A Quebec firm developing a lithium mine and production plan has agreed to supply materials to Ford for use in electric vehicle batteries for an 11-year period.

The partnership announced on Monday by the automotive giant and Nemaska Lithium will make the American automaker the Quebec company’s first customer.

According to a joint news release, Ford will purchase up to 13,000 tons of lithium hydroxide per year from Nemaska’s factory in Bécancour, Que., roughly 150 kilometers northeast of Montreal.

“This agreement is a vote of confidence for the solidity of the project, of the quality of the product that will be produced, and, of course, a testament to the effort of the Nemaska teams,” said CFO Steve Gartner.

The company’s Whabouchi mine in northern Quebec’s James Bay region is set to start producing lithium ore in 2025, which will then be processed at the Bécancour plant when it opens the following year.

“Lithium is a key component in high-quality and high-performing electric batteries,” Gartner added. “We have a world class deposit in the James Bay region and we look to establish the first integrated mine to lithium hydroxide plant in Quebec to support the North American supply chain for electric vehicles.”

Before the plant begins producing lithium hydroxide, Ford will also purchase spodumene concentrate, a lithium mineral, from Nemaska Lithium. According to a press statement, Nemaska will provide a sustainable source of lithium, allowing the manufacturer to grow manufacturing of electric vehicles and make them more accessible to customers.

Gartner said the project will provide a more environmentally friendly source of lithium than many of its competitors.

“One of the strong advantages that our product will have is that we have access to hydroelectricity,” he said. “[We] use up to 12 times less water than certain processes and (emit) more than 70 per cent less greenhouse gas emissions than other similar processes around the world.”

Ford has been ramping up lithium supply deals, recently with North Carolina-based Albemarle and Chilean firm SQM.

“We don’t have to rely on anything from China for our lithium needs at this point,” said Ford VP of EV Industrialization Lisa Drake. “We’ve diversified ourselves away from that.”

Ford Motor VP of EV Industrialization Lisa Drake says that the company doesn't have to rely on China for lithium anymore https://t.co/ibn9nQhhdH pic.twitter.com/yZbs8gL34c

— Bloomberg (@business) May 22, 2023

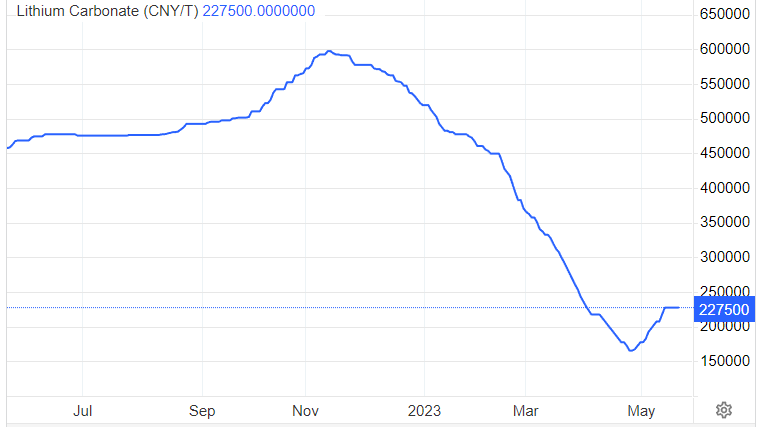

Prices for lithium carbonate surpassed CNY 227,000 per tonne, extending the recovery from a 19-month low of CNY 165,500, amid increased optimism for electric battery demand. According to new data, new EV sales and output in China increased by 110% year on year in April, alleviating fears about low demand at the start of the year.

The reduction in demand coincided with a major oversupply of batteries during the first quarter, as producers took advantage of final inflows of government subsidies and stepped up production until the end of 2022, resulting in unsustainable inventory levels.

Longer-term demand forecasts are also strong, supporting wagers that lithium will prolong its recovery from this year’s drop, as government incentives to switch to EVs lead experts to forecast that lithium demand by 2040 will be 16 times higher than today’s levels.

Nemaska is a joint venture between Quebec’s economic development agency, Investissement Québec, and Livent, a lithium firm based in Philadelphia.

The Quebec government and Livent stated last summer that they would each pay $80 million to fund the studies and preparatory work required to restart mine construction and commence building of the Bécancour facility.

A former version of the firm, under different ownership, filed for bankruptcy in 2019, costing Investissement Québec $71 million. Quebec invested $130 million to subsidize that company during the previous Liberal government.

When the government took up the project with a private-sector partner in 2020, it pledged to invest up to $300 million on the project’s relaunch. $175 million of that financing has already been announced.

Information for this briefing was found via CTV News and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.