As the global demand for oil dried up significantly during the height of the pandemic, oil prices crashed and many producers were forced to reduce production. However, now that oil demand is beginning to rebound with the reopening of large economies around the world, a considerable risk still remains in the event that a resurgence of the deadly virus erupts.

The demand for crude oil has fallen significantly, given the reduction in air travel and consumerism. According to the International Energy Agency (IEA), the forecasted demand for crude oil to fall by 8%, or 7.9 million barrels per day. However, the third quarter of 2020 is expected to boost demand by approximately 14%, to an average of 94.3 million barrels per day.

As OPEC+ has enforced substantial oil production cutbacks, meanwhile the US and Canada have reduced their drilling output and investment in the industry. Thus, the global oil supply has fallen to a nine-year low of 86.9 million barrels per day in May.

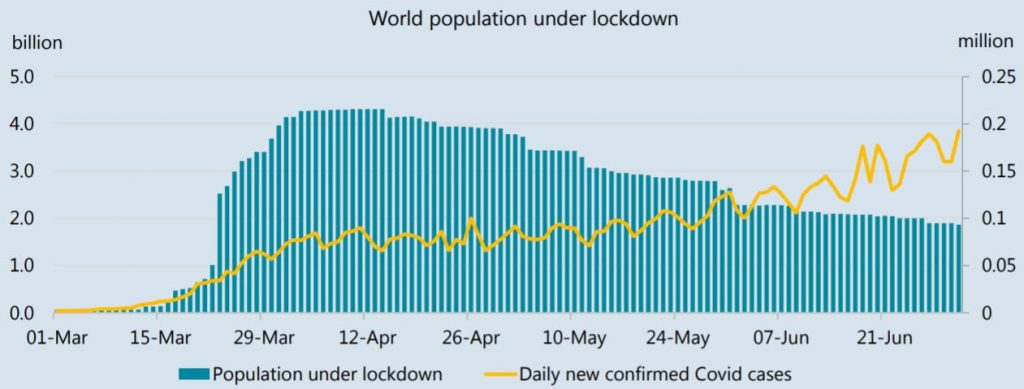

However, IEA’s forecasts are based on a steady rebound of the oil market, with consumption increasing relative to the easing of travel restrictions and successful coronavirus mitigation efforts. In the event that a second wave of the virus erupts, or scattered outbreaks become more severe, the oil market could potentially collapse once again. The US is currently battling record daily surges in infection rates, causing some states to put their restriction-lifting plans on hold. In addition, Asia is also reporting a re-emergence of the virus, even though it was nearly eradicated a short while ago.

Nonetheless, the continued acceleration of the coronavirus in some countries signals that the pandemic is far from over; as a result, the optimism in the oil global oil market may become short-lived.

Information for this briefing was found via the International Energy Agency, Reuters, and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.