By all accounts, it appears that another real estate crash across the United States is drawing very, very near. Last night, Reuters published an exclusive report outlining that JPMorgan Chase (NYSE: JPM), the countries largest lender and fourth largest mortgage provider, would be modifying the terms that qualifies a borrower for a new mortgage as of Tuesday.

As per the Reuters report, JPMorgan Chase is planning to announce this week that it will be requiring all new borrowers as of Tuesday have a FICO credit score of at least 700, and a 20% down payment. Terms that simply, most American’s will be unable to meet in many markets, especially the latter in places such as California.

While the lender did not disclose current broad requirements to qualify for a mortgage, most banks across the nation require a 10% down payment currently.

The move has resulted in a rash of twitter criticism and concern from some of the largest talking heads, such as Peter Schiff.

Once real estate prices crash due to the inability of new buyers to qualify for mortgages, how many over-leveraged homeowners with negative equity will continue making their mortgage payments, especially when there is a freeze on foreclosures?

— Peter Schiff (@PeterSchiff) April 12, 2020

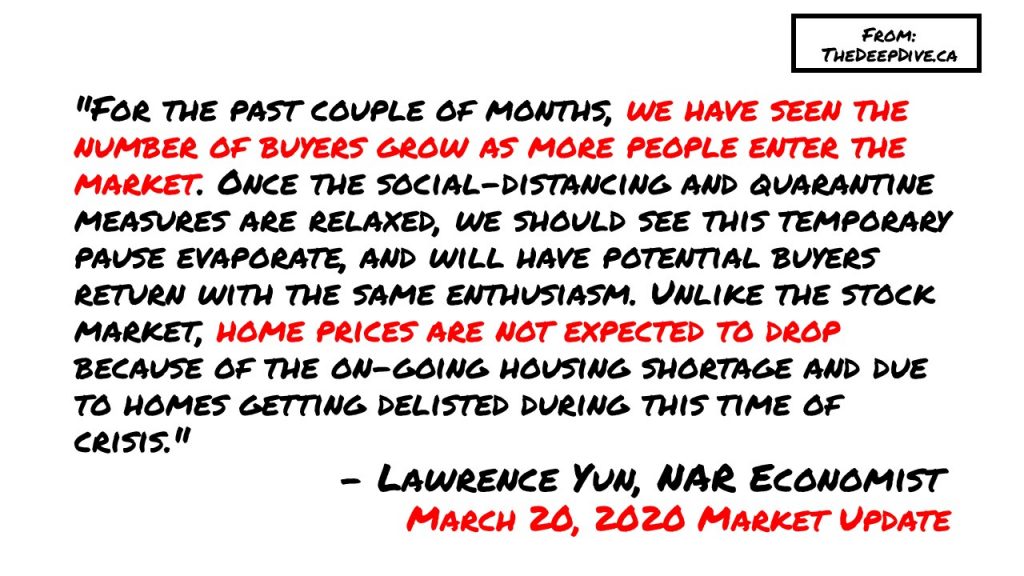

While often controversial, the gold bug has a point here – why pay a mortgage that you’re heavily underwater on as a result of the market crash? The US has already rolled out a forbearance program that will enable mortgage holders to defer payments for up to six months – but when that runs out, and the market has crashed, will they resume paying? Those requests had already increase 1,600% in the second half of March, and with further unemployment, has little sign of slowing down.

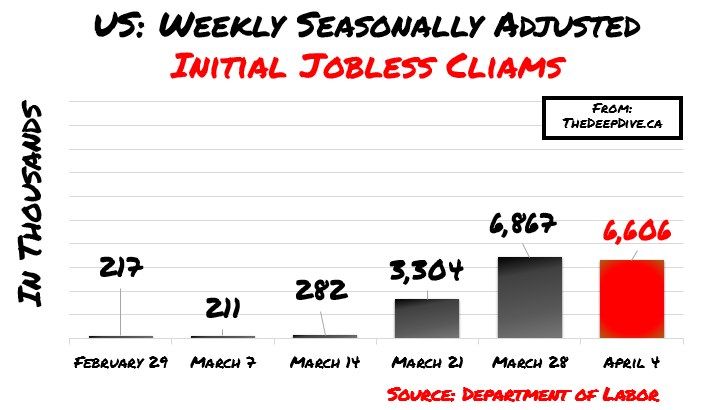

Of course, JPMorgan Chase plans to enact these new borrowing requirements as a result of market conditions. With an additional 6.6 million jobless claims made last week, on top of the 6.8 million jobless claims made a week prior, the environment for lenders in the US is not exactly ideal. Rather, they need to make the required moves to protect their own capital.

In terms of home sales, the National Association of Realtors (NAR) is expected to release March data on April 21. The February data, released late last month, indicated a slow down in the Northeast in February, in line with the timing of the arrival of the novel coronavirus. Seasonally adjusted figures released last month revealed 5.77 million units sold during the month of February. Of those sales, 32% were first time home buyers.

Annually, the share of home sales to first time home buyers is typically 33% based on a report released in 2019. The result, is that tightening of mortgage lending requirements across the board by America’s largest lenders could have a disastrous effect on the real estate market as a whole.

Only time will tell.

Information for this briefing was found via Reuters and The National Association of Realtors. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.