The UK sterling hit a new record low on Monday against the dollar, seemingly the market’s reaction to the government’s recently unveiled fiscal plan consisting of tax cuts and spending measures.

The pound reached near parity to the dollar at US$1.03 when the Asian markets opened–an all-time low for the currency. It has since went back up to around US$1.07, still a 37-year low.

The consensus: the free fall is a result of the British government’s big tax cuts–its biggest since 1972.

The euro is right there behind it, although with the declines coming at a somewhat slower pace. pic.twitter.com/CbeU1rZzhL

— Lisa Abramowicz (@lisaabramowicz1) September 26, 2022

UK Chancellor Kwasi Kwarteng, who unveiled the plan, refused to comment on the matter, saying there’s “a much more front-footed approach to growth.”

“I think that if we can get some of the reforms… if we get business back on its feet, we can get this country moving and we can grow our economy, and that’s what my focus is 100% about,” he told BBC.

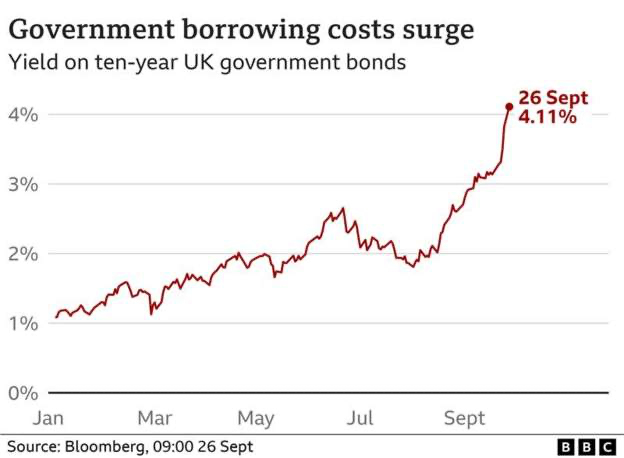

Critics are worried that the tax cuts would lead to higher borrowing for the government at a time that interest rates are hiking. The Bank of England raised the rate last week to 2.25%, its highest in 14 years.

However, Kwarteng defended the plan, saying that “UK has the second lowest ratio of public debt to GDP in the G7.”

We have to act in the short-term to support households and businesses through the energy shock – just as we did during the pandemic.

— Kwasi Kwarteng (@KwasiKwarteng) September 25, 2022

The UK has the second lowest ratio of public debt to GDP in the G7. We are committed to getting debt to GDP down over the medium-term. pic.twitter.com/ihUz01Uc1O

Following the pound’s fall, the CME temporarily halted the trading of British Pound futures.

CME GBP FUTURES HALTED #currencycrash

— FXHedge (@Fxhedgers) September 26, 2022

The sterling’s sharp decline could mean higher prices passed on to consumers, as US is almost one-sixth of London’s total imports. Compounding to this soaring prices is the rising cost of borrowing that will eventually be passed on, as well.

Nevertheless, British government is confident that the fiscal plan will further boost the economy in the long run, with Kwarteng saying that high tax rates “damage Britain’s competitiveness.” Despite the falling currency, he signified that he wants to “keep cutting taxes.”

“We’ve actually put more money into people’s pockets,” he said. “We’re bringing forward the cut in the basic rate [of income tax] and there’s more to come.”

While the plan is also being criticized for potentially benefitting only the rich, Kwarteng countered by saying that he plans to focus on tax cuts “across the board.” He further defended the plan by saying it favors “people right across the income scale.”

“I want to see over the next year, people retain more of their income, because I believe it’s the British people that are going to drive this economy,” he added.

Former Conservative chancellor Lord Kenneth Clarke, however, disagrees. He doesn’t accept the premise “that you make tax cuts for the wealthiest 5%, and it makes them work so much harder, and rush to invest, and it pays for itself or even attracts investment into the country”.

“I’m afraid that’s the kind of thing that’s usually tried in Latin American countries without success,” he said, speaking to BBC. “If it was so simple, we would have got rid of taxes altogether some time ago.”

Information for this briefing was found via BBC, The Guardian, CNBC, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.