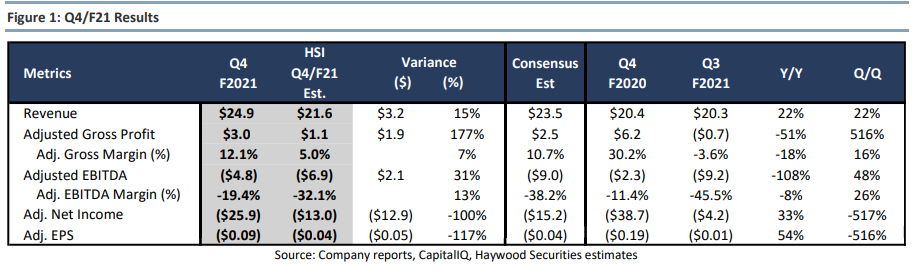

On November 23rd, Organigram Holdings (TSX: OGI) announced its fourth quarter fiscal 2021 results. The company reported net revenues of $24.85 million, up 22% year over year, while the cost of goods sold came in at $25.87 million greater than the net revenues. The company reported adjusted EBITDA of ($4.82) million and a net loss of $25.97 million. The firms market share meanwhile grew to 7%, up from 5.4% last quarter.

A number of analysts cut their 12-month price targets on Organigram, bringing the average to C$3.55, or a 32% upside to the current stock price. Organigram has 12 analysts covering the stock, with 1 analyst having a strong buy rating, 2 have buy ratings and 9 have hold ratings. The street high sits at C$5.50 from Cantor Fitzgerald while the lowest sits at C$2.65.

In Haywood’s fourth quarter review they lower their 12-month price target on Organigram to C$3.00 from C$3.50 and reiterate their hold rating. They say that the company reported better than expected quarterly results but are keeping the stock at a hold rating, “as we await further evidence on revenue growth and margin expansion to support positive EBITDA.”

For the quarterly results, Haywood forecasted revenue to be $21.6 million, which Organigram beat due to adult-use sales coming in higher than expected. Adjusted gross profits came in at $3 million, $1.9 higher than forecast. The results came in higher than expected due to the company taking market share away from competitors.

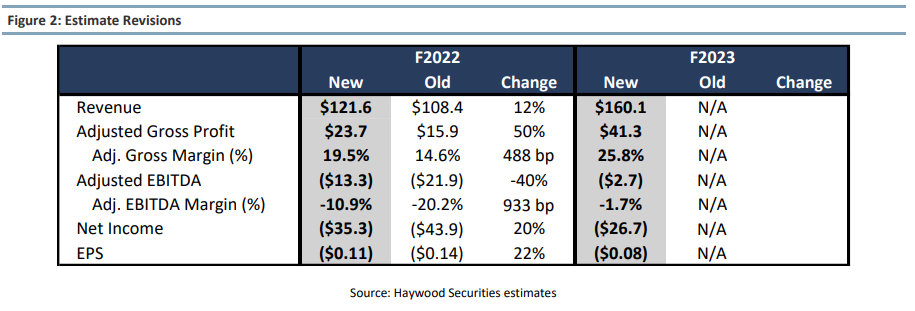

Lastly, you can see Haywood’s updated fiscal full year 2022 and new 2023 estimates. They say that they have bumped their gross margins due to the quarterly results but are still below the company implied guidance.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.