On January 21, Eldorado Gold Corporation (TSX: ELD) announced an agreement to buy QMX Gold Corporation (TSXV: QMX) at a takeover price of $0.30 per share, nearly a 40% premium to its January 20 closing price and an 80% premium to its year-end 2020 close. Eldorado had previously acquired a 17% stake in QMX Gold at a bargain price of C$0.06 in a late December 2019 private placement.

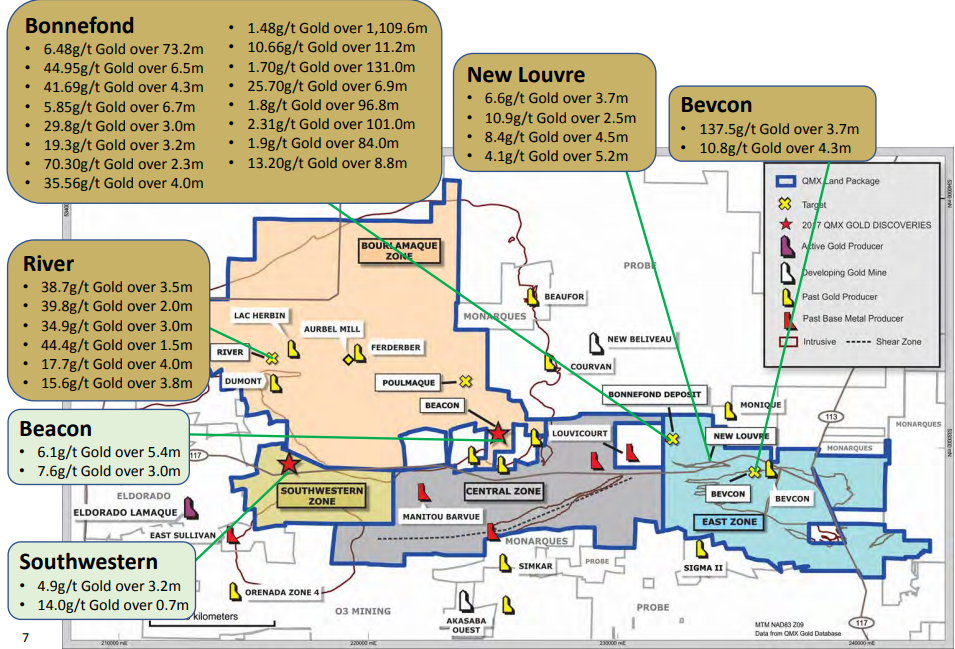

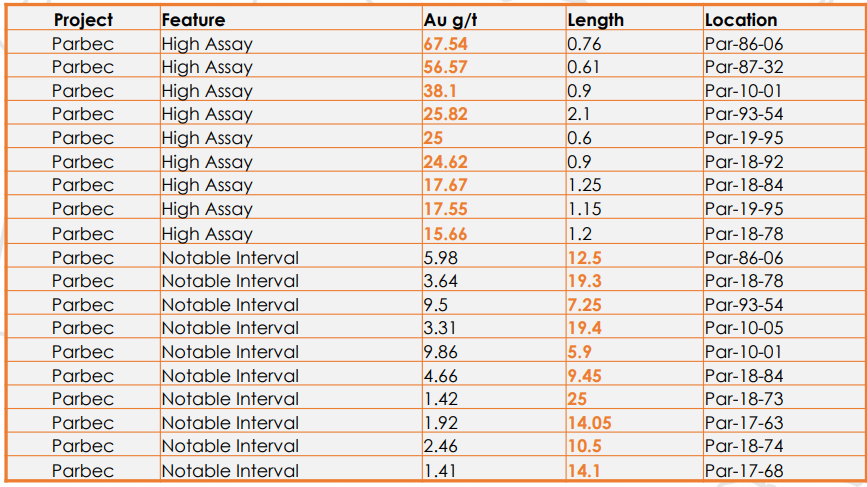

Eldorado cited QMX Gold’s exploration projects in the Abitibi Greenstone Belt, a world-class mining region, and in the Val d’Or gold district as key reasons for its action. In addition, assay results at a number of QMX Gold’s development projects show promising gold intercept results. See Figures 1 and 2. Given the significant takeover premium, below we examine two junior mining companies, Renforth Resources Inc. (CSE: RFR) and Radisson Mining Resources (TSXV: RDS), both which have similarly well-positioned land holdings in the Abitibi region, and could potentially become acquisition targets.

