Puerto Rico regulators are making a mistake by ordering Euro Pacific Bank to stop operations in the territory instead of allowing the financial institution to be sold, according to the bank’s owner Peter Schiff.

“Despite no evidence of crimes, Puerto Rico regulators closed my bank anyway for net capital issues, rather than allow a sale to a highly qualified buyer promising to inject capital far in excess of regulatory minimums,” claimed Schiff.

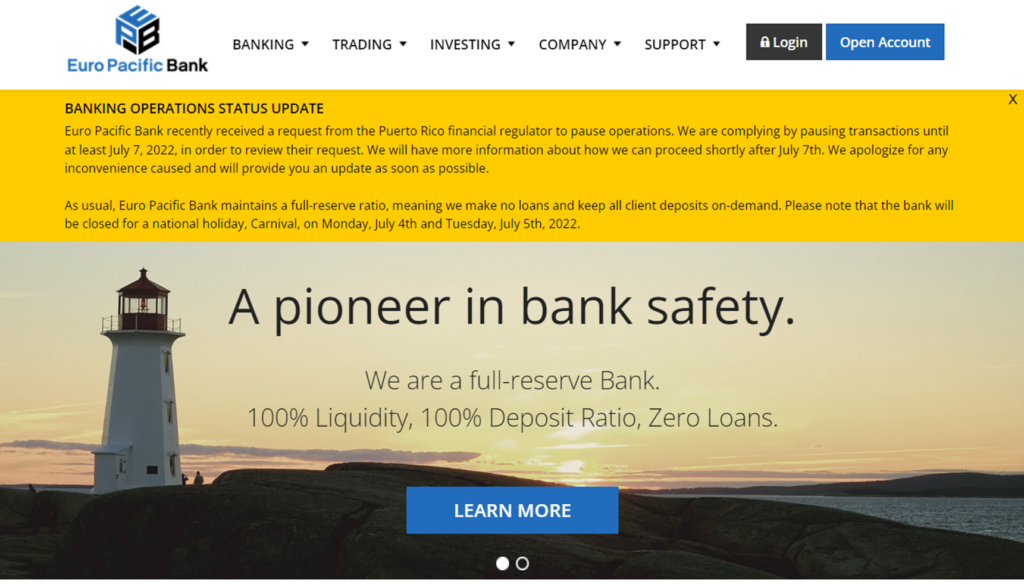

The US territory’s Office of the Commissioner of Financial Institutions issued a cease-and-desist order on Thursday against the bank based on inadequate capital levels and compliance controls.

“Euro Pacific has a long history of noncompliance,” Commissioner Natalia Zequeira Díaz said in a statement. “We will not allow or tolerate any financial entity with a license issued by the government of Puerto Rico to operate outside the law or ignore the clear mandates of applicable laws and regulations.”

Schiff however lamented that the regulators did not allow the potential sale of the bank to go through instead, pointing at the supposed contention of the regulatory body on him still owning 4% post-transaction.

The reason regulators gave for tuning down the sale is that post sale I would own 4% of the company buying the bank. They said that due to the bad press about me, they did not want me owning 4% of a bank, even though the know first hand the allegations in the media are false.

— Peter Schiff (@PeterSchiff) July 4, 2022

“They never let me know they objected,” Schiff said in a tweet. “Had they ever told the 4% stake was a problem I would have restructured the deal. I just wanted out.”

The controversial banker also highlighted that “it costs a fortune to run a small bank” and he had “to put in US$7 million in the last 2 years to cover operating losses due to bad press.”

“That’s why I never really made any money. The compliance costs are outrageous,” he added.

The Puerto Rican move is said to be part of the larger investigation launched by the Joint Chiefs of Global Tax Enforcement in 2018 as a response to the leaked Panama Papers. The so-called “J5” is composed of tax regulators from the United States, Australia, Britain, Canada, and the Netherlands.

One of the key investigations by the task force is Euro Pacific as a suspected vehicle for tax evasion and money laundering.

But the chief of the US tax body said that Puerto Rico’s action is separate from the J5 investigation. However, it clearly sends a strong message to like-minded financial institutions.

“There is no doubt that O.C.I.F.’s work sends a strong message to others that the Puerto Rican financial industry will not be a haven for tax evaders or illegal conduct,” said the US Internal Revenue Service’s Criminal Investigation Chief Jim Lee.

Despite all these, Schiff still maintains that he has not been proven guilty of tax evasion or money laundering.

Where are these news headlines? Peter Schiff vindicated. After a 2.5 year investigation authorities of 5 nations found absolutely no evidence that Euro Pacific Bank or Peter Schiff facilitated tax evasion or money laundering. Those who reported guilt prior to charges were wrong.

— Peter Schiff (@PeterSchiff) July 3, 2022

Information for this briefing was found via The New York Times and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.