FULL DISCLOSURE: This is sponsored content for Power Nickel.

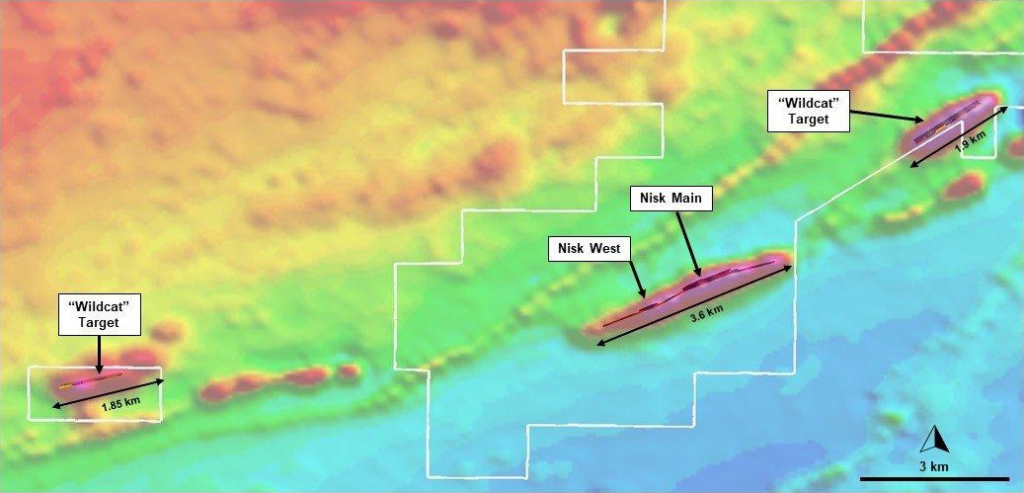

Power Nickel (TSXV: PNPN) this week released its initial mineral resource estimate for its flagship Nisk nickel sulphide project, found near Nemaska, Quebec.

The resource estimate is based on both open-pit as well as underground mining methods, and follows a successful drill campaign this past summer, the first results of which included 19.5 metres of 0.57% nickel and 0.81% copper.

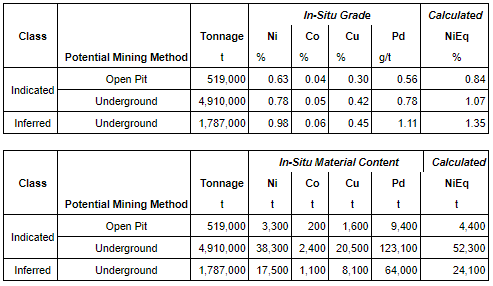

The resource estimate meanwhile amounts to 5.43 million tonnes of 1.05% nickel equivalent in the indicated category, and a further 1.79 million tonnes at 1.35% nickel equivalent in the inferred category.

Broken down, this translates to 519,000 tonnes in an open pit model at 0.63% nickel, 0.04% cobalt, 0.30% copper, 0.56 g/t palladium, and 4.91 million tonnes in an underground model at 0.78% nickel, 0.05% cobalt, 0.42% copper, and 0.78 g/t palladium in the indicated category. The inferred category meanwhile amounts to 1.79 million tonnes in an underground model at 0.98% nickel, 0.06% cobalt, 0.45% copper, and 1.11 g.t palladium.

“Moving forward, Power Nickel will continue working with CVMR Inc., as they conduct a feasibility study that will review the viability of a mine at Nisk that produces not the concentrate that was modeled in this NI-43-101 but refined products. These refined products, including powders, nano powders, wires, anodes, and precursors, currently generate revenues for CVMR 2.5 to 3 times LME concentrate levels. [..] Between now and the end of Q2 2024, we anticipate continuing to drill and grow the Nisk resource and for the ongoing feasibility study to validate substantially greater recovery rates and reveal how finished products significantly improve the overall economics,” commented CEO Terry Lynch.

READ: Power Nickel Raises Flow Through Funds At $0.90 A Share For Next Stage Of Feasibility Study

The results of the mineral resource estimate compares favourably to peers on a valuation basis, as demonstrated below.

| Power Nickel | Noront Eagles Nest | Panoramic Savannah | Talon Tamarack | Premium Nickel Selebi | Magna Mining | ||

|---|---|---|---|---|---|---|---|

| Jurisdiction | Canada | Canada | Australia | Canada | Botswana | Canada | |

| Ownership | % | 80 | 100 | 100 | 51 | 100 | 100 |

| Tonnage | mt | 7.2 | 11 | 13.9 | 17 | 17.8 | 34 |

| Nickel | % | 0.81 | 1.7 | 1.6 | 1.3 | 0.87 | 0.33 |

| Copper | % | 0.42 | 0.9 | 0.7 | 0.7 | 1.42 | 0.35 |

| Cobalt | % | 0.05 | – | 0.1 | 0.03 | – | 0.02 |

| Palladium | g/t | 0.85 | 3.0 | – | 0.2 | – | 0.36 |

| Market Cap (M) | C$ | 36.9 | 617 | 93.5 | 163.2 | 193.4 | 71.9 |

Power Nickel currently trades at a $6.4 million per mt in resource multiple (accounting for their 80% ownership in Nisk), versus peers, such as Noront Resources, who last year sold for $617 million to Wyloo Metals, which equates to a $56.1 million per mt of resource multiple.

The initial resource estimate is also a notable improvement from the historical estimate that existed for the property, which consisted of 1.3 million tonnes in the measured category at 1.09% nickel and 0.56% copper, 783,000 tonnes in the indicated category at 1.00% nickel and 0.53% copper, and 1.1 million tonnes in the inferred category at 0.81% nickel, and 0.32 copper, which combined for just 3.1 tonnes across the three categories, versus the 7.2 million tonnes under the 43-101 compliant resource estimate.

The estimate itself is based on 117 surface drillholes and 3,835 samples, with the cut-off date for drill data used being November 26.

Power Nickel last traded at $0.255 on the TSX Venture.

FULL DISCLOSURE: Power Nickel is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of Power Nickel. The author has been compensated to cover Power Nickel on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.