Against a backdrop of consumer prices sitting at the highest in 40 years, an escalating Russia-Ukraine conflict teetering on the edge of WW3, and commodity shortages, the Fed— which by now has shamefully walked away from its policy error on transitory inflation— turned up the hawkish rhetoric on Wednesday, hiking rates by 25 basis points for the first time since 2018.

BREAKING: world’s economy is fixed with a 0.25% fed rate increase

— Not Jerome Powell (@alifarhat79) March 16, 2022

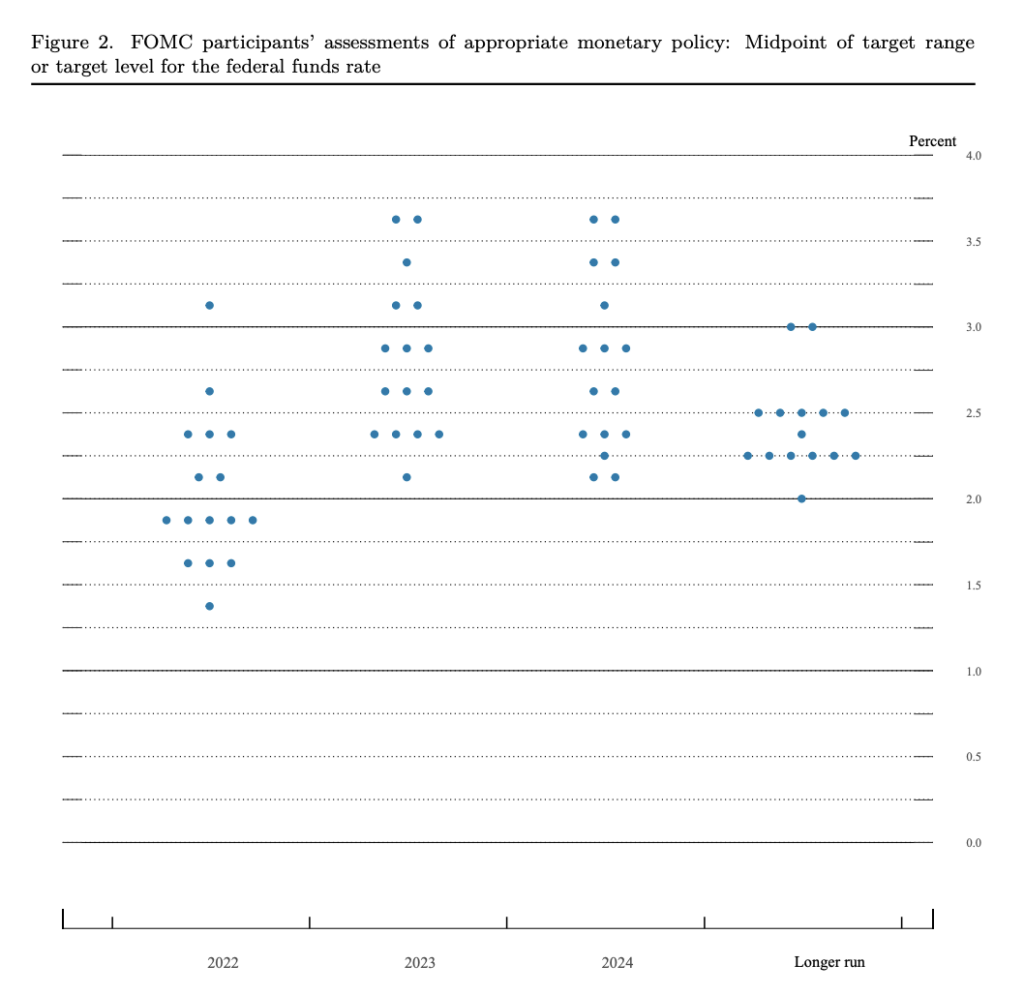

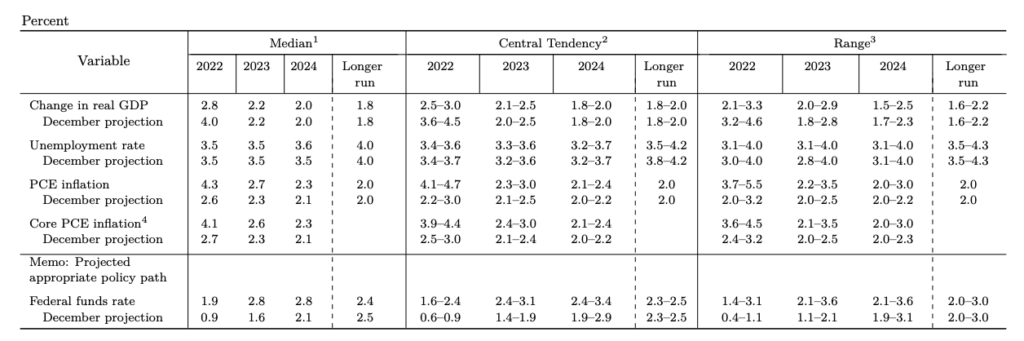

As markets widely anticipated, the Fed raised its federal funds target range by 25 basis points to 0.25% and 0.5% on Wednesday, admitting elevated inflation is more persistent than previously anticipated, with broader price pressures throughout the economy. The infamous “dot-plot,” which provides a visual depiction of Fed officials’ views on monetary policy, showed median expectations of at least seven rate increases throughout the remainder of the year, followed by another three hikes in 2023. Fed members expect rates will sit at 1.9% by the end of the year, followed by a 2.8% Fed funds rate to cap off 2023 and 2024.

However, the most interesting and obvious take-home message from the FOMC meeting was the economic growth and inflation projections. The Fed upgraded its core PCE inflation forecast from 2.7% to 4.1% before the end of the year, and downgraded output growth from 4% to 2.8%… stagflation, anyone?

Indeed, with current CPI sitting at 7.9%— the highest in 40 years and nearly four times higher than the target range, Fed Chair Jerome Powell has no choice but to make a sharp U-turn from his ultra dovish monetary policy enacted in support of increasing economic growth and reaching maximum employment. As per his own admission, the labour market has reached a period of unprecedented tightness, while supply chain disruptions are much larger and longer-lasting than previously anticipated.

By waiting until the eleventh hour to begin raising rates, the Fed made its task even more precarious in wake of unexpected geopolitical events in eastern Europe and subsequent surge in energy costs. Powell may be forced to hike borrowing costs even higher than it now expects, heightening the risk of sending the US economy into a recession.

With the spread between short-term and long-term yields continuing to tighten, the Fed may be forced to raise rates into an inverted yield curve if inflationary pressures do not abate anytime soon. So, the real money question: what happens next? Well, with the Fed now surely trapped between a rock and a hard place with its unmistakable policy error, Powell will have to continue raising rates over the coming months, further inverting the yield curve until once again left with no choice but to embark on more quantitative easing in wake of yet another recession.

2 year 10 year spreads getting tighter.

— SmallCapSteve (@smallcapsteve) March 16, 2022

Fed going to raise into an inverted curve? Might have to if inflation doesn't start coming down. pic.twitter.com/QwHldFK9Aq

Information for this briefing was found via the Federal Reserve and twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.