Newscope Capital, whom is currently doing business as Pharmather (CSE: PHRM) is the latest firm to begin trading on the Canadian Securities Exchange, having made its debut Friday. The specialty life sciences firm is currently focused on research and development of psychedelic pharmaceuticals, while taking a novel approach to the FDA process.

First and foremost, the company identifies itself as a psychedelics life sciences firm, with the mission of targeting large unmet medical needs with psychedelic pharmaceuticals. Presently, it is focused on the brain and nervous system. It intends to tackle this mission by integrating a unique AI discovery process that will be used to identify new uses of psychedelics in combination with already approved FDA drugs.

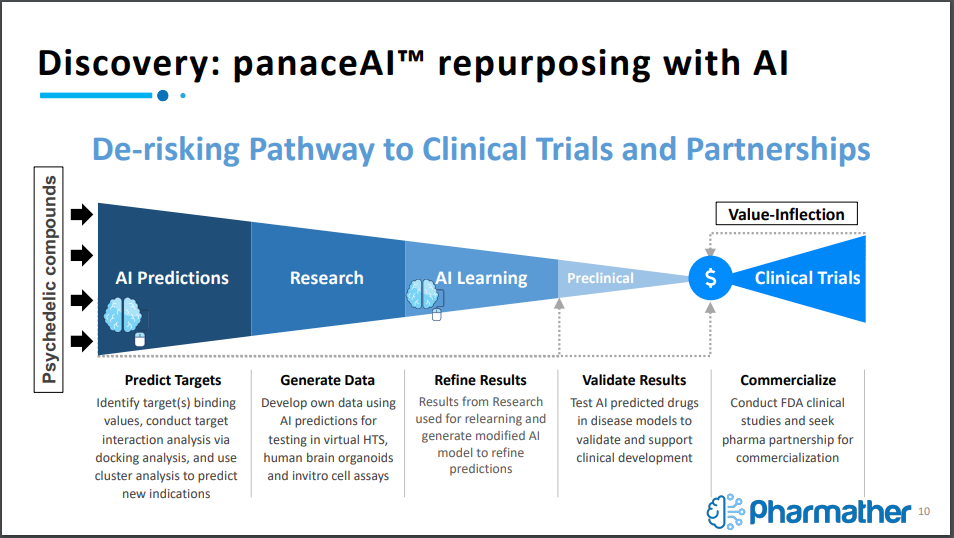

The utilization of artificial intelligence is being treated as a way to de-risk the pathway to clinical trials. It works by using AI to predict targets for binding psychedelic compounds with already approved FDA drugs based on target interaction analysis and then using cluster analysis to predict new indications.

From here, results are further refined until the company is confident with the predictions, from which it will conduct the necessary research to forge ahead with preclinical and clinical trials.

Initially, Pharmather will be focused a number of targets based on the prevalence of the disorder. Initial targets include depression, acute pain, traumatic brain injury, chronic pain, stroke, neuropathic pain, parkinsons, and complex regional pain syndrome. Furthermore, a number of future targets have been identified as well, including Huntington’s Disease, Alzheimer’s, bipolar disorder, and more.

The company is currently working on a simple discovery – development – delivery model, with its key market differentiator being the use of AI technology to feed into the discovery portion of this model. Once discovered, Pharmather will conduct research and development on combining psychedelics with the FDA approved drugs, with the intent of providing drug delivery via a novel microneedle delivery system for psychedelics.