Renforth Resources

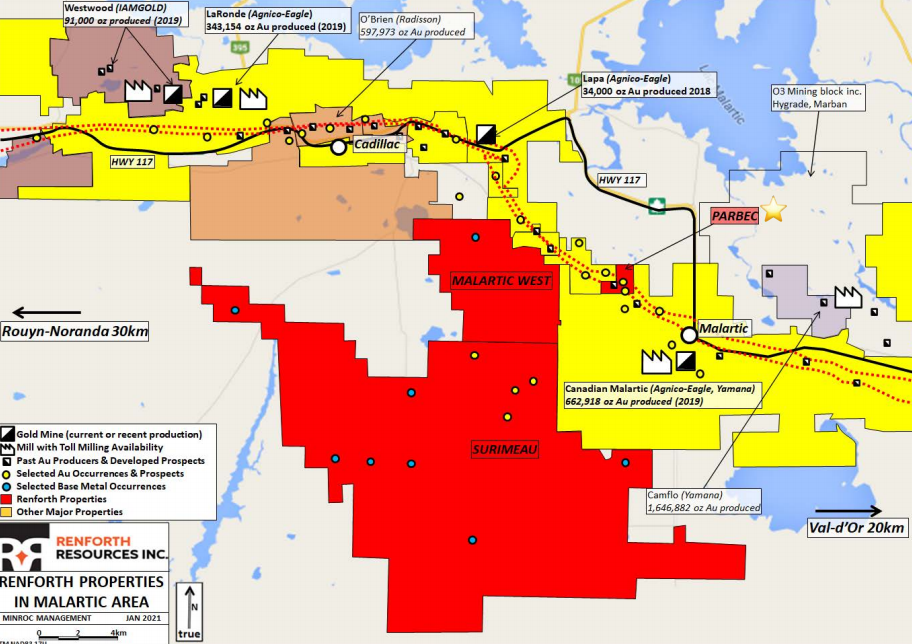

Renforth’s principal asset, the Parbec open pit gold deposit, holds resources containing an estimated 281,000 ounces of gold (combined indicated and inferred resources) and is adjacent to Agnico Eagle’s Canadian Malartic mine (see Figure 1 above). It sits on the Cadillac-Larder Lake Break; QMX Gold’s properties are located near this fault zone as well. Parbec’s assay results include impressive gold intercepts. See Figure 3 and 4.

Renforth’s properties are shown in red.

Factoring in total cash and securities holdings of $6.8 million and no debt, Renforth’s enterprise value (EV) is about $8.0 million, equivalent to $29 per estimated ounce of gold resource. In contrast, QMX Gold’s takeout EV is around $110 million. Its principal asset is the Bonnefond gold property, which has an estimated 687,900 ounces of gold resource (combining indicated and inferred resources). The QMX Gold acquisition price therefore equates to $160 per ounce of gold resource, or 5.5 times Renforth’s figure.

Radisson Mining Resources

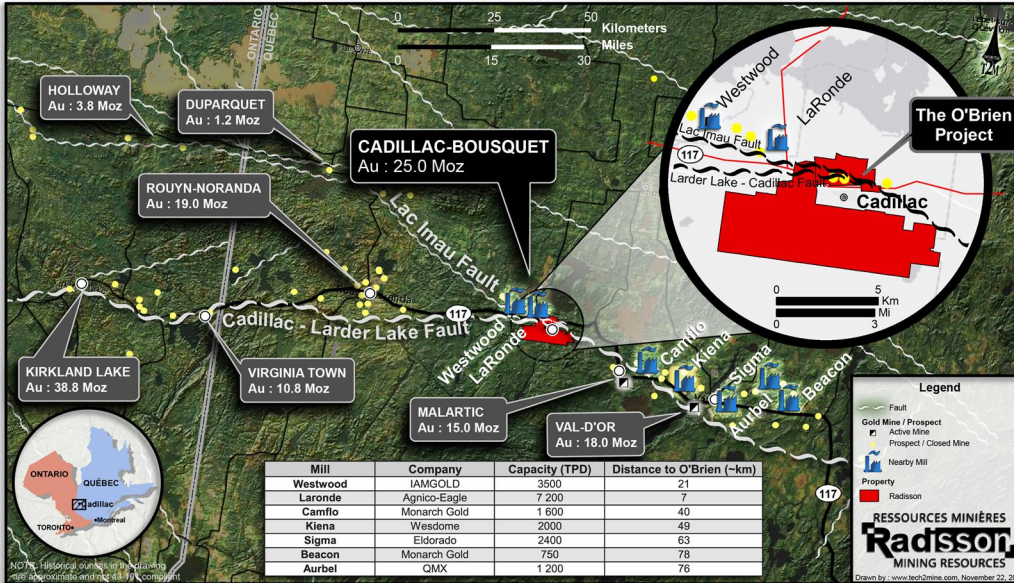

Radisson’s 100%-owned O’Brien gold project sits along both the Cadillac-Larder Lake Break and the Lac Imau Fault and, like Renforth’s Parbec property, is near the Canadian Malartic mine. See Figure 5. At a cut-off gold grade of 5 grams per tonne of resource, it potentially contains 434,000 ounces of gold (combining indicated plus inferred estimates).

The company’s EV is about $64 million (stock market capitalization of about $75 million less $6.9 million of cash; no debt). As a consequence, Radisson’s EV represents about $147 per ounce of gold resource.

Investment Conclusion

Eldorado’s friendly acquisition of QMX Gold could be a one-off transaction, but it could also suggest that large gold miners are evaluating other mining properties in the Abitibi Greenstone Belt. On that basis, Renforth Resources and Radisson Mining may be interesting speculations. The cash-rich, debt-free companies’ properties are located near a number of major mines. Also, both stocks trade at discounts to QMX Gold’s takeover price in terms of EV per estimated ounce of gold resource.

Renforth Resources trades at $0.06 on the Canadian Stock Exchange, and Radisson Mining Resources trades at $0.295 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.