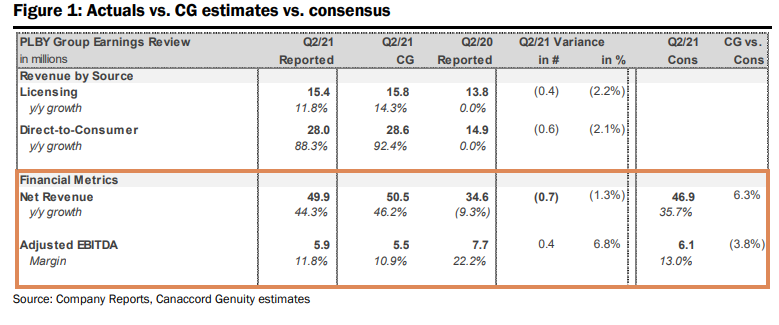

On August 10, PLBY Group (NASDAQ: PLBY) reported its second quarter financial results. The company reported net revenues of $49.85 million, up 44% year over year, while the company’s direct-to-consumer segment grew 88% year over year, accounting for $28 million in revenue. The company reported a net loss of $8.91 million or an earnings per share of -$0.24. Adjusted EBITDA came in at $5.88 million for the quarter.

Two analysts changed their 12-month price targets, bringing the average consensus to $47.60, down from $51 last month. The company only has 4 analysts covering it, with 2 having strong buy ratings and the other 2 having buy ratings. The street high sits at $50 while the lowest comes in at $45.

Canaccord was one of the firms to tweak its price target. Canaccord now has a $48 price target, down from $52, and a buy rating, saying that the near-term investments raise the long-term outlook of the company.

PLBY Group’s second quarter financials came in mixed, with total revenue beating Canaccord’s estimates by 6%, but adjusted EBITDA missed by 3%. Specifically, DTC growth came in slightly below their estimates, primarily due to COVID headwinds. Canaccord says, “The company is still in its early days of shifting from a licensing to DTC focused model, and in a challenging macro environment no less, so there are bound to be growing pains.” Canaccord says that the guidance raise is strong and makes sense since the company has several strong pieces that are taking time to come together to create “a sustainable long-term grower.”

Canaccord says that the company has been investing pretty aggressively to help hit the new $600 million 2025 guidance, with the majority of the investments going into brand development and technology infrastructure. Canaccord says that the big takeaway has to be “that all these tech investments should allow the company to leverage its growing customer data and increasingly diversified product categories to become a more efficient e-commerce destination offering the best customer experience with the most relevant products.”

The firm believes that 2021 was primarily a transitional year as COVID headwinds are still impacting the company, but in the fourth quarter the company will release its Big Bunny label, the first private label product. This will continue into 2022 with the company producing a color cosmetics product and a Playboy branded lingerie line.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.