On February 25, Precipitate Gold Corp. (TSXV: PRG) paused the planned 10-hole, 2,000-meter maiden diamond drilling program at its flagship 100%-owned Ponton copper-gold project in the Dominican Republic (D.R.) after drilling only two holes. A faction of the local community objected to the drill program and to the company’s exploration goals, and Precipitate Gold halted its initiative.

The halt came despite the Ministry of Environment and Natural Resources’ granting a drilling permit in January 2021.

The risk for the company is a protracted stand-off with the local opposition, which could potentially become an impasse into which the Dominican government is disinclined to intervene. Such stand-offs have occurred in other foreign countries, such as Ecuador, and against more powerful companies than Precipitate Gold. There, indigenous communities forced the halt to the US$3 billion San Carlos Panantza project, which was backed by China’s ExplorCobres S.A., for about two years.

Precipitate Gold’s Ponton drilling situation could of course be resolved quickly and amicably, but the halt of a drilling program in a foreign country, even one which has been granted all necessary regulatory approvals, raises a red flag. The reason: any resolution would likely require government intervention against the will of at least some of its own people and in favor of a foreign-domiciled company. Such an action is unpopular to enforce.

Precipitate Gold’s Projects

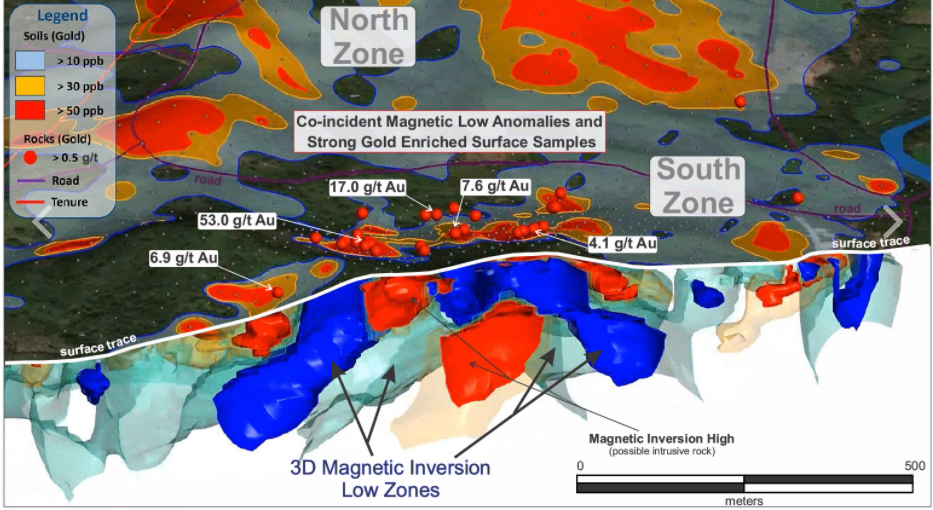

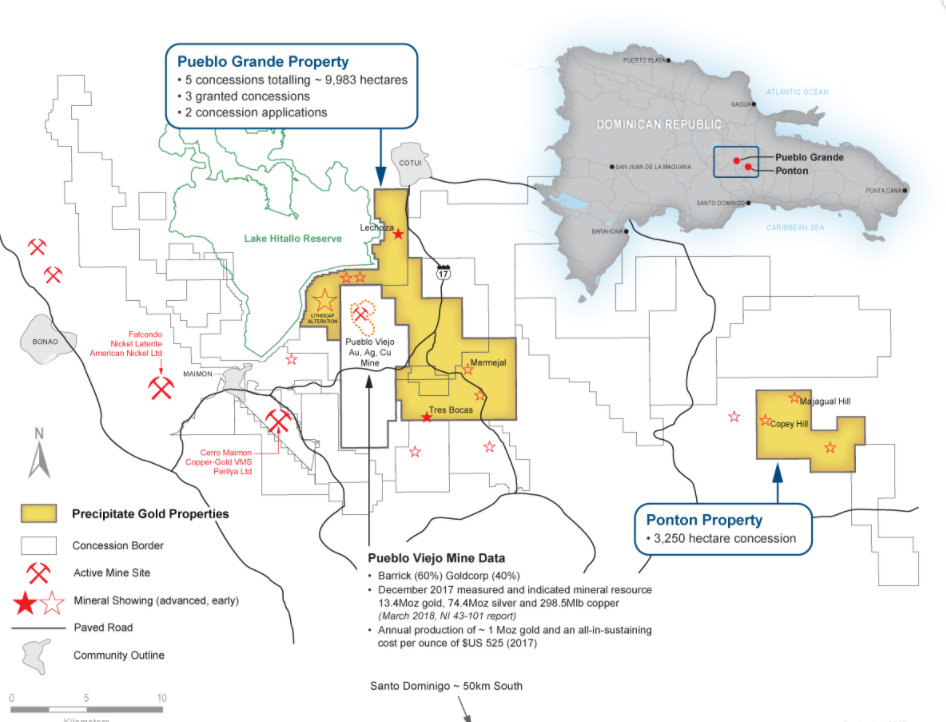

The Ponton Project is located 35 kilometers east of Barrick Gold Corp’s giant Pueblo Viejo mining operation, which produced 542,000 ounces of gold in 2020. Barrick Gold holds a 60% stake in Pueblo Viejo, and Newmont Corp. the other 40%. Ponton and Pueblo Viejo share the same volcanic rock formation. In December 2020, Precipitate Gold announced that the results of a geophysical magnetic study at Ponton’s Copey Hill Gold Zone displayed large and strong magnetic anomalies. These anomalies are frequently consistent with gold epithermal systems.

The 100%-owned Juan de Herrera gold project is located within the Tireo Gold Trend in the D.R. It is adjacent to GoldQuest Mining’s Romero Project.

The 100%-owned Pueblo Grande project contains mining concessions of 9,863 hectares and borders the Pueblo Viejo mine. In April 2020, Precipitate signed an earn-in agreement with Barrick Gold on Pueblo Grande whereby Barrick can acquire a 70% interest if it completes at least US$10 million in exploration spending and produces a Pre-feasibility Study by April 2026. In December 2020, Barrick Gold mobilized two rigs to Pueblo Grande to commence a 3,750-meter initial drilling campaign in two different areas.

Debt-Free Balance Sheet

As of August 31, 2020, Precipitate Gold had $1.8 million of cash and no debt. A pre-revenue company, Precipitate Gold’s operating cash flow deficit averaged about $300,000 per quarter over the last five reported quarters.

| (in thousands of Canadian $, except for shares outstanding) | 3Q FY20 | 2Q FY20 | 1Q FY20 | 4Q FY19 | 3Q FY19 |

| Operating Income | ($366) | ($646) | ($384) | ($297) | ($139) |

| Operating Cash Flow | ($339) | ($202) | ($433) | ($357) | ($156) |

| Cash – Period End | $1,790 | $2,063 | $984 | $1,400 | $466 |

| Debt – Period End | $0 | $0 | $0 | $0 | $0 |

| Shares Outstanding (Millions) | 106.3 | 105.8 | 93.0 | 92.9 | 82.7 |

The differences between members of the community surrounding the Ponton Project and Precipitate Gold could of course be resolved relatively quickly. If so, and if drilling results at the site were to be encouraging, the Ponton property could prove quite valuable.

Investor uncertainty could weigh on Precipitate Gold shares until the surrounding communities’ differences regarding the Ponton drill program are resolved. If drilling were to restart, and factoring in that the project is located near and has similar geologic characteristics as other producing mines, Ponton could in time become an attractive asset.

Precipitate Gold Corp. stock is trading at $0.17 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.