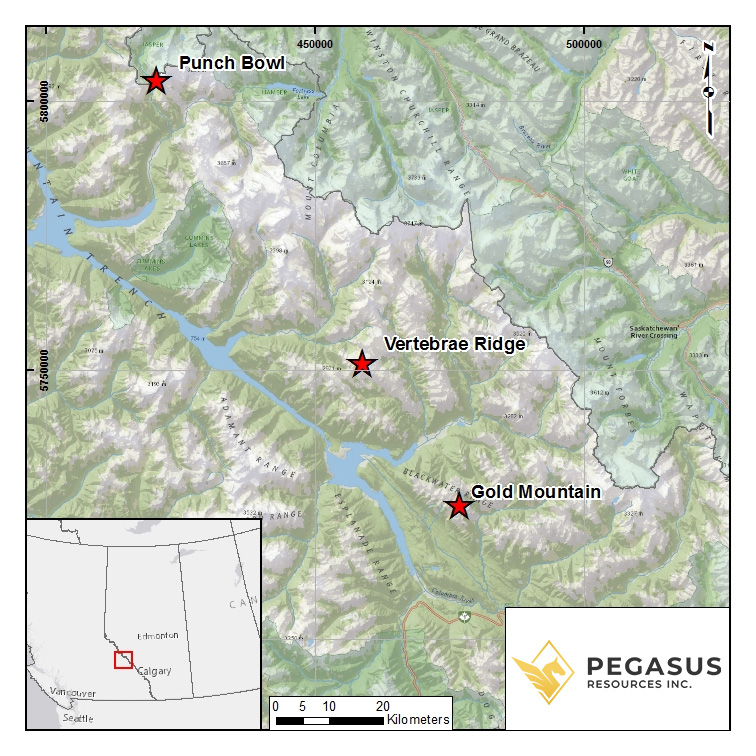

Pegasus Resources (TSXV: PEGA), formerly Pistol Bay Mining, recently made a series of interesting moves that seemingly have caught the market’s attention. The company recently sold and optioned off some of its Red Lake properties, and acquired 100% interest in three exploration properties near Golden, British Columbia. Pegasus is exploring for both precious and base metals.

On November 22,2020, Trillium Gold Mines (TSXV: TGM) acquired several of Pegasus’ Confederation Lake assets for $500,000 in cash and $1.25 million worth of Trillium common shares. The Company retained three of its Confederation Lake properties that were optioned to Infinite Ore Corp. (TSXV: ILI) in February, 2020.

PEGA retains 20% of the Garnet Lake and Fedart Properties and 25% of their Dixie 17-20 claims. PEGA is due to receive a payment of $30,000 and 500,000 ILI shares on February 21, 2021 towards the Dixie property, $70,000 and 750,000 ILI shares due June 15, 2021 and 1,000,000 ILI shares due June 15, 2022 for Fedart. $150,000 cash and 1,000,000 ILI shares in February 2021, and 2 million shares in 2022 meanwhile are due on the Garnet Lake property.

These transactions are significant for Pegasus shareholders because it enables Pegasus to carry on its exploration programs without having to go to the markets to raise capital and dilute the Company’s shares. Historical data provides a compelling reason for further exploration of the B.C. assets, particularly at today’s high gold prices.

The Golden area properties are interesting because all three have different geological characteristics and are in a relatively unexplored area of British Columbia near the Alberta border. The Gold Mountain Property, located 50 km north of Golden, is known for polymetallic quartz-carbonate veins that host gold and silver. It was first explored in the 1930’s and additional work was done in the 1980’s.

