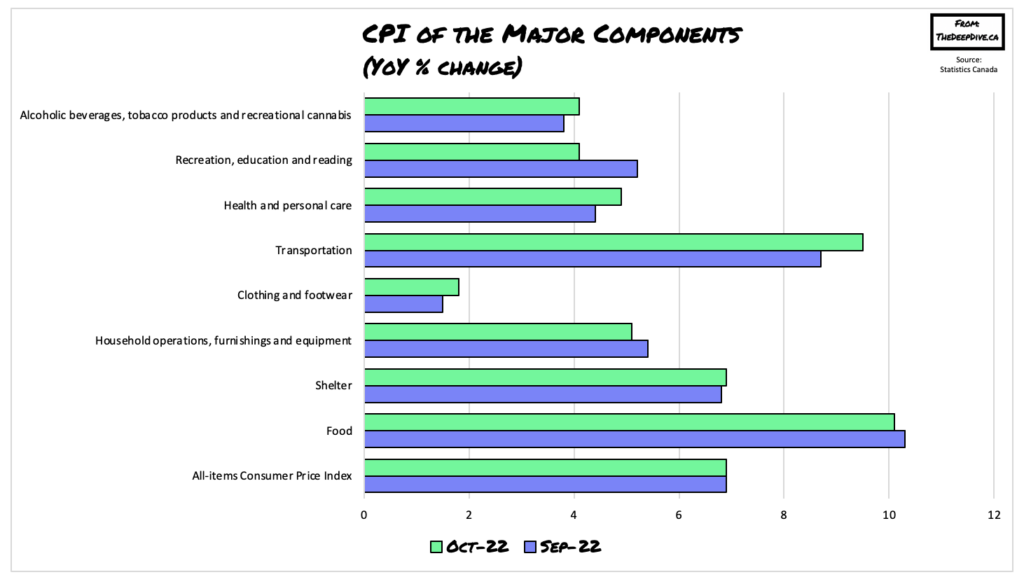

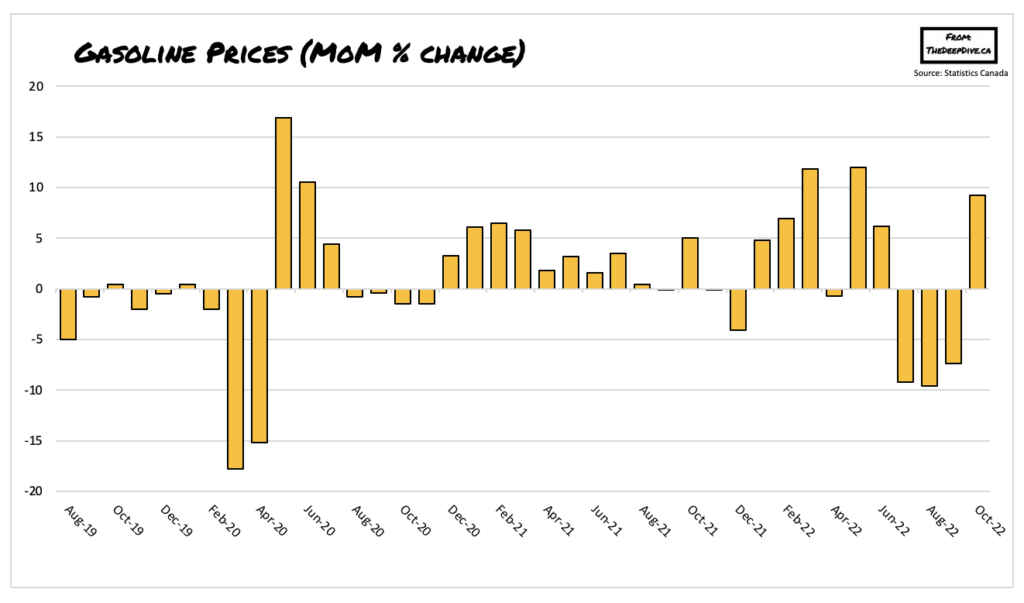

Much of last month’s increase was attributed to higher gasoline prices at the pump, which rose 9.2% following a 7.4% decline in the month prior. The stark reversal in fuel prices comes after OPEC announced substantial crude production cuts, coupled with a weakened Canadian dollar relative to its US counterpart. On an annual basis, the price of gas rose 17.8%, after increasing 13.2% in September.

Meanwhile, Canadians continued to pay more for homeownership, as mortgage interest costs jumped 11.4% compared to October 2021— the sharpest year-over-year increase since February 1991. Conversely, the homeowners’ replacement cost index, which is linked to new home prices, decelerated to 6.9% last month after rising 7.7% in September.

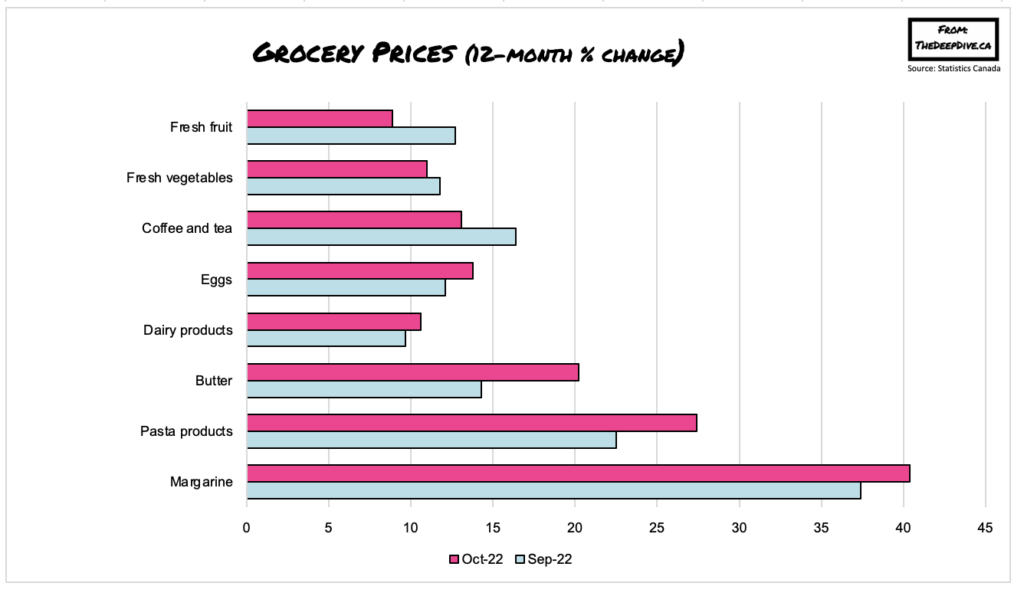

Food price growth also slowed in October, albeit at a paltry rate. Canadians still paid 10.1% more for food last month, which is slightly less than the 10.3% year-over-year increase reported in September. However, for food purchased from stores, grocery prices continued to rise at a faster annual pace than overall CPI for the 11th straight month, increasing 11% from October 2021.

And, lastly, Statistics Canada reported that average hourly wages increased 5.6% from one year ago, implying that, on average, consumer prices rose at a faster rate than wages, further stripping away at Canadians’ purchasing power.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.