Through February 2, the high-risk Nasdaq Composite gained 16%, its best performance over the first 33 calendar days of a year since 1975. These year-to-date 2023 gains are based primarily on a belief that the Federal Reserve will not only stop raising short-term interest rates within months but begin cutting rates before the end of 2023, presumably in response to a slight economic downturn in the second half of the year.

The day before, Fed Chairman Powell reiterated his opinion that the Fed’s implementing rate cuts before year end was unlikely, but investors generally do not share that view. As an aside, the NASDAQ and the S&P 500 reach recorded gains of around 30% in 1975.

READ: Jerome Powell Hikes Rates 50 Basis Points, Signals More Hawkish Tightening

Partly due to the explosive start to 2023, many observers are concerned that the stock market is exhibiting even more of casino-like atmosphere than it has in recent years, which in turn makes predicting the direction of its next major move, and the magnitude of that leg, extremely difficult. Two unusual conditions surrounding the equity markets are worth noting.

First, retail investors’ share of total trading volume in the U.S. was 23% from January 25 through February 1, according to JPMorgan data. This figure represents the highest percentage ever recorded, edging out the 22% level achieved during the 2021 height of trading frenzies in meme stocks like GameStop Corp. (NYSE: GME) and AMC Entertainment Holdings, Inc. (NYSE: AMC). In late 2022, orders placed by retail traders comprised just 15% of total volume. Generally, institutional investors place more emphasis on tangible stock valuation parameters like P/E or price-to-cash flow ratios than retail traders.

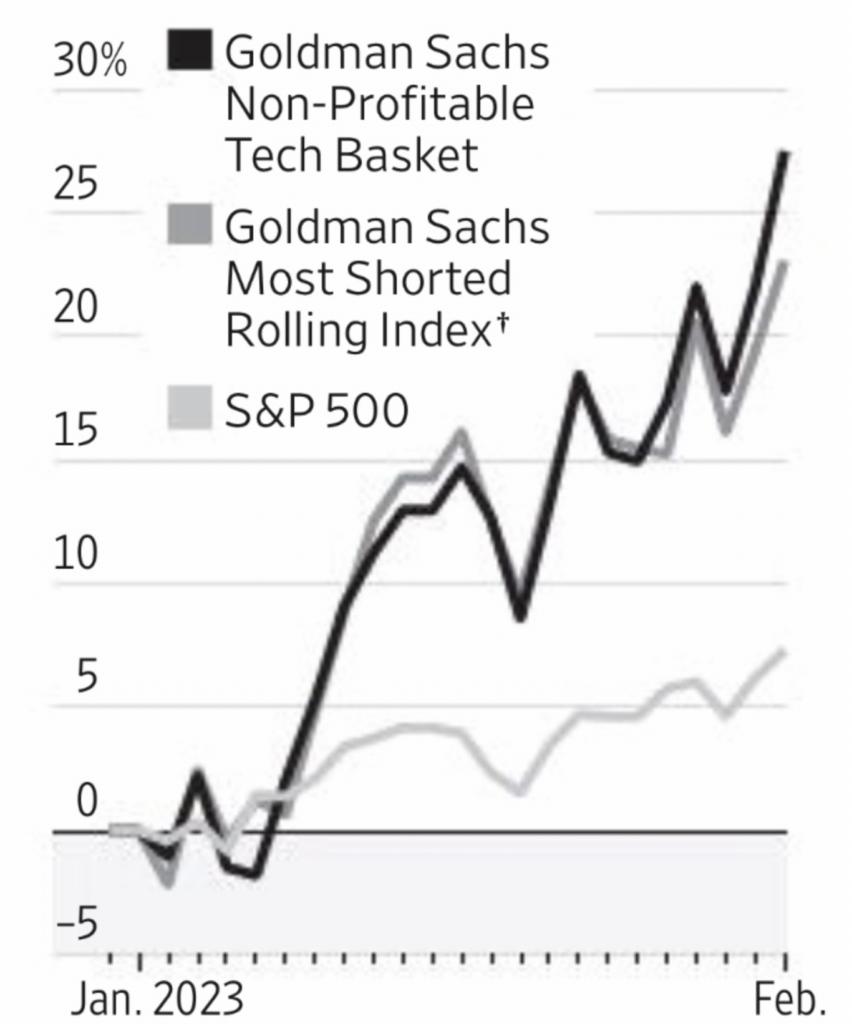

Perhaps reflecting the ascendence of retail traders in the current market environment and their investing appetites which can extend beyond the more rigid rules of institutional investors, non-profitable technology companies and heavily shorted stocks have trounced the S&P 500 Index so far this year.

Second, the Chicago Board Options Exchange (CBOE) reports that daily volumes for S&P 500 Index options with expirations of seven days or fewer reached 1.8 million contracts in 4Q 2022, approximately double the total in 1Q 2022. Much of this volume traces to trading in options on the day of expiration, so-called “zero days to expiry” options. Zero-day options comprised 43% of overall S&P 500 options trading in December. It is difficult not to consider such dramatic growth in zero-day options trading to be very much like “red or black” casino bets.

Investors should be prepared for continued highly volatile trading conditions for at least the intermediate term. The unprecedented large footprint of retail traders seems to ensure such a trading environment, as does the increasing level of zero-day options day trading.

Information for this story was found via JPMorgan and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.