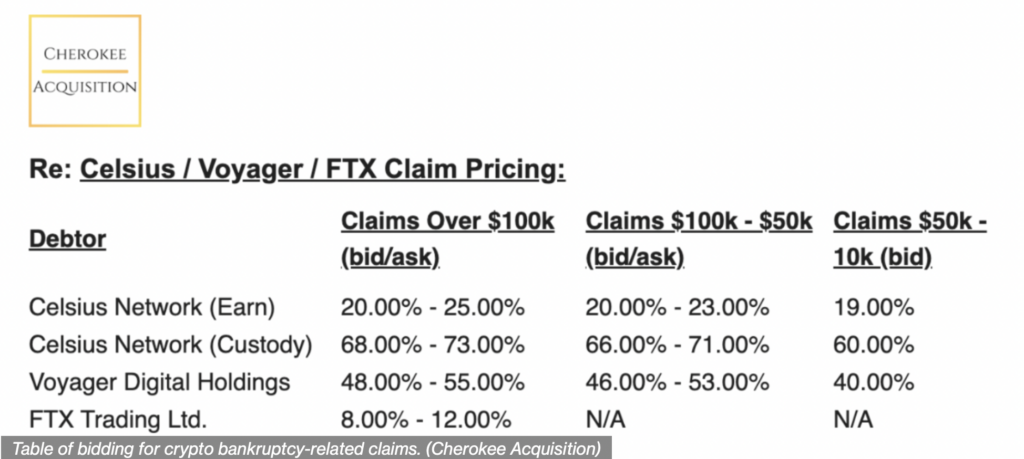

If one acknowledges that the free marketplace is generally the best arbiter of the value of any financial instrument, the bid-ask quotation that a distressed asset investment firm is making for the depositor claims on the failed crypto exchange FTX suggests that FTX account holders may recover very little of their investments. Specifically, the firm Cherokee Acquisition is quoting a price of just 8-12 cents on the dollar for nominal deposit amounts of over US$100,000.

What’s more, the true market might even be lower than a ~10% recovery. One investor told Bloomberg that he bought US$8 million of FTX deposit claims for just three cents on the dollar, or around US$240,000.

Total FTX deposits have been reported to be in the vicinity of US$8 billion, the majority of which are from institutions. Note that the magnitude of FTX deposit losses could exceed the total amount of unsecured claims against FTX. According to its bankruptcy filing, FTX faces US$3.1 billion of unsecured claims.

Note also that the expected recovery percentage for FTX depositors is dramatically less than the expected recovery rate for the users who deposited about US$210 million in the crypto lender Celsius Network. Celsius filed for voluntary Chapter 11 bankruptcy protection in mid-July.

Similarly, investors in another failed crypto lender, Voyager Digital, are expected to recover much more of their capital — in this case, about 50% — than FTX depositors. Voyager also filed for Chapter 11 protection in July. In September, FTX won a bidding war to acquire Voyager’s assets, beating out, among others, rival crypto exchange Binance and the digital asset investment firm Wave Financial. Not surprisingly, Voyager terminated the FTX deal just after FTX filed for bankruptcy.

Separately, and amazingly, embattled FTX founder Sam Bankman-Fried has announced that he still plans to speak at The New York Times’ DealBook Summit on November 30. It is of course unclear how detailed his remarks will be on the causes for FTX’s failure, particularly given the legal jeopardy he seems to be facing.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.