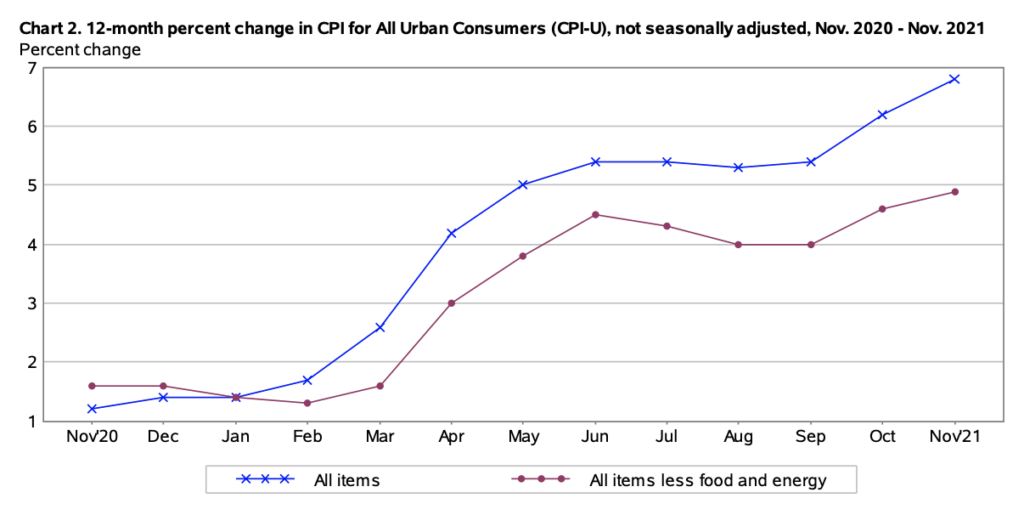

Recall, we were told to stay calm on Friday and ignore the Labour Department’s latest CPI print because according to Joe Biden, last month’s eye-watering acceleration in consumer prices “does not reflect today’s reality.” Well, fast forward to this morning, it’s pretty hard to ignore that price increases have yet again hit a new record, rising by the most in nearly 40 years as inflation cements itself into perpetual motion.

Just as expected, consumer prices jumped 0.8% from the month prior to an annualized 6.8% in November, marking yet another month of colossal gains that have been rapidly increasing since the beginning of the year, and the sharpest pace since 1982. Core CPI, which does not account for the goods and services Americans are buying on a daily basis, was up 4.9% year-over-year— the highest since 1991.

In yet another testament that the transitory narrative has officially been tossed in the trash bin, last month’s price gains were broad-based, spanning across an increasing number of categories that were thus far unaffected by the pandemic. Costs for both goods and services were up, as were food and energy prices. Looking under the microscope, everything was up last month, with shelter costs— which account for nearly one-third of the index— rising 3.8% from November 2020, marking the largest gain since 2007.

The index for used cars and trucks continued to climb higher in November, rising 2.5% month-over-month and 31.4% from a year earlier. The food at home category increased 6.4% from November 2020— the most since December 2008. After several months of declines, airline fares rose 4.7%, suggesting that travel is beginning to pick up.

The latest figures have sent President Joe Biden’s approval ratings straight to the dumpster, as political pressure on the White House to act continues to mount. Although the Biden administration has taken a pledge to tackle rising price pressures by laughably creating a supply-chain task force— it appears it has done little— if anything at all— to impact the staggering increases in consumer prices.

And, despite Joe Biden proudly exclaiming that wages have grown since the beginning of the economic recovery, the BLS report suggests otherwise. Real-wages contracted for the eighth straight month, falling 1.9% in November from a year earlier, and marking the largest decline since June.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.