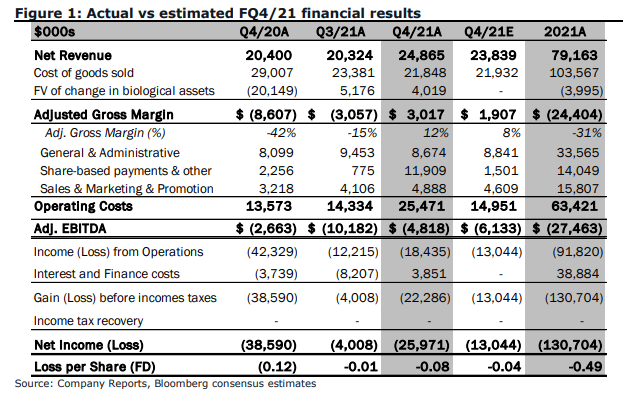

On November 23rd, Organigram Holdings (TSX: OGI) announced its fourth quarter fiscal 2021 results. The company reported net revenues of $24.85 million, up 22% year over year, while the cost of goods sold came in at $25.87 million greater than the net revenues. The firm also reported adjusted EBITDA of ($4.82) million and a net loss of $25.97 million. While the company reported a 7% market share in the Canadian recreational cannabis market, up from 5.4% last quarter.

A number of analysts cut their 12-month price targets on Organigram, bringing the average to C$3.55, or a 32% upside to the current stock price. Organigram has 12 analysts covering the stock, with 1 analyst having a strong buy rating, 2 have buy ratings and 9 have hold ratings. The street high sits at C$5.50 from Cantor Fitzgerald while the lowest sits at C$2.65.

In Canaccord’s fiscal fourth quarter review note, they reiterate their hold rating but lower Organigram’s 12-month price target to C$3.00 from C$3.50, saying, “An encouraging end to the fiscal year while macro challenges remain.”

For the quarterly results, Organigram came in slightly below Canaccord’s revenue estimate of $23.84 million but beat their adjusted gross margin estimate by almost $1.1 million. Canaccord says that the revenue and adjusted gross margin beat is due to Organigram increasing market share this quarter thanks to its SHRED value-priced flower and edibles.

Canaccord says that the quarterly results are overall better than their estimates but say “adj GM% is still ~1,800bp below levels on a YoY basis, as overall pricing in the sector continues to contract.” They additionally warn that the company has a significant portion of revenues derived from the value segment and that this segment will continue to see margin compression.

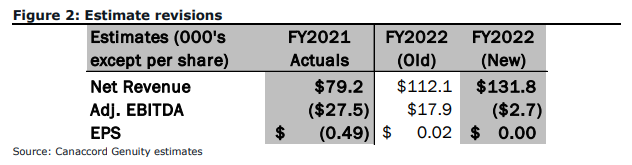

Below you can see Canaccord’s updated fiscal 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.