Ottawa’s push to reverse Nutrien’s decision to build a potash export terminal in Longview, Washington, pits Canada’s critical minerals ambitions against the fertilizer producer’s cost and logistics calculus.

Transport Minister Steven MacKinnon said he has requested a meeting with Nutrien’s project team to “convince them to change their mind” after the company announced plans for an up to $1-billion export terminal with capacity of five to six million tonnes a year at Berth 4 in Longview.

“Saskatchewan potash should be moved out of a Canadian port,” he said, adding, “I’m disappointed at this decision, and we’re hoping to persuade the company to change its mind.”

MacKinnon said he met Nutrien CEO Ken Seitz on Thursday and flagged Ottawa’s willingness to invest in Canadian port infrastructure, particularly at Saint John and the Port of Vancouver, but he did not specify incentives.

Nutrien’s plan is to add Longview to an existing network that already channels potash from six Saskatchewan mines through terminals in North Vancouver, Saint John, and Portland, Oregon, with Vancouver remaining the largest node at about 10 million tonnes of operational potash capacity. The new Longview facility would match or exceed the scale of Nutrien’s current presence in Portland and deepen its use of Pacific Northwest ports that often receive direct US taxpayer subsidies.

Chief commercial officer Chris Reynolds said the company evaluated options across the Pacific Northwest on a matrix of roughly 30 criteria, including rail rates, freight costs and construction costs, and that the 97-year-old Berth 4 site “came out on top” repeatedly. Longview benefited from a redevelopment that followed six decades of grain terminal operations and a rebuild between 2014 and early 2024, reducing greenfield execution risk and capital intensity relative to Canadian alternatives.

Within Canada, Nutrien had identified only Vancouver and Prince Rupert as meeting its core requirements of deep-sea access and rail connectivity. Even so, the Port of Vancouver’s effective potash capacity is constrained by a single bridge linking rail lines to the North Shore, a piece of infrastructure that has become a recurring bottleneck despite the nominal 10-million-tonne capacity. That choke point has weighed heavily in Nutrien’s internal scoring of export reliability.

Recent disruptions have sharpened those concerns. A 2023 port strike in Vancouver choked access through the Neptune terminal and forced Nutrien to curtail production at its Cory mine in Saskatchewan, demonstrating how Canadian rail and port labour disputes can quickly translate into lost volumes and revenue on the potash side.

By contrast, leveraging existing supply chains into Portland and a redeveloped berth in Longview offers Nutrien a cleaner risk profile as it plans for higher global demand.

That rationale collides with Ottawa’s broader trade and industrial policy goals. Potash is a designated critical mineral and Canada’s fifth-largest export, with Saskatchewan mines providing more than 30% of global production, ahead of any other country. Prime Minister Mark Carney has pledged to double non-US exports from around $300 billion to around $600 billion.

The Longview project has therefore become an early stress test of Carney’s promise to streamline approvals and “get Canada back to building big projects,” especially in critical minerals.

Information for this story was found via The Globe And Mail and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

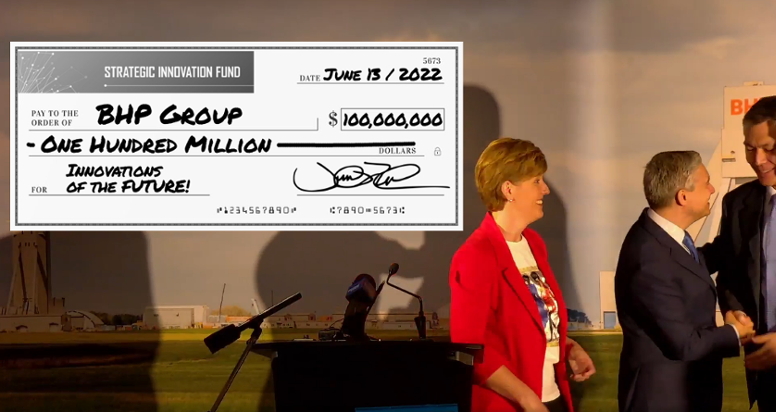

To the Editor Board:

It seems to me that CEO Mr. Seitz, and all of the members of the Board of Nutrien, should remind themselves that they only have the opportunity to belatedly do right by Saskatchewan and Canada, by exporting from Canada. Had the Government of Canada not blocked the hostile takeover bid for the company (and its resources) by BHP, Mr. Seitz’z and the members of the Board would be doing something, but it would not be running the largest potash producer on the planet. The Board and the Corporation it governs, owes its present existence to that intervention. It has a debt to pay to Canada and the time to pay is now.

Nation building projects envisioned and articulated by the Prime Minister on behalf of the Government of Canada and all Canadians, in response to unprecedented upending (attack ?) on our past relationship with the United States requires not only the leadership of the Prime Minister of Canada and the Premiers of the Canadian provinces but also leadership from the Boards of Directors’ of our leading companies. If that requires some sacrifice from the respective income statements of those companies then that is a price that will have to be paid. Continental, geo-political and global economic change is happening and it is happening with at a pace which demand close attention as the events happening now will reverberate for generations. Our corporate leadership had best be making decisions consistent with not only the interests of the shareholders of the corporation but also the stakeholders of the corporation. Those decisions, on would hope, will be much better atuned to the National moment in which we find ourselves than the shockingly miopic port announcement made by Nutrien’s Board.

Nutrien is must rise to this National moment and reconsider the ill conceived plan to build and export facility in the United States. Failure to do so will be a corporate disgrace that will follow it and its board members for a long, long time.

Regards,

Craig Leggatt

Companies are required to do what is best for shareholders, not for anyone else at the expense of shareholders. Perhaps BC should take a look in the mirror and recognize why the decision was made, and what choices of their own led to this decision. Government policy has impacts. This is one of them.