Rio Tinto (NYSE: RIO) became the latest multinational firm to sever ties with Russian businesses. The company is the first major player from the mining industry to announce its stand related to the ongoing war in Ukraine.

“Rio Tinto is in the process of terminating all commercial relationships it has with any Russian [businesses],” said the company spokesman in an emailed statement.

There are no specific details yet on which relationships or what impact would this pronouncement entail. Nevertheless, the Anglo-Australian miner has an 80-20 joint venture called Queensland Alumina Limited with Russia’s Rusal International. Said to be “one of the world’s largest alumina refineries”, Queensland Alumina produces approximately 3.7 million tonnes of smelter-grade alumina annually.

Russian oligarch Oleg Deripaska, a major shareholder in En+ Group International, Rusal’s parent company, has been part of US sanctions since 2018. The UK followed suit on Thursday by announcing a full asset freeze and travel ban on seven Russian oligarchs including Deripaska.

While Rusal holds 20% equity on Queensland Alumina, the aluminium refinery is so far not part of the sanctions imposed by the global community pertaining to the invasion of Ukraine.

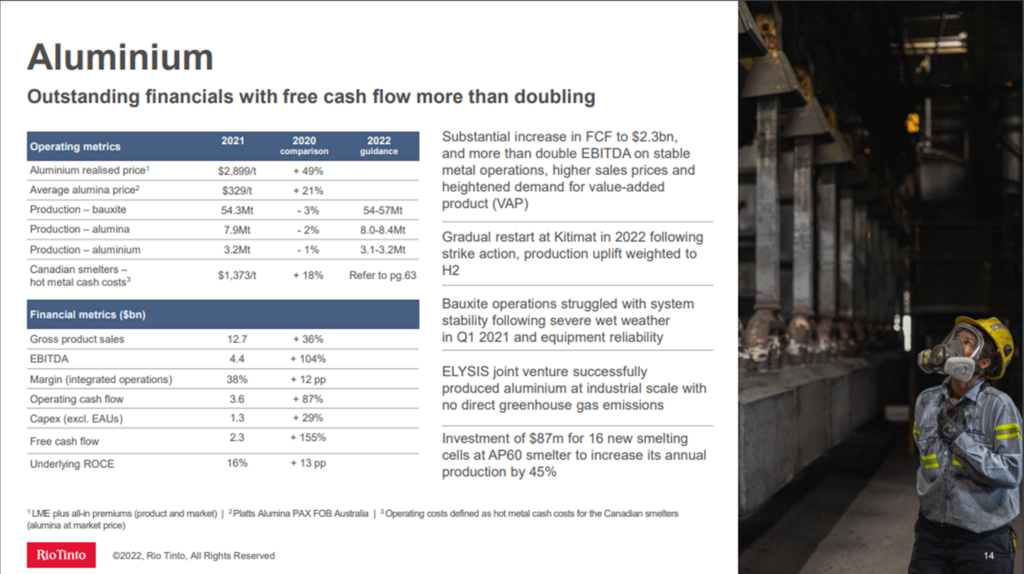

In 2021, the global miner recorded US$66.6 billion in annual sales, US$12.7 billion of which was contributed by its aluminium business unit–its second-largest revenue generator after iron ore.

On Wednesday, however, Rio Tinto’s chief executive of copper business Bold Baatar raised concerns on the possibility of halting energy imports from Russia to power the miner’s Oyu Tolgoi copper project in Mongolia. Bataar relayed that the company is working on searching for alternative fuel sources but admitted it’s hard to stop buying from Russia altogether.

Aluminium prices sharply declined following the announcement but continue to rally following its record-high prices this week.

During the earnings call with shareholders in February 2022, CEO Jakob Stausholm answered a question on aluminium prices pertaining to the Russia-Ukraine conflict, saying “it has the potential to create disruption in

the market”.

“What I’m trying to say is, I think, actually we are – we have tried sanctions before,” Stausholm explained. “I think we are quite well-placed because we have got that integration between bauxite mines, refineries and smelters, so that we would be quite robust if those disruptions take place.”

Rio Tinto last traded at US$74.85 on the NYSE.

Information for this briefing was found via Reuters, Bloomberg, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.