At the tail end of August, Peloton Interactive (NASDAQ: PTON) reported its fiscal fourth quarter and year end financial statements. For the fourth quarter, the company reported $937 million in revenues, up 54% year over year but down 25% sequentially. Gross profits came in at $253.6 million, down 43% sequentially, while the gross margin was 27.1%, down from the 35.2% last quarter. The company had a (32.3%) operating margin and earnings per share of ($1.05.)

The company also reported connected fitness subscriptions grew to 2.33 million and digital subscriptions to 874,000. Total members grew to 5.9 million.

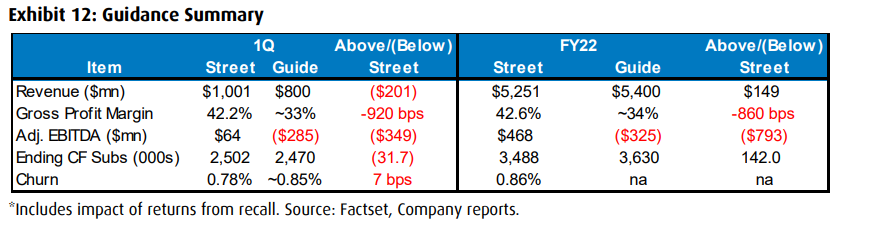

The company is guiding for $800 million in revenue, 2.47 million connected fitness subscriptions, and a gross profit margin of 33% for the fiscal first quarter. Further, the company is guiding for 3.63 million connected fitness subscriptions, $5.4 million revenue, and a gross profit margin of 34% for the full fiscal 2022 year.

The company also announced they would be slashing their prices on the bike and that there was a material weakness in the companies internal reporting.

It seems like analysts slightly raised their 12-month price target to $134.60, from $133.46 last month. There are 28 analysts covering Peloton with 8 having strong buy ratings, 14 have buys, 4 have holds and 2 have sell ratings. The street high sits at $185 from KeyBanc Capital Markets, while the lowest comes in at $45.

The bear, BMO Capital Markets, reiterated their $45 price target and underperform rating on Peloton after their earnings, starting the note off by writing, “When companies have little competition, they don’t need to market or promote. When competition arises, so does the need for marketing and discounts.”

BMO says that sales growth slowed down this quarter while digital subs fell. Net sales grew 54% while the last 4 quarters sales grew >100%. This is the same for CF sales, which grew 38% below the >100% average for the last 4 quarters. Subscription sale growth also dropped, but very slightly to 132% from 144% last quarter.

They believe these results are primarily due to a lower barrier to entry into the market. The company beat CF subscribers by 56,000 but digital subscribers saw their first decline since the fourth quarter of 2019. BMO writes, “the decline could be attributed to conversion into all-access pass… or it could be attributed to a material churn…”

BMO believes that the company is having somewhat of a hard time selling bikes, as the company has just reported its second price decrease of the year. The price this year started at $2,245 and is now sitting at $1,495. They write, “it is clear competition in the space is growing (versus next to nothing last year) and it seems PTON is responding in kind, upping their marketing and discounting their product.”

BMO believes that gross margins will be pressured all through fiscal 2022 due to managements guidance, which is about 10% below the street estimates. Management cited, “logistics headwinds on last-mile delivery, the reduction in Bike price and commodity and freight costs, all of which appear more recurring than one time in nature.”

BMO says that first quarter guidance misses all the streets estimates, while the full fiscal year guidance is mixed versus consensus estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.