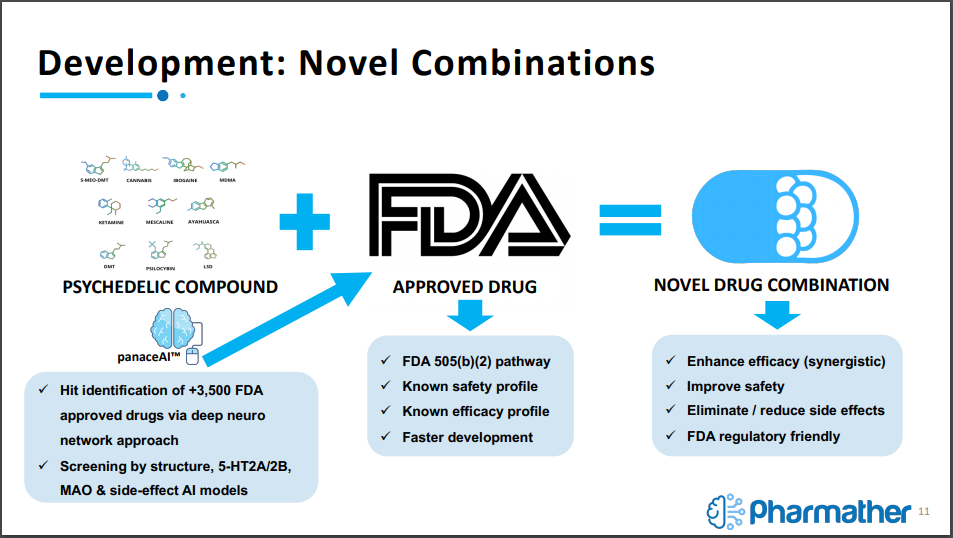

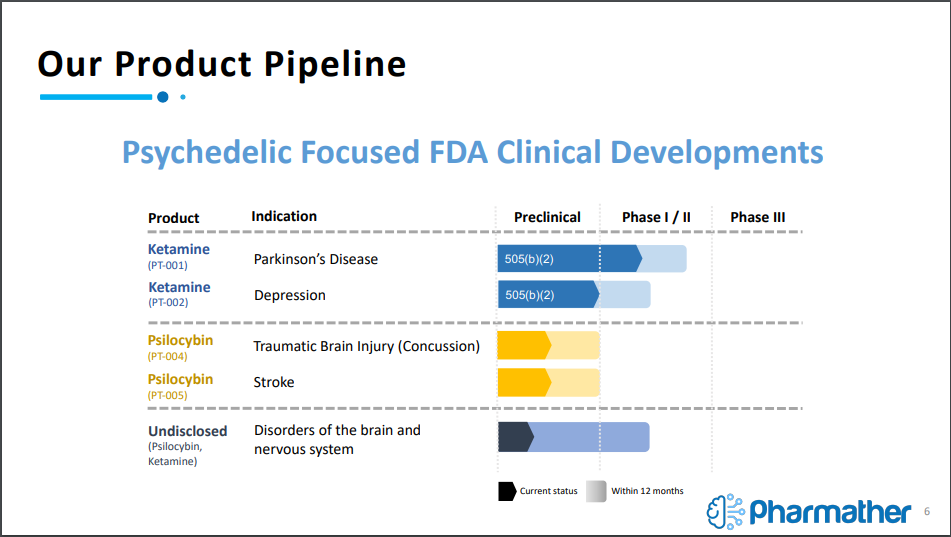

This methodology has already lead to a robust product pipeline for Pharmather, with five novel products currently being focused on. The first two products, referred to as PT-001 and PT-002, are focused on utilizing Ketamine in combination with an undisclosed FDA approved drug to tackle the indications of Parkinson’s Disease and Depression, which are believed to be through pre-clinical trials thanks to the FDA 505(b)(2) pathway.

For those unaware, the 505(b)(2) pathway is a pathway under the FDA approval process that states, “an application that contains full reports of investigations of safety and effectiveness but where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference.”

In layman terms, it means the safety and effectiveness investigations have already been conducted, allowing for a portion of the process to be skipped over, providing a jump start to the clinical trial process. The company is able to use this path due to latching the psychedelic compound onto an FDA approved drug to create a novel drug combination.

With respect to ketamine, the company currently holds an exclusive license from the University of Arizona Health Sciences for the use of its patent for the compositions and methods for treating motor disorders. The technology behind the patent contains robust data of tolerability, safety and longer term reduction of abnormal involuntary movements, while also reducing depression in Parkinson’s patients.

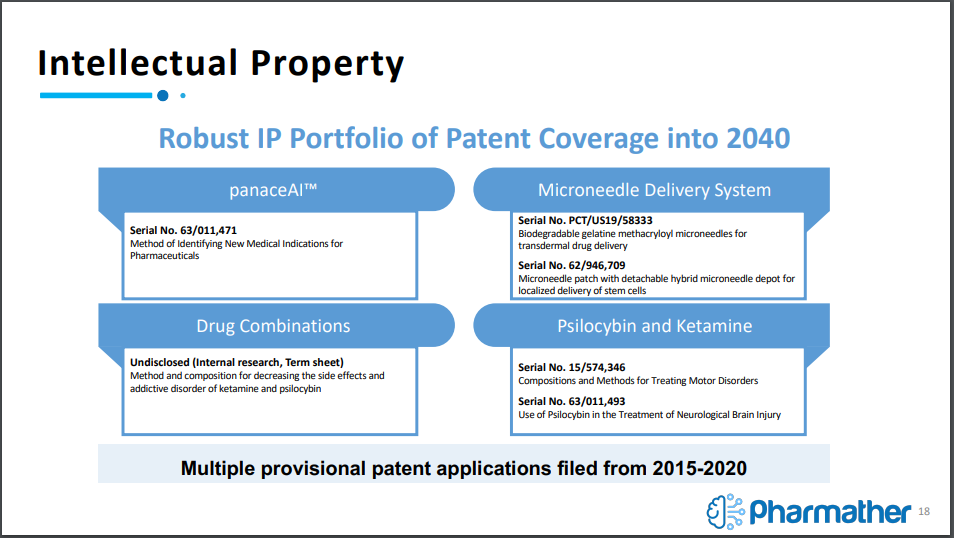

On the topic of intellectual property, Pharmather currently holds a robust portfolio of IP tech, focused on a number of different areas in the pharmaceutical field. Coverage includes tech related to ketamine, psilocybin, transdermal drug delivery, drug combinations, and more. This IP comes through licenses with a number of key relationships, including The University of Arizona, Camargo Pharmaceutical Services, The National Health Research Institute, and the University Health Network Princess Margaret Cancer Centre.

Pharmather commenced trading on Friday on the Canadian Securities Exchange, with a total of 65,376,000 common shares outstanding, along with 1.8 million warrants and 4.9 million stock options. It closed Friday’s session at $0.20, giving it a market capitalization of just $13.1 million.

FULL DISCLOSURE: Pharmather is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Pharmather on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.