Wholesale used-vehicle prices experienced a notable drop in October, as indicated by two major reports in the automotive market.

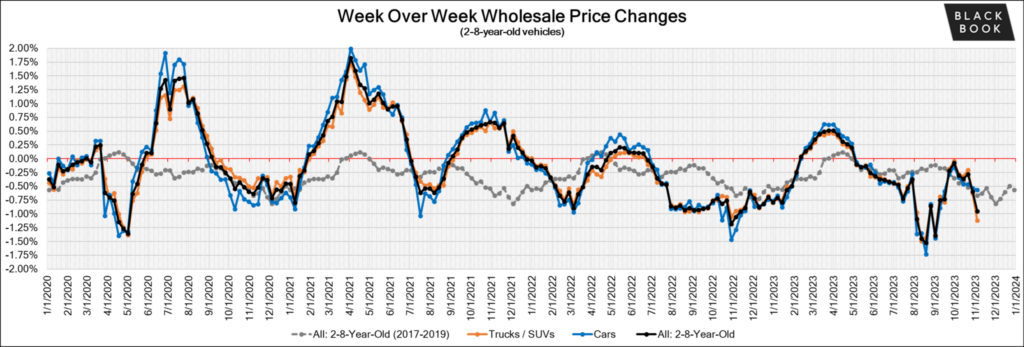

Black Book’s recent market insights, published in the week ending November 4, highlighted a return to higher-than-typical seasonal wholesale price depreciation. This shift was attributed in part to the United Auto Workers (UAW) and the Detroit 3 automakers reaching tentative agreements to conclude a strike that had been ongoing since September 15.

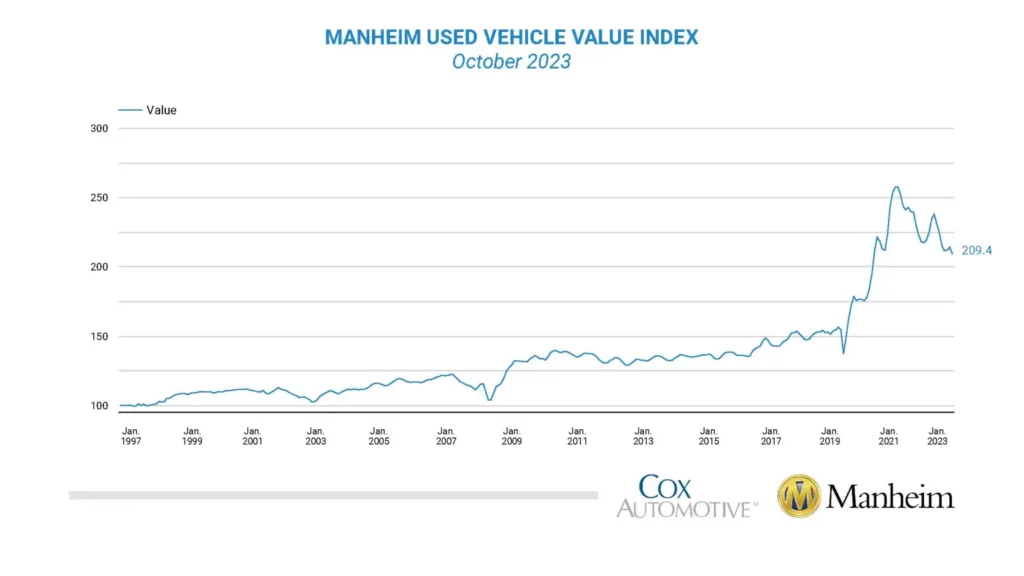

Cox Automotive’s Manheim index, which measures wholesale used-vehicle prices by tracking sales at Manheim’s US auctions and applying statistical analysis, reported a 2.3% decline in October compared to September.

This figure was adjusted for factors such as mix, mileage, and seasonality. Cox Automotive’s Senior Manager of Economic and Industry Insights, Chris Frey, mentioned that the resolution of the UAW strike played a role in avoiding potential price increases.

The strike’s timely resolution prevented dealers from seeking more aggressive alternatives in the wholesale market due to potential new vehicle inventory shortages.

The Manheim index for October was 4% lower compared to the same month in 2022, though seasonal adjustments helped mitigate the impact. Unadjusted figures showed a 3.1% decrease from September and a 6.3% decline year over year.

Related: Subprime Auto Borrowers Hit Record-High in Loan Delinquencies

Additionally, the average nonadjusted wholesale prices for 3-year-old vehicles, the largest model year cohort at Manheim auctions, fell by an aggregate 3.6% over the last four weeks.

Cox Automotive estimated that retail used-vehicle supply in the United States reduced to 49 days at the end of October, down from 50 days in September and 54 days in October 2022. Wholesale used-vehicle supply was estimated at 27 days at the end of October, up from 26 days in September but down from 28 days in October 2022.

Information for this story was found via Black Book, Cox Automotive, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.