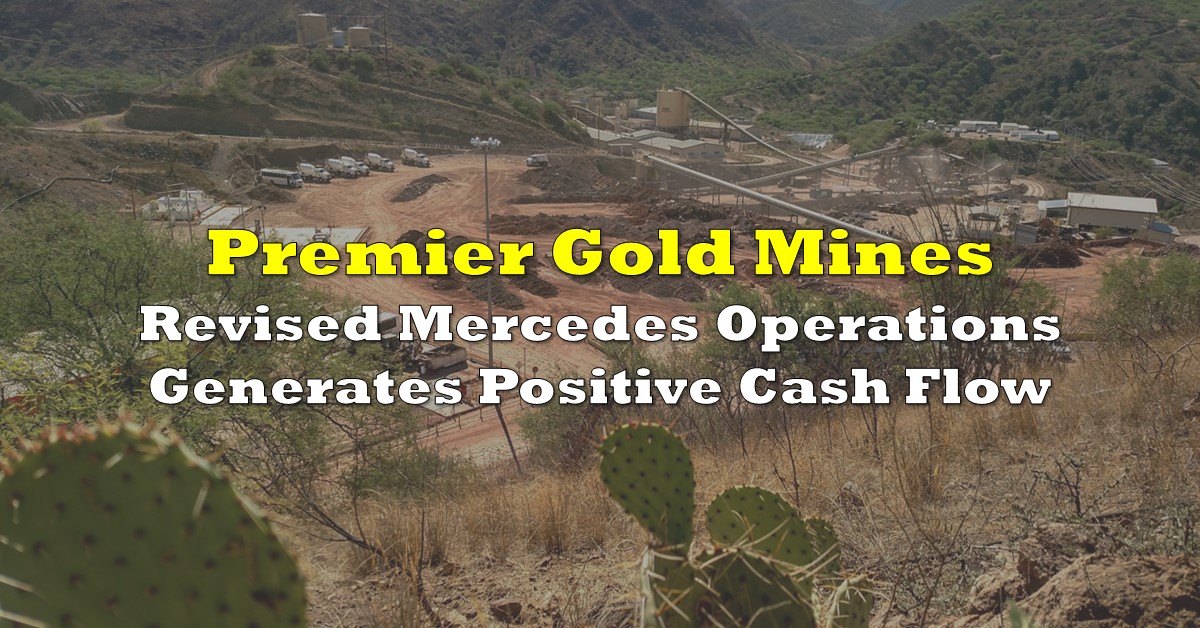

A quick update was released this morning by Premier Gold Mines (TSX: PG) in relation to its Mercedes Mine in Sonora, Mexico. The company was pleased to report this morning that since restarting operations at site following a shutdown due to the pandemic, the company has since began generating positive cash flow under a revised production plan.

Notably, Premier had reduced the workforce at Mercedes after revising its production plan for the site, with the result being a cutback in 40% of its staff, whom were layed off. Further, production was pulled back to 1,200 tonnes per day versus the prior 2,000 tonnes per day as the company looked to rightsize operations. This new production plan is referred to as a “simplified production plan” by the company, and saw implementation begin last month.

The focus of the changes were to improve operating margins as well as positive cash flow for the project. To date, the changes have been successful as the company now continues to develop and mine the Diluvio, Lupita and Lupita Extension zones. Higher than planned gold production has occurred as a result, mixed with lower unit operating costs.

Continued exploration at site is currently focused on supporting a return to a processing capacity of 2,000 tonnes of rock per day while prioritizing extending the life of the mine through the growth of reserves. This is being done by both the exploration of existing mine workings as well as the delineation of future resources at the San Martin and Marianas zones.

Premier Gold Mines last traded at $2.68 on the TSX.

Information for this briefing was found via Sedar and Premier Gold Mines. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.