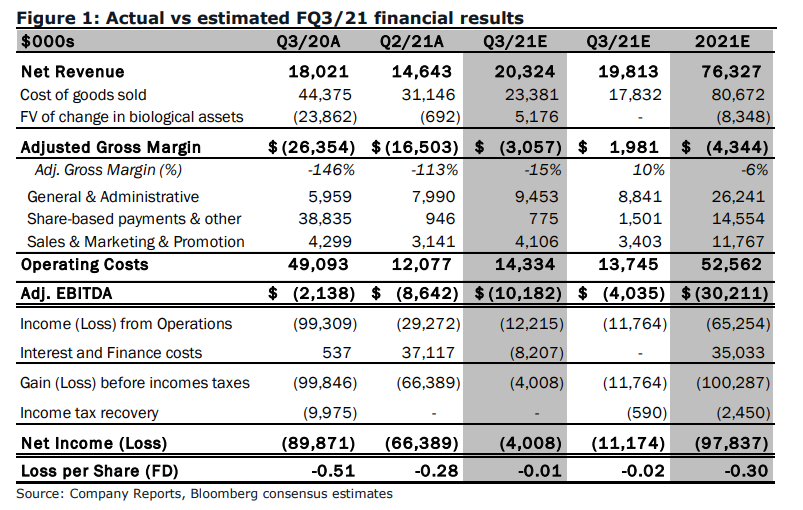

On July 13th, Organigram Holdings (TSX: OGI) (NASDAQ: OGI) reported their fiscal third-quarter results. The company announced top-line revenue of $20.3 million, a 39% increase quarter over quarter and 13% year over year. The companies adult-use net revenue segment grew 40% over the last quarter to $16.8 million. The company had a negative gross margin before fair value adjustments of $3 million and had a net loss of $4 million.

Two analysts increased their 12-month price targets following earnings, bringing the 12-month average price target to C$3.93. The company has 14 analysts covering the stock, with the street high sitting at C$5.95 from Cantor Fitzgerald and the lowest comes in at C$2.50. Out of the 14 analysts, one analyst has a strong buy rating, two have buys, and the other 11 have hold ratings.

In Canaccord’s note on July 13th, they reiterate their C$3.50 price target and hold rating, saying that the top-line growth still didn’t move the needle towards profitability. The results generally came in below their estimates.

Below you can see Canaccord’s estimate versus the results. Canaccord estimated that revenue would come in at $19.8 million. They say that the increase was primarily due to “a normalization of ~C$7M of lost revenues in the prior quarter due to production and processing constraints.” COVID-19 headwinds and lower provincial demand however still damped the growth in the adult-use segment. Canaccord believes that the companies $22 million in cash on hand will be sufficient for all “near-to-medium-term operating losses and planned Capex spend.”

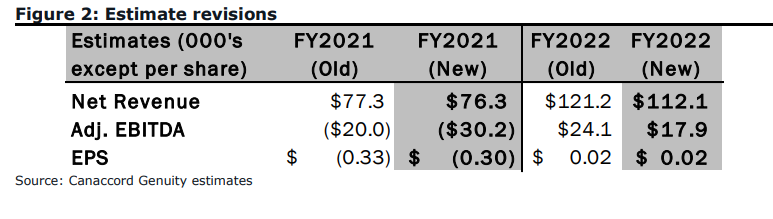

Below you can see Canaccord’s revised 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.