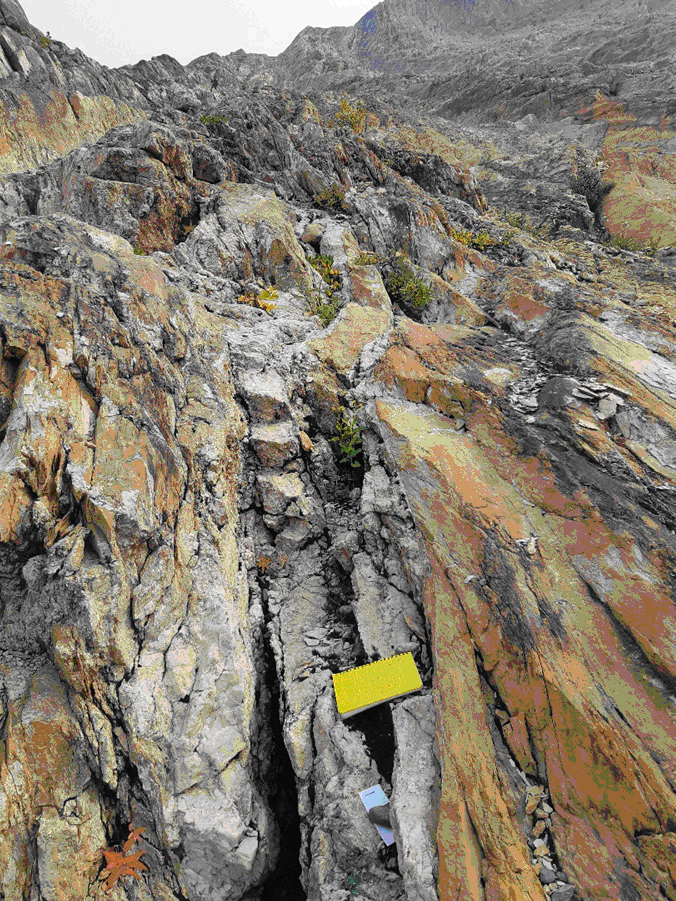

Assays from grab samples in the 1980’s showed values of 4.87 g/t gold, 647 g/t silver and 1.89% copper on the North Showing, and trenching that exposed five veins showed returns as high as 30.3 g/t gold, 123.1 g/t silver and 32.54% copper on the South Showing. On January 12, 2021, the Company announced assay results from its 2020 work programs. 28 samples were taken from Gold Mountain and assays graded as high as 6,670 g/t silver and 7.44 g/t gold, and 4 of these samples had values of 1,000 g/t silver or more.

The program indicated polymetallic mineralization over 600 – 700 meters of strike, open in all directions, and vein widths were as wide as 2 metres. A key takeaway from these results show that the type and high-grade characteristics of the mineralization indicate that this could be a district scale system with the possibility that an unidentified intrusive may be responsible for this mineralization. The Company will use this new data to prepare its 2021 exploration program.

The Punch Bowl Property meanwhile first saw gold discovered during the late 1960’s. The geology indicates siliciclastic-hosted gold mineralization found within quartz veins, and samples showed returns as high as 80 g/t gold. To date the Company has completed a site visit of the Punch Bowl property, and also on January 12, 2021, reported that 53 samples were collected with values returning up to 3.41 g/t gold with an overall average of 0.37 g/t gold. These are very encouraging results and PEGA plans to conduct more exploration on Punch Bowl in the summer of 2021

The Vertebrae Ridge Property meanwhile, which is located 81 km northwest of Golden and consists of two claims covering an area of 2,871 hectares, has had very little exploration, although two copper mineralization zones were discovered in 2014. Copper Zone 1 appears to be 2 km in length with widths between 50 and 100 metres, and consists of pyrite bearing breccias, quartz veins and stockworks.

On January 21, 2020, PEGA announced that samples taken during its 2020 exploration program indicate a new copper-zinc-lead-silver discovery on the Vertebrae Ridge property. Assays from Zone 1 on 18 rock samples from a 1400 metre strike returned values of 4.13% Copper, 28.6% Lead, 4.74% Zinc, and 360 g/t Silver. 13 rock samples from Zone 2 North that were collected from a 650 metre strike showed assay values of 2.5% Copper and 4.5 g/t Silver, with peak values of 10.7% Copper and 29.1 g/t Silver. Results from 7 samples from a 250 metre strike on the Vein 160 Showing returned values of 10.5% Copper and 14.7 g/t Silver, with peak values of 35.5% Copper and 96.7 g/t Silver.

Pegasus is not a one-trick pony (please pardon the pun). With a diversified portfolio of properties, the company will be conducting a number of concurrent exploration programs in 2021 in addition to the work being carried out at the Confederation Lake properties .This can provide a level of comfort to its shareholders, knowing that there will be an ongoing news cycle for PEGA.

The company has an experienced and capable management team with years of exploration and public company experience, and the company can self fund their exploration work, so there is no concern of share dilution any time in the near future. With 68.3 million shares outstanding and a low market capitalization of $4.1 million, Pegasus appears to represent a relatively low risk, early stage exploration play.

FULL DISCLOSURE: Pegasus Resources is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Pegasus Resources on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.