A South America-focused porphyry copper explorer is in the process of being established, with Pampa Metals (CSE: PM) this morning announcing it has entered into a letter agreement to acquire Rugby Resources (TSXV: RUG).

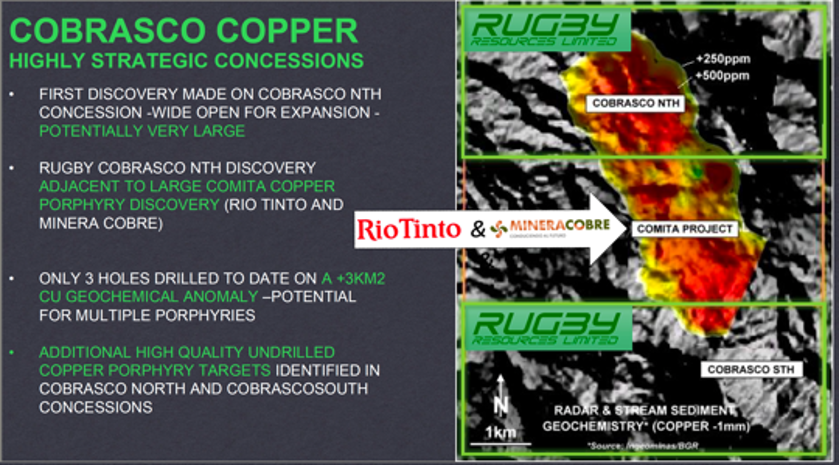

The merger will bring together Pampa’s Piuquenes copper-gold porphyry project in Argentina with that of Rugby’s Cobrasco copper-moly porphyry discovery in Colombia and their Mantau IOCG copper project in Chile. While both porphyry projects have seen drilling in recent years, both are in the early days of their discovery, with Rugby’s project having seen only three drill holes ever reported on it.

The proposed transaction would see Rugby shareholders receive one share of Pampa for every 6.4 shares of Rugby currently held, valuing Rugby shares at roughly $0.025 per each. Rugby shareholders are expected to hold 38% of the resulting issuer upon closing.

But Pampa is only interested in certain of Rugby’s assets. Prior to the closing of the transaction, a number of assets will be transferred to a SpinCo that current Rugby shareholders will receive an interest in.

Assets to be spun out include a 20% interest in the Cobrasco Project which will be free-carried through to the completion of a feasibility study, as well as the El Zanjon and Venidero gold-silver projects in Argentina, a joint venture interest in the Georgetown project in Australia, and a 1.5% NSR on the Mantau project.

As part of the the transaction, Bryce Roxburgh, CEO of Rugby, will join the board of Pampa Metals. No other management changes are expected.

Post-transaction, Pampa has indicated it will pursue a dual-listing on the Australian Stock Exchange, alongside a TSX Venture listing.

The transaction remains subject to a 45 day exclusivity period for the two parties to enter into a definitive agreement.

Pampa Metals last traded at $0.19 on the CSE.

Information for this briefing was found via Sedar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.