On Thursday, PopReach (TSXV: POPR) announced a $5.0 million investment from eWTP Tech Innovation Fund LP, a global investment arm of the Alibaba Group. Along with the announcement, Canaccord upgraded their price target 10c to $1.60.

In 2018, the eWTP Ecosystem Fund was launched to invest in enterprises focused on innovation and quality consumption. The anchor investors being Alibaba Group and Ant Financial. According to China Daily, the fund’s mission is to ‘drive strategic investments that help companies accelerate their international expansion and support ideas that drive technological innovations around the world, including projects and plans closely related to the Belt and Road Initiative.’

PopReach is a free-to-play mobile game publisher focused on acquiring and optimizing proven game franchises. They have acquired 12 successful game franchises competing mainly in the North American game market, including Smurfs’ Village (IP under license), Kitchen Scramble, Gardens of Time, City Girl Life, War of Nations and Kingdoms of Camelot. The company reports to have over 1.2 million unique users a month playing their games.

Canaccord analyst Aravinda Galappatthige forecasts the issuer will generate $4.2M in EBIDTA on $18.8M in topline revenue, after having generated $3M EBITDA on $18M topline in 2019. The company currently trades at 28x trailing EBITDA, with Canaccord having the company trading around 21x their forward forecast.

The Funds Allow for Further M&A

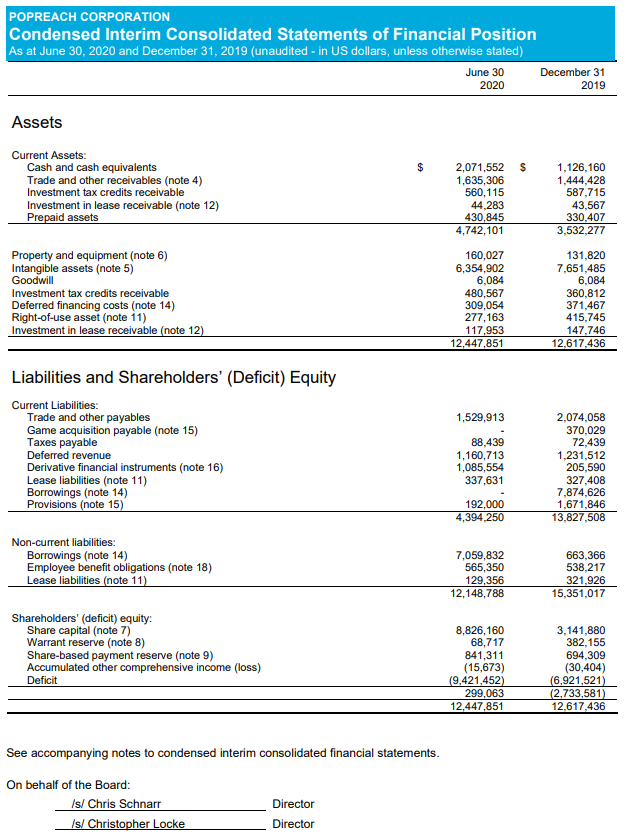

The company states they intend to use the net proceeds from the raise to fund acquisitions and for other general corporate purposes. Canaccord states that this will allow the company to seek further M&A with their net debt postion now near zero . The company’s balance sheet includes a borrowings line item, which came as the result of the RockYou acquisition from December 23, 2018. To fund this acquisition PopReach entered into a senior secured credit agreement of $10,000,000 with a maturity date of December 23, 2022.

In a note Beacon released on the same day, they also see this raise as an opportunity for PopReach to have “a war chest to execute on its pipeline of M&A opportunities.” Beacon maintained their price target of $1.85.

For the time being, the company has a strengthened balance sheet, generates cashflow, and is looking for their next accretive deal. Realistically, it is more than likely the next acquisition deal is already done and hinted at towards the Chinese investment group under NDA discussions.

Overall Thoughts

The Canaccord upgrade, okay it’s a sell side report, boasts about what the connection to AliBaba could mean for the platform in China. We are skeptical whenever a Canadian issuer says they will access the lucrative Chinese market. That being said, PopReach is like a leprechaun in the Canadian gaming stock world. It is an easy-to-understand investment grade security that actually generates cash flow. During the first 6 months of 2020, the company generated over $1M in operating cash flow, and based on the company’s listing statement they generated over twice that in the trailing twelve months leading up to the June 30, 2020 reporting date.

There are of course risks to a model like this. In simple terms the company will need to keep generating games that grab users attention so the company can further monetize their portfolio. Of course from a high level, it appears as though M&A might be the path to maintaining this pipeline, which would cause us some caution. As the saying goes “roll ups go blow up.”

Overall, we think this is an interesting name to keep an eye on and expect substantial newsflow in the coming months.

The stock closed Friday’s trading session up 9c to $1.57.

Information for this briefing was found via Sedar, PopReach, and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.