As Russia and Ukraine appear to move closer to war every day, investors are calculating the potential impact on financial and commodity markets. Most stock market broad indices have reflected little fear of the potential conflict since the start of the year, until they suffered notable declines on February 9 and 10 as the leaders of western nations, including the U.S. and the UK, signaled that a Russian invasion was almost inevitable.

(Many high-multiple growth stocks have plummeted over the last few months, but those declines seem more attributable to nosebleed valuations and central banks’ being forced to pull back on ultra-easy monetary policies to combat inflation.)

Of course, predicting how the stock market will react on a longer-term basis to a conflict initiated by one of the world’s leading producers of oil and natural gas, Russia, is exceedingly difficult. Russia is the world’s largest exporter of natural gas and its second largest oil producer (accounting for about 12% of worldwide oil production).

This calculus will doubtless be made even tougher when/if the U.S. and European nations impose harsh economic sanctions on Russia that will impact that country’s consumers, industrial operations and employment. Media reports that the sanctions may be similar to the export controls the U.S. has imposed on countries like Iran and North Korea.

The last time a land war of potentially similar scope involving an “energy power” occurred was in 1990 when Iraq invaded Kuwait. At the time Kuwait owned an estimated 20% of the world’s oil reserves. The effects on the stock market and oil prices were dramatic: the Dow Jones Industrials Average dropped 18% between July 3, 1990 and October 16, 1990, while oil prices more than doubled over the same period, rising from US$17 per barrel to US$36.

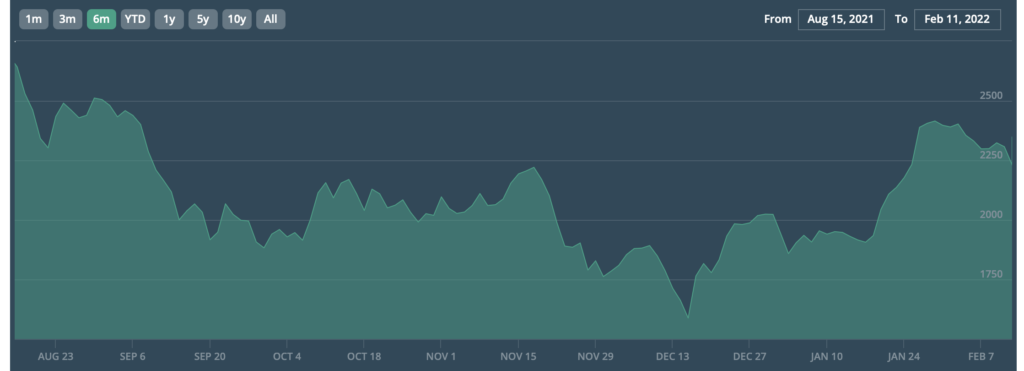

In response to all this, speculators have rationally bid up the price of oil on almost a straight-line basis over the past 2 ½ months. The price of Brent crude is now just above US$94 per barrel, up from US$70 in early December 2021.

Given this 34% oil price move in a very short time, investors may want to consider investing in other commodity hedges (or perhaps producers of that commodity) that have not advanced as much but could potentially still offer protection in the event of war. One such commodity could be palladium. Russia accounts for about 40% of the global production of this silvery-white metal. It is used primarily in catalytic converters of cars with conventional internal combustion engines and in hybrid vehicles.

The price of palladium has risen about 23% so far this year, less than oil’s appreciation despite Russia’s much more dominant market share. In addition, palladium is trading at the same level it did just five months ago in September 2021.

Leading, non-Russian palladium producers include Sibanye Stillwater Limited (NYSE: SBSW) and Anglo American Platinum Limited (OTC: ANGPY). SBSW’s operations are in North America, South America and Africa, while ANGPY’s mines are also located in those areas plus in Europe, China and Finland.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.