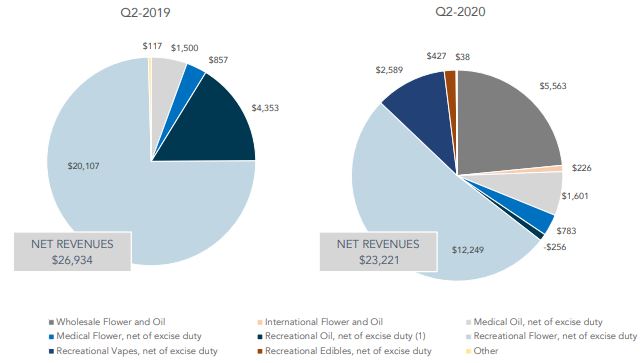

Organigram Holdings (TSX: OGI) (NASDAQ: OGI) released their second quarter financials this morning, and plainly, things aren’t looking good. The company has began its trend of decreasing revenues, posting net revenues of $23.2 million, which is down both quarter over quarter and year over year.

On top of decreasing revenues, the company is also in violation of covenants related to its credit facility with the Bank of Montreal. The company as a result has marked $76.4 million in long term debt as current, given that the company has received a waiver from the lender until May 30. Organigram will have to renegotiate the terms of the facility or risk a default on the loan.

With net revenues of $23.2 million, the company reported a cost of sales of $15,811, which is oddly the same figure as last quarter. As a result gross margin before fair value adjustments came in at $7.4 million. Despite the declining sales figures, the company saw an increase in total operating expenses from the first quarter of fiscal 2020 at $15.3 million as compared to $11.0 million. Expenses largely consisted of general administrative at $8.5 million, and sales and marketing at $5.4 million.

Net loss for the quarter came in at $6.8 million as compared to $0.8 million in the first quarter.

In addition to lower sales, several key insights into Organigram were offered up this quarter. For instance, the company claimed that its cash and all-in cost of production per gram of cannabis was lower in the second quarter at $0.53 per gram and $0.75 per gram respectively, as compared to $0.61 and $0.87 per gram in the first quarter. However, cost of sales was the same during the quarter, despite lower sales figures – identifying why this non-IFRS number is fairly irrelevant as a tool to compare operational efficiencies.

The rise in cost of goods sold was blamed on post-harvest costs due to a lower mix of wholesale product sold, which uses far less packaging.

Other key items offered up include the blaming of lower sales on a year over year basis on the lack of additional Alberta and Ontario retail locations opening up. Without the large pipeline orders for product to fill store shelves initially, the company saw its sales impacted overall due to “changing consumer preferences.”

Additionally, the company appears to be consuming cash rapidly. While the firms net cash position increased from $33.9 million to $41.0 million from the first to second quarter, Organigram has already utilized its entire $55.0 million at-the-market offering that was announced in December 2019. While the firms cash will be conserved due to recent significant layoffs, the company will likely need to find further sources of funding in the near future, before the credit facility covenant violation is considered.

Organigram Holdings last traded at $1.81 on the Nasdaq.

Information for this briefing was found via Sedar and Organigram Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Who cares? Pot stocks are so 2017…

Another one bites the dust?

Remember when OGI was the bees knees just a few quarters ago?