In addition to marked declines in headline stock indices this year, investors also have had to cope with an erosion in real estate values over the last six months Tightening actions by the U.S. Federal Reserve and the Bank of Canada have lifted mortgage rates, making home ownership less affordable for many. In turn, housing prices have adjusted lower, quite sharply in some cities where prices exploded higher during the housing boom.

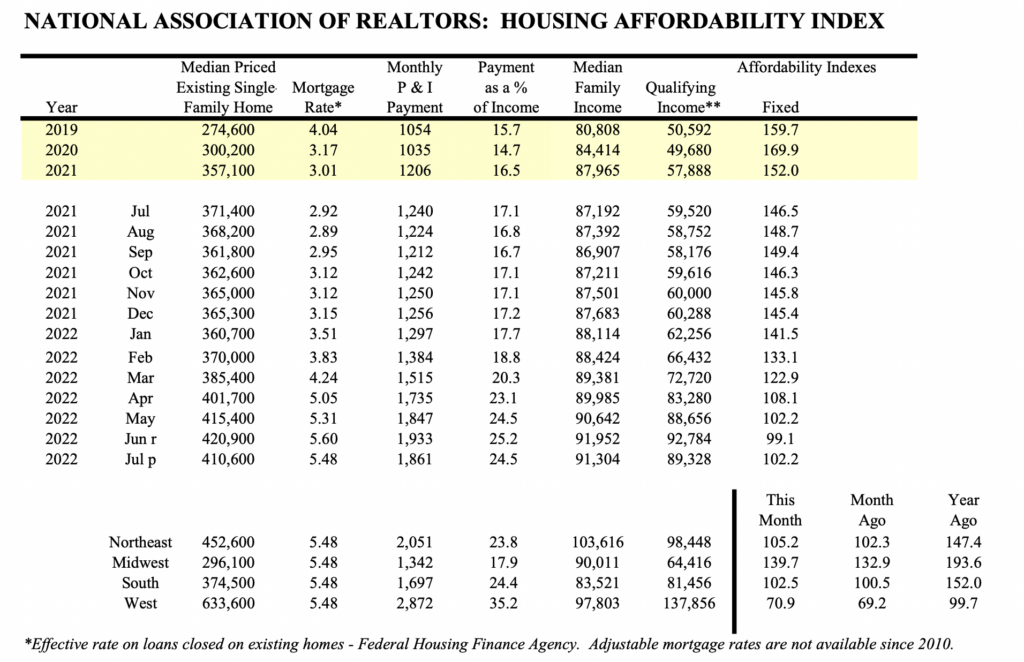

An index of U.S. housing affordability compiled by the National Association of Realtors has plunged since February 2022. This index is down about 30% since the end of 2021.

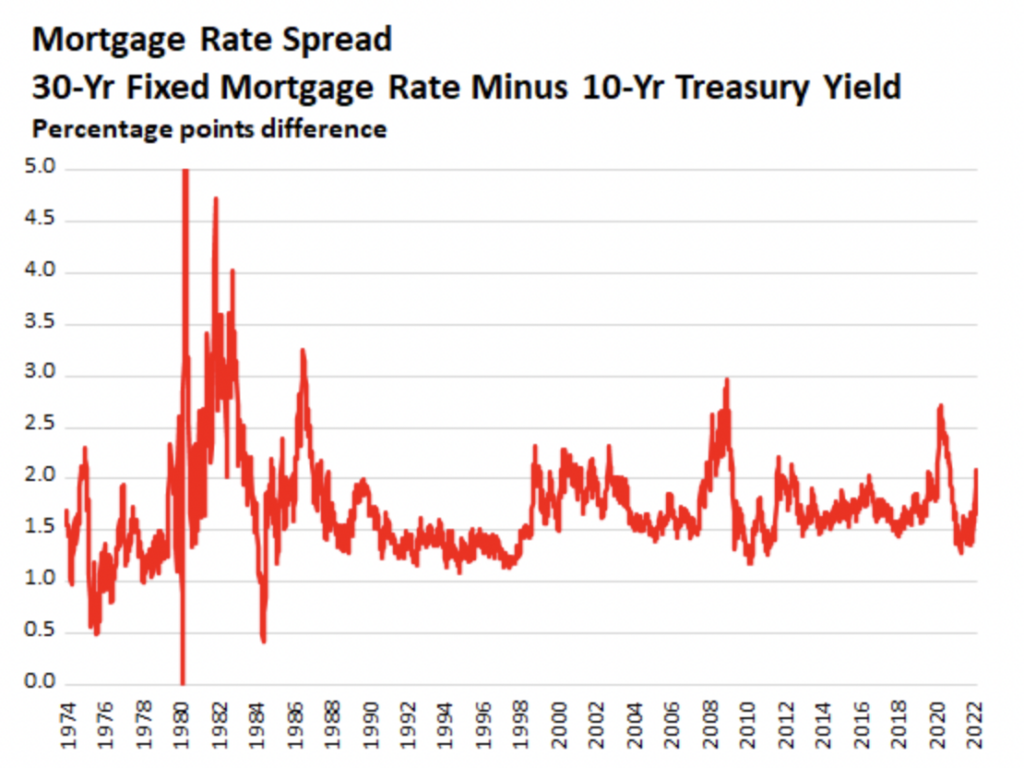

An unusual and exacerbating element of the current real estate downturn has been the degree to which mortgage rates now exceed the U.S. government bond yields. The spread between the average 30-year fixed mortgage rate, currently 6.02%, and the 10-year U.S. Treasury yield of 3.45%, is around 260 basis points (bp), far higher than the fairly steady ~170 bp average premium over the last decade, and the highest it has been since:

- 1) a brief, fear-induced blip higher at the outset of the COVID-19 pandemic, and

- 2) a longer span during the Financial Crisis of 2008-2009.

Mortgage rates are closely tied to the ten-year Treasury yield because the average lifespan of a mortgage is about ten years.

A constructive interpretation of the above graph is as follows: if the current premium were to reset to the 170 bp average seen over the last ten years, mortgage rates would be around 5%. While not as low as rates in the 3% range that prevailed in 2021, a 5% average mortgage rate would increase buyer affordability and would likely be consistent with noticeably higher housing values than which currently prevail.

A more concerning interpretation is that the present economic/macro environment — extreme levels of inflation which the Fed belatedly decided to combat — may be more like the early 1980s than the 2008-2009 or March 2020 time frames. During those periods, the Fed aggressively cut short-term rates, and mortgage rates took some time to react lower. In the early 1980s, high mortgage premiums persisted for some time — before plunging in late 1983/early 1984.

How the markets resolve the mortgage rate premium over the coming months, either in favor of the more positive or more pessimistic scenarios, seems likely to have a significant impact on the near-term direction of housing prices — and potentially overall stock market valuations.

Information for this briefing was found via the St Louis Fed and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.