Retail investors played an enormous role in the market’s rally over the first seven weeks of 2023, according to Vanda Research, a global independent research company.

Retail traders funneled a net average of just over US$1.5 billion per day into U.S. equity markets over the last 21 days, eclipsing the previous 21-day rolling peak set in early 2021 when meme stocks like GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings, Inc. (NYSE: AMC) zoomed to unprecedented (and largely unwarranted) levels.

It's unwise to underestimate the importance of the retail cohort. Last month, #retail investors poured on average $1.51bn/day into the #US markets, the highest amount on record. They've continued driving US market swings with institutional investors remaining bearish on #stocks. pic.twitter.com/G0fe05YhGG

— Vanda Research (@vandaresearch) February 17, 2023

In January, small investors generally bought well-known large technology stocks like Tesla, Inc. (NASDAQ: TSLA), Amazon.com, Inc. (NASDAQ: AMZN), Apple, Inc. (NASDAQ: AAPL), and NVIDIA Corporation (NASDAQ: NVDA), as well as much smaller, highly speculative stocks like ARK Innovation ETF (NYSE: ARKK).

The common characteristic is retail investors re-entered many of the risky stocks which were decimated in 2022. Institutional investors, on the other hand, have maintained a negative to cautious stance on the market fearing the Fed’s ongoing rate increase program will cause the economy to turn down at some point in 2023.

An element in all this which is difficult to pin down is: what prompted retail investors as a group to become so bullish on January 1? Answering this question becomes even more challenging after factoring in the tough year many investors absorbed in 2022. Vanda estimates that the value of the average retail investor’s portfolio ended calendar year 2022 down about 35% from its all-time high.

In any event, the participation by and importance of retail investors in the markets cannot be underestimated. Many pundits had anticipated that retail investors, flush with federal stimulus cash and having few entertainment options on which to spend it, ramped up their trading activity during the early days of COVID and would eventually cut allocations to market investing as the world returned to normalcy.

That pullback clearly has not occurred, even after a terrible market year in 2022. Retail interest in the equity markets is dramatically higher than it was over the six-year period from January 2014 through January 2020.

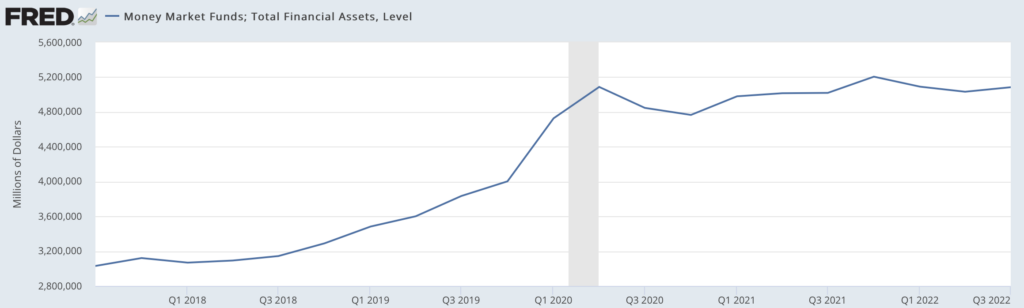

Moreover, resilient retail investors could potentially allocate still more dollars to stocks; they certainly have the dry powder to do so. Cash stashed in money market funds totaled about US$5 trillion as of September 30, 2022, up about US$2 trillion in just four years.

Of course, the much higher interest rates now available on those funds might dissuade investors from withdrawing their cash.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.