Oil futures rose late in the day today as we head into tomorrow’s scheduled OPEC+ meeting which is anticipated to result in production cuts globally for oil. The commonly used benchmark of West Texas Intermediate (WTI) rose as high as $26.41 per barrel in intraday trading, coming off the days low of $23.72.

The rise is largely related to larger signs that production cuts will be agreed to by the nations joining in on the virtual call, with Algeria’s oil minister today indicating that production cuts “may reach 10 million barrels a day” among participating nations as reported by Energy Intel. The market reacted positively to this news, despite US President Donald Trump providing similar figures late last week before making tariff threats over the weekend.

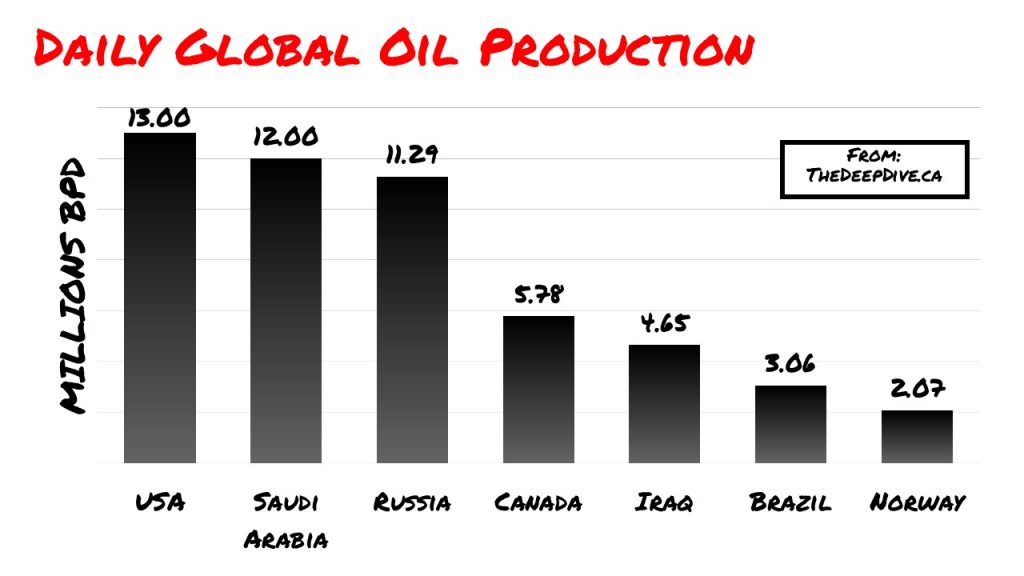

Energy Intel has also reported that Russia is willing to cut production by as much as 1.6 million barrels per day (bpd) under an Opec+ deal, which would equate to roughly a 14% cut to production. This cut may be in question however as a result of the US no longer planning to take part in the production cuts, or the meeting at all for that matter.

I'm not participating in the OPEC+ call tmrw but if I were I'd say at least 20mbpd in cuts are needed & the US will cut at least 4mbpd in next 3 mos organically. If nothing is done inventories fill up in 2mos, at which point the world will need to cut as much as 30mbpd. #OOTT

— ryansitton (@RyanSitton) April 8, 2020

According to a report issued earlier by ZeroHedge, Russia is unlikely to commit to production cuts if the US is not involved in similar cuts. The US is currently outputting approximately 13 million bpd of oil as of the end of March, while Russia was outputting slightly less at 11.29 million bpd.

Should a deal not be reached in tomorrow’s meeting, a further decline in the price of oil is anticipated by many, with the worldwide benchmark of Brent Crude, currently trading in the range of $33.00, expected to fall near the $20 a barrel mark. Should that occur, WTI will be expected to trend even lower, while Western Canadian Select likely to flirt with negative pricing.

Negative oil for WCS is becoming a more likely scenario, with Alberta’s Premier Jason Kenney stating as much yesterday. Indicating that there’s a “very real possibility” for negative oil, he outlined the threat that it means for Alberta’s primary industry, with the provinces budget deficit expected to balloon to C$20 billion in such an instance. The price per barrel for WCS has swung wildly as of late, touching as low as $3.92 this morning before climbing back to $7.31 based on data from BNN Bloomberg.

West Texas Intermediate meanwhile last traded at $26.05.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.