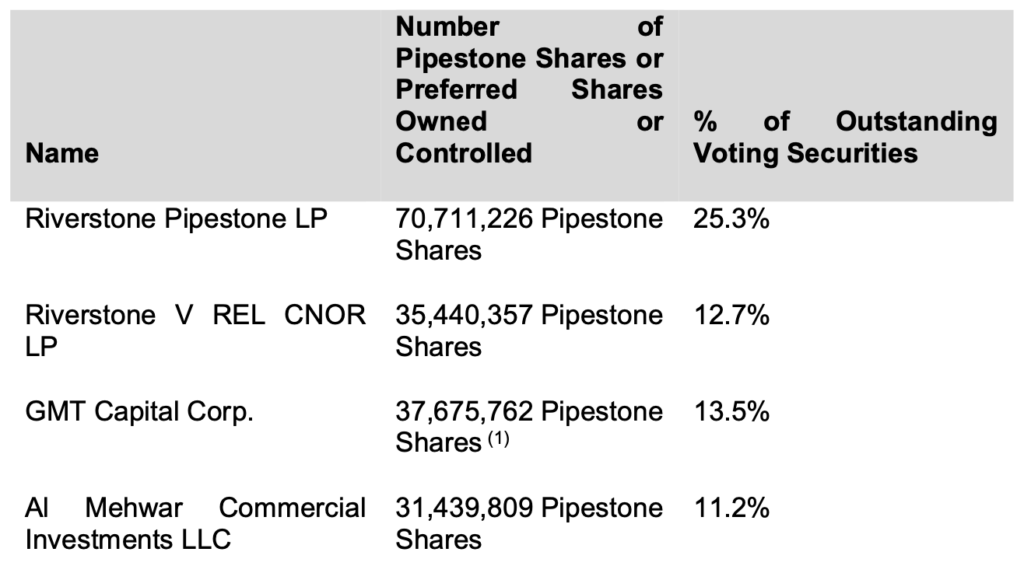

GMT Capital, the second-largest shareholder of Pipestone Energy Corp (TSX: PIPE), has already announced its intention to vote against a proposed all-stock deal by Strathcona Resources, its larger rival, citing undervaluation of the company.

Strathcona, a Canadian oil producer, unveiled its plan to go public by acquiring Pipestone, resulting in the creation of a merged entity with a market capitalization of $8.6 billion. The proposed all-stock deal, scheduled to conclude in October, entails Pipestone shareholders receiving 9.05% of the pro forma equity in the combined entity, while existing Strathcona shareholders retain the majority.

GMT Capital, an investment firm who claims to represent 19.03% stake in Pipestone, has expressed concerns that the buyout deal fails to adequately recognize the value of Pipestone Energy’s common shares.

It is noteworthy, however, that in Pipestone Energy’s primer on the acquisition vote, it lists GMT Capital with 13.5% equity.

Most recently, another investor, Bison Interests, also manifested its intention to vote against the acquisition, characterizing the deal as “structurally odd.”

“This company was up for sale last year… They actually had an offer at a substantially higher price that the company rejected,” Josh Young, CIO of Bison Interests, said in an interview. “Fast forward a year, they accept this lowball bid.”

GMT Capital will vote against Strathcona's all-stock deal to acquire Pipestone Energy $pipe.to@Josh_Young_1 joins me to discuss why @BisonInterests intends to vote against the deal too, and why the transaction undervalues the company pic.twitter.com/MvYlY4Mx5O

— Margot Rubin (@margot_rubin) September 20, 2023

Pipestone Energy earlier responded to GMT Capital’s claims against the proposed acquisition deal. The firm said that “a significant number of GMT’s claims are based on personal views, ‘beliefs’ and ‘feels’.”

Approval for the acquisition hinges on the support of two-thirds of Pipestone shareholders, with a vote scheduled for a meeting in September.

Strathcona has previously stated that the combined entity will retain its current name and be led by its CEO, Rob Morgan.

Pipestone Energy Corp. last traded at $2.47 on the TSX.

Information for this briefing was found via Reuters and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.