Chilean regulators are worried that Rio2 Limited’s (TSXV: RIO) Fenix Gold Project might be the straw that would break the camels’ (and rodents’) back. The country’s environmental assessor published a recommendation to eject the project over concerns for species of camels and chinchillas.

The Canadian mining firm announced on Thursday that Chile’s Servicio de Evaluación Ambiental (Environmental Assessment Service) released its evaluation report on the project, as the latter seeks to pass the Environmental Impact Assessment (EIA) process. While the report notes that the project “fulfills all the applicable environmental regulations,” it has not provided enough measures to mitigate the possible negative impacts on the country’s fauna.

“It has been alleged that Fenix Gold has not provided enough information during the evaluation process to eliminate adverse impacts over the chinchilla, guanaco, and vicuña,” the company said in its statement regarding the agency’s recommendation to nix the project.

The evaluation report will still be presented to the Comision de Evaluacion Regional, which the company said includes 11 government bodies with “environmental competencies.” The commission will vote to approve or disapprove the firm’s EIA application.

However, the company’s shares sank 57.41% on the day following the announcement.

Fenix’s environmental “hurdle”

The 16,050-hectare Fenix Gold Project is located in Atacama Region within the Copiapo province of Chile, touted to be “the largest undeveloped gold heap leach project in the Americas.”

In the last feasibility study conducted on the property in 2019, the site is estimated to hold 5.0 million gold ounces in the measured & indicated category, as well as around 1.8 million gold ounces of proven & probable reserves.

The plant has a capacity of an average throughput of 20,000 tonnes per day for estimated gold production of 80,000 ounces. Life of mine is expected at around 12 years.

The Canadian mining firm targets the first gold pour at its Chilean site by Q4 2022.

One of the hurdles it has to jump through to reach that goal: the EIA process. Chilean law requires, among others, “mining projects which will produce more than 5,000 tons per month of mineral ore” to undergo the assessment process to be conducted by the Environmental Assessment Service.

The company noted that the indigenous consultation part of the assessment has been concluded, garnering support from all six affected indigenous groups.

But, the commission apparently wasn’t satisfied with the project’s plans to “eliminate adverse impacts over the chinchilla, guanaco, and vicuña.”

The animals that sit on top of the gold

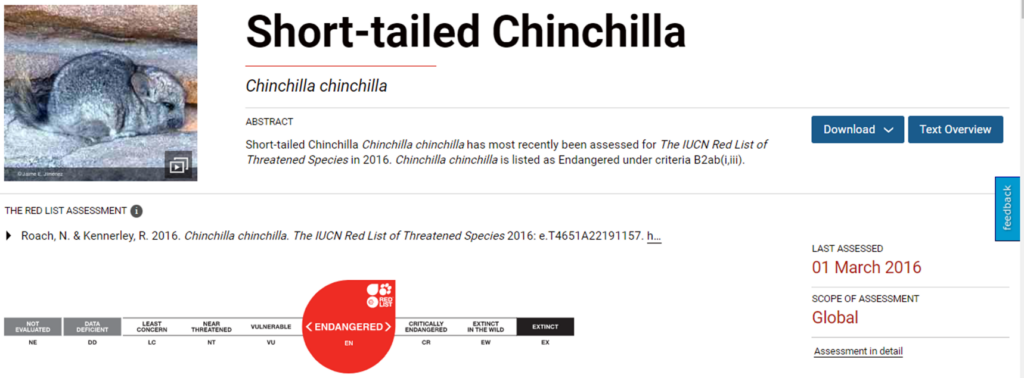

The Chilean chinchilla is a rodent specie that has been classified as endangered by the International Union for Conservation of Nature. The animal has seen its population dwindle as demand for its fur has increased.

In a similar fashion, South African mining firm Gold Fields has undertaken to develop its Salares Norte project within the same Atacama region. The firm also targeted its first gold pour by the end of 2022.

The company also faced the same chinchilla concern from the regulators so it worked with Chilean authorities to devise a relocation plan for the animals. The idea is to relocate 25 endangered chinchillas elsewhere and check their survivability outside their colony atop the Andes mountains.

Out of the first four animals relocated, two died and one got a leg injury.

This raised the alarm for the Chilean regulators, prompting an order to stop the relocation efforts and for Gold Fields to devise a new plan in addressing the chinchilla population concern.

In an interview with Undark, then-CEO Nick Holland claimed that the Chilean government has outlined protocols for the relocation too strictly.

“They said to us that we had to house them in fairly confined areas. We felt that those areas were too small, but we followed the protocol, and unfortunately two died,” Holland said.

But for Chile’s Superintendent for the Environment Cristóbal De La Maza, “all mitigation measures, including the relocation protocol, were proposed by Gold Fields during the environmental assessment of the project.” He added that “if required, new control measures must be established to avoid damage to the environment.”

As of December 2021, the firm’s US$860-million project still hinges on figuring out the chinchilla problem. First gold production has also been pushed to early 2023.

On the other hand, while the guanacos and vicuñas aren’t classified as endangered or threatened and have seen their respective populations increasing, the camelid species are endemic to the Atacama region.

The US$125-to-US$135-million problem

The Canadian gold miner is currently securing a mine financing package of approximately US$125 to US$135 million to help build the Fenix Gold Project.

To finance this, the firm has raised around US$35.1 million through a combination of public offering and private placement in August 2021. It also secured a US$50 million gold stream agreement with Wheaton Precious Metals in November 2021, and received the initial deposit of US$25 million in March 2022.

The remaining US$25 million is expected to be paid to Rio2 “following the receipt of the EIA approval” for the project.

All these financing measures are poised to help the firm secure a US$50 to US$60 million senior debt facility.

“We have completed a comprehensive review of numerous financing options and we are very pleased with the outcome of our process,” said Chief Strategy Officer Jose Luis Martinez. “We have arranged financing with two leading financial partners to fully fund the construction costs at Fenix Gold.”

While waiting for the Comision de Evaluacion Regional’s decision on the project’s EIA, the project is scheduled to be reviewed by the state’s environment assessor on July 1.

But with Chile determined to protect its chinchillas and other endemic animal species–evidenced by a national plan to conserve its population–it seems the future of the gold project is up to the animals.

Rio2 last traded at $0.29 on the TSX Venture.

Information for this briefing was found via Undark, Sedar, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Dude. “The plant has a capacity of an average throughput of 20,000 tonnes per day for estimated gold production of 80,000 ounces. Life of mine is expected at around 12 years.” Production is 48k ozs per year and P&P is 1.8m. How the fuk do you get 12 years out of that? This isn’t rocket science for FUK sakes. You have done this before, what is wrong with you precisely? Are you just lazy, or is it stupidity?

Directly from the company website: “During Year 1 the mine production rate will be ramped up to 20,000 tpd of high-grade ore (> 0.40 g/t) for estimated gold production of 80,000 oz.”