The coronavirus pandemic has turned the entire economy upside down, causing businesses and companies to unprecedented hardships. As a result, many companies decided to withdrawal issuing earning guidance given the current economic uncertainty and volatility. However, one billionaire businessman thinks that long-term earnings forecasts should be scrapped altogether – and permanently.

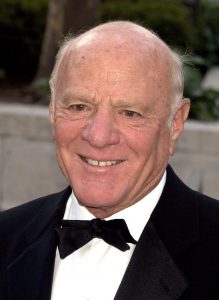

Speaking on CNBC’s Squawk Box, chairman of IAC and Expedia Barry Diller said his companies will no longer be providing earning guidance, and will instead have employees utilize their time towards more meaningful work. According to Diller, all companies should look into suspending the practice, and divert those efforts towards ensuring the firm is being run smoothly and efficiently. He does not see earning guidances as a means of keeping companies accountable, but rather as an incentive for manipulating numbers to exceed expectations on a quarterly basis.

Diller further expressed his discontent with the practice, saying it is wasteful to always be ensuring the model is correct. Furthermore, guidance forecasts can lead to under-achieving, because a company can always set up the model in such a way so that expectations are always met, regardless of how minuscule they are.

Information for this briefing was found via CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.