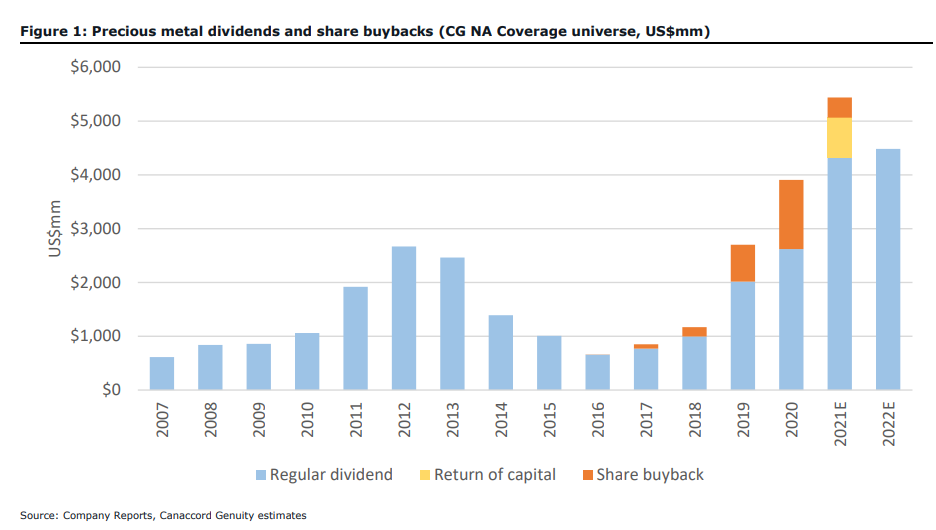

Recently, Canaccord put out a note titled, “Record return of capital and building cash.” Within, they comment that gold prices remain elevated which has helped companies return higher capital to shareholders.

Canaccord estimates that there will be roughly $5 billion of dividends paid out to investors of precious metals firms during 2021, almost double the $2.6 billion issued last year. This is on top of share buybacks. A good chunk of this years record payouts comes from Barrick Gold’s (TSX: ABX) one-time $750 million return of capital. Canaccord expects that dividend payments stay elevated at $4.5 million in the coming years.

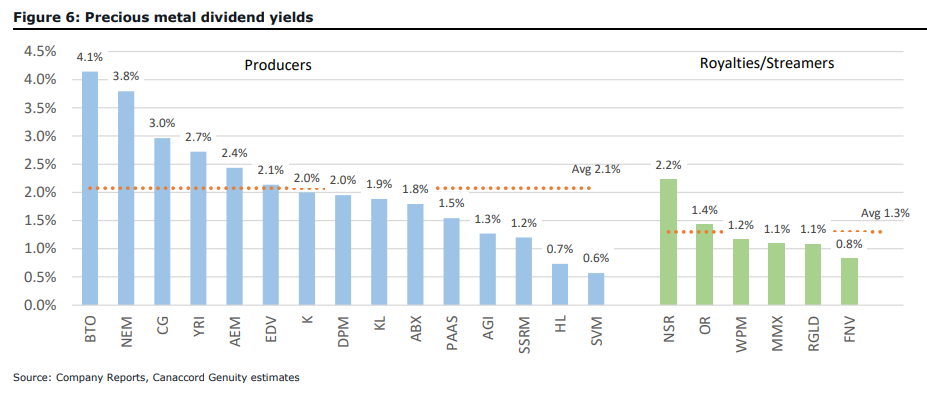

Canaccord believes that most of these companies’ dividends are sustainable even if gold drops down to $1,300 an ounce and says, “we note some company dividend policies allow for lower payouts in the event of lower gold prices.” They also believe that the yields are very attractive at an average yield of 2.1%, while B2Gold and Newmont have a 4.3% and 3.8% yield respectively.

Canaccord estimates that on top of the $5 billion in dividends, companies have bought back $376 million in shares year to date. Canaccord says, “Share buybacks were largely non-existent in the past cycle and have been increasingly adopted as a way to return excess capital and maintain a dividend that can be sustained at lower gold prices.”

Lastly, below are Canaccord’s top picks within the resource space:

• Senior Producers: Endeavour Mining, Pan American Silver, Kinross and Yamana

• Intermediate and Junior Producers: SSR Mining and K92 Mining

• Royalty and streaming companies: Osisko Gold Royalties and Nomad Royalty

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.