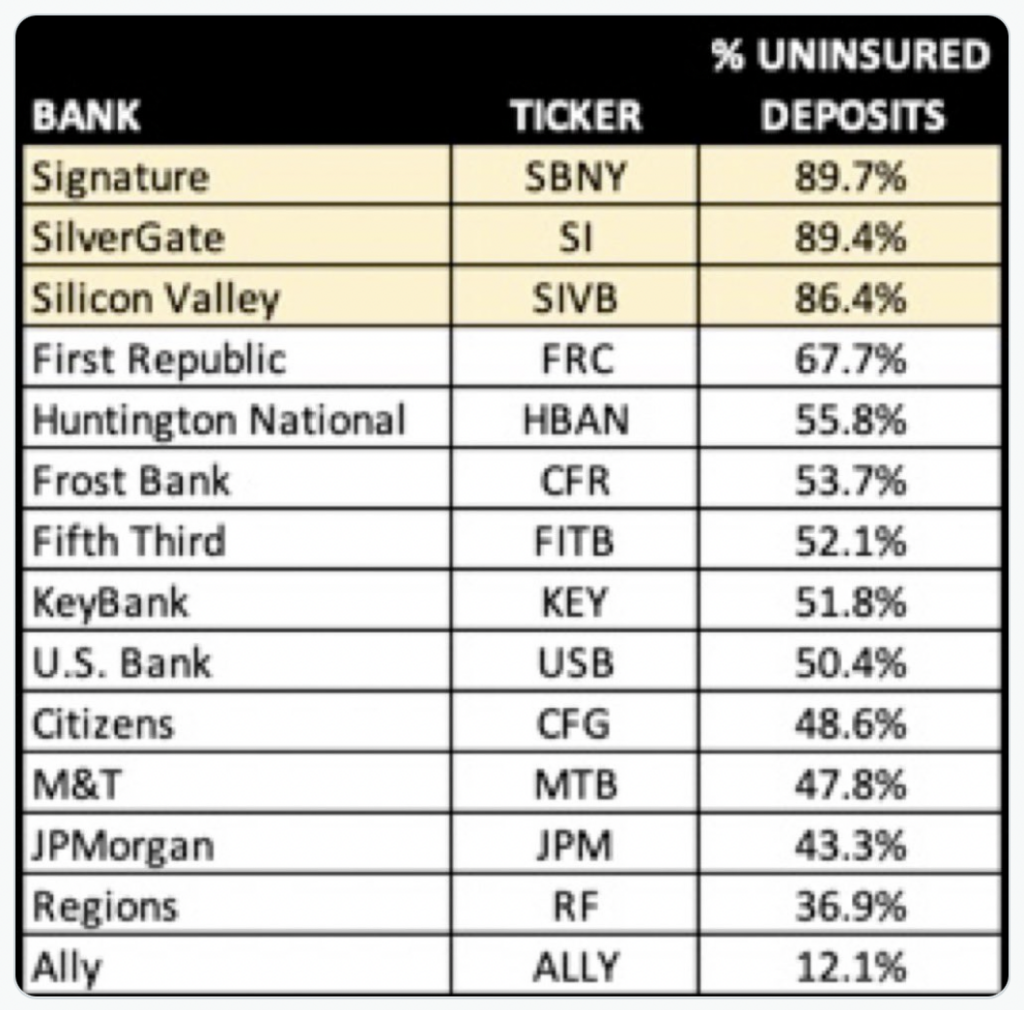

On its surface, the U.S. government’s decision to backstop all depositors at SVB Financial Group (NASDAQ: SIVB) and Signature Bank (NASDAQ: SBNY) reads like a constructive development for U.S. banks, particularly for embattled regional banks. After all, depositors will be made whole, even those who had account balances substantially in excess of amounts insured by the Federal Deposit Insurance Corporation (FDIC).

However, most bank stocks, especially regional bank stocks, have plummeted on the news. For example, First Republic Bank (NYSE: FRC) fell 54% on March 12 and is down 81% over the last month. Speculative-minded investors may be tempted to swoop in and pick up what may be perceived as overly discounted values, but before doing so, the following factors must be considered.

READ: SVB Financial Group Officially Files for Bankruptcy

After this scare, a substantial percentage of deposits at all regional banks will transfer to safer money center banks like JPMorgan Chase & Co. (NYSE: JPM) and Bank of America Corporation (NYSE: BAC). This outflow will obviously limit the amount of assets on which a bank can earn returns by investing in high-yielding fixed income instruments or by issuing loans. Furthermore, since deposits are a bank’s cheapest source of capital by far, a bank’s net interest margin will decline markedly as higher cost capital will have to replace low-cost deposits.

Until the SIVB failure, bank depositors had a very limited appreciation of the large percentage that any bank’s deposits are uninsured. Indeed, even 43% of JPMorgan’s deposits are uninsured. Depositors have learned a lesson over the last week they will not soon forget. It is difficult to imagine that depositors will not value safety over a small amount of incremental interest income that can be gained at a small bank.

Some new, higher FDIC insurance cap per account will have to be renegotiated. As this uncertainty lingers, this will similarly drive depositors to large banks. Return of capital now trumps return on capital considerations by a large margin.

The loud cries by venture capital (VC) and private equity (PE) funds over last weekend that SIVB must be bailed out by the government were rewarded with action by the U.S. Administration. However, it is difficult not to label the pleas made by these investors as rank hypocrisy. After all, many VC/PE investors have espoused libertarian/complete free market viewpoints. As sophisticated investors, they surely understood the limits of FDIC insured deposits.

The economic upheaval caused by the SIVB/Signature Bank difficulties increases the odds that the Federal Reserve will choose to pause, for at least one meeting, its pattern of raising overnight interest rates. Such a pause would likely be greeted by a sharp, short-term rally in equity markets.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.