On January 11th, Organigram Holdings (TSX: OGI) issued its second fiscal quarter earnings for 2022. The company reported net revenues of $30.38 million or a 22.2% increase quarter over quarter. The company also reported a cost of sales of $27.92 million, meaning the company gross margin before fair value changes was $2.45 million. The company reported adjusted EBITDA of ($1.88) million, and a net loss of $1.3 million. Cash and equivalents dropped 8.5% to $168.04 million

Organigram currently has 13 analysts covering the stock with an average 12-month price target of C$3.26, or a 53% upside to the current stock price. Out of all 13 analysts, 2 have strong buy ratings, 3 have buys and the other 8 analysts have hold ratings. Cantor Fitzgerald currently holds the street-high 12-month price target at C$5.30 or a 148% upside, while the lowest price target comes in at C$2.25.

In Haywood Capital Markets’ review, they cut their 12-month price target on Organigram from C$.003 to C$2.50 and reiterate their hold rating saying that the companies results are being overshadowed by the market sentiment.

For the quarter, Organigram maintained being the 4th largest Canadian license producer with 7.5% of the adult-use market share, up from 7% last quarter. Haywood says that the acquisition of Laurentian will be immediately accretive and will help the company get its legs into the premium segment, which will help its top-line and improve its margins.

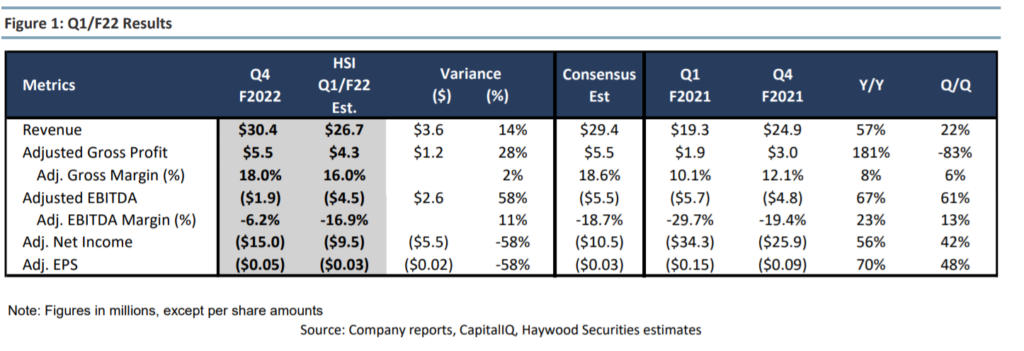

For the results, Organigram came in better than Haywood expected on revenue, gross profit, and adjusted EBITDA numbers. For revenue, Haywood expected Organigram to report $26.7 million with an adjusted gross profit of $4.3 million.

Haywood says that the beat primarily came from growth in the company’s Adult-Use segment while international sales also grew from $0 to $3.4 million.

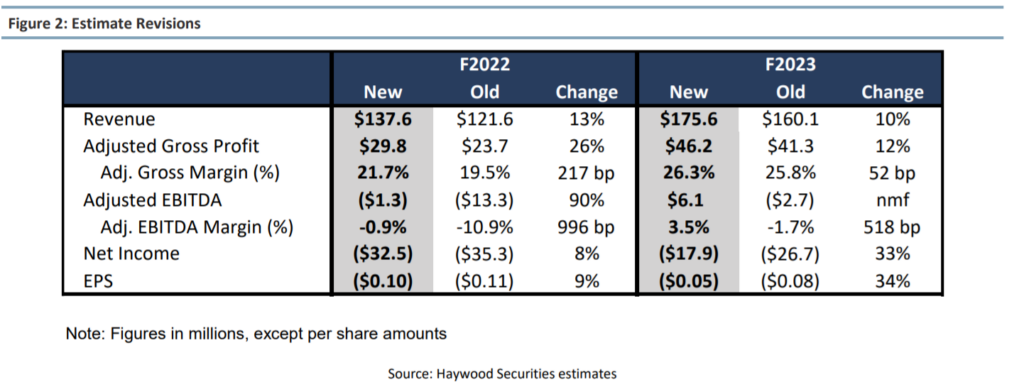

Surprisingly for a Canadian Cannabis company, Haywood has actually increased its fiscal 2022 and 2023 estimates, based on its ability to increase its market share in Canada. While they expect Laurentian to immediately be accretive to their operations and expect more international optionality to come available.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.