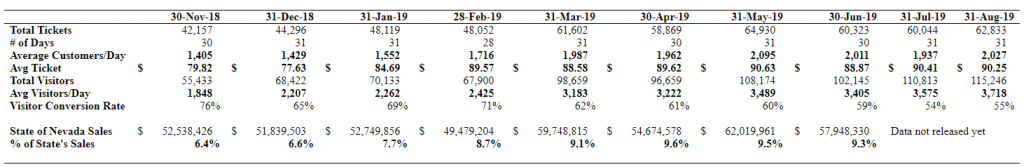

This morning Planet 13 (CSE: PLTH) gave a corporate update which showed the Superstore is continuing to crush it in Las Vegas. The company had another month with over 2,000 customers and an average ticket price above $90. What’s impressive? Over the last few months of available State Wide data, Planet 13 has over a 9% market share in the State of Nevada.

In the highly competitive Las Vegas market the SuperStore continues to dominate based on the strength of the customer experience and the unique entertainment it offers… Over the rest of the year we will continue to rollout new and exciting restaurants, stores and attractions allowing customers to eat, shop, and play all under one cannabis inspired roof.

Bob Groesbeck, Co-CEO of Planet 13

Okay, Is the Company Making Money?

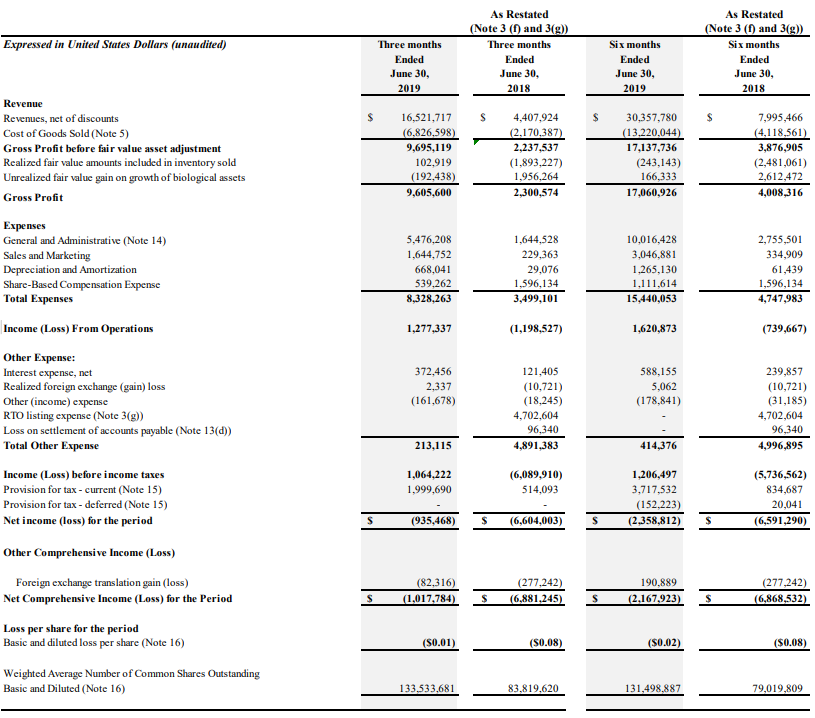

Let’s start by looking at the income statement released last week.

We can see from the above income statement Planet 13 yields an impressive top line of $16.5M in the last quarter, with 58% gross margins and a positive operating income of $1.3M.

Here is where the fundamental question comes in for all US cannabis operators: Does the company produce postive cash flow?

From the last quarterly income statement we can see the company is paying $2M in taxes (thanks 280e!) against the operating income of $1.3M. On an operating cash flow basis, the company produced approximately $270k of operating cash flow in the quarter and $2.84M in the last 6 months. So the answer appears to be, depends on what metrics you want to use, overall they are close…

How’s the Growth So Far?

First, the company has shown some solid growth since moving from their old Medizan location with an increase of more than 161% in terms of average daily customers and an increase in average ticket size of $22.78 or 33.7% from October 2018 (the last month the Medizin store was open) to July 2019.

What About Expansion?

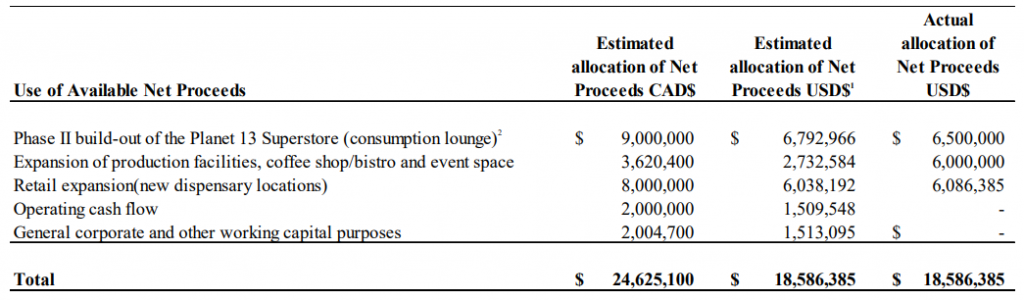

With the company’s last bought deal, they earmarked $8M for new site expansion.

They also signed an LOI for a California dispensary in Santa Ana for approximately $14M in combination of cash and stock. This will be a 40,000 sq. ft. store just outside of Los Angeles, a greater area of 13.2M people which hosts over 24M visitors per year. If we look at the current model, this LOI seems to fit in nicely with the overall strategy.

Since going public in July 2018, the stock has increased 159% and has recently consolidated in the mid 2 dollar range.

Information for this briefing was found via Sedar and Planet 13 Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.