FULL DISCLOSURE: Canacom Group is long the equity of Riverside Resources.

Riverside Resources (TSXV: RRI) has completed the spin-out of Blue Jay Gold Corp, effective as of this morning. The new company is expected to apply to list its shares on the TSX Venture.

“We believe that Blue Jay, with its strong portfolio of Canadian gold assets, dedicated management team, and clean capital structure, is well-positioned for exploration and growth. This spinout not only provides Riverside shareholders with direct exposure to a focused new exploration company, but it also reinforces Riverside’s track record of creating value through strategic actions that serve the company and shareholders,” commented John-Mark Staude, CEO of Riverside Resources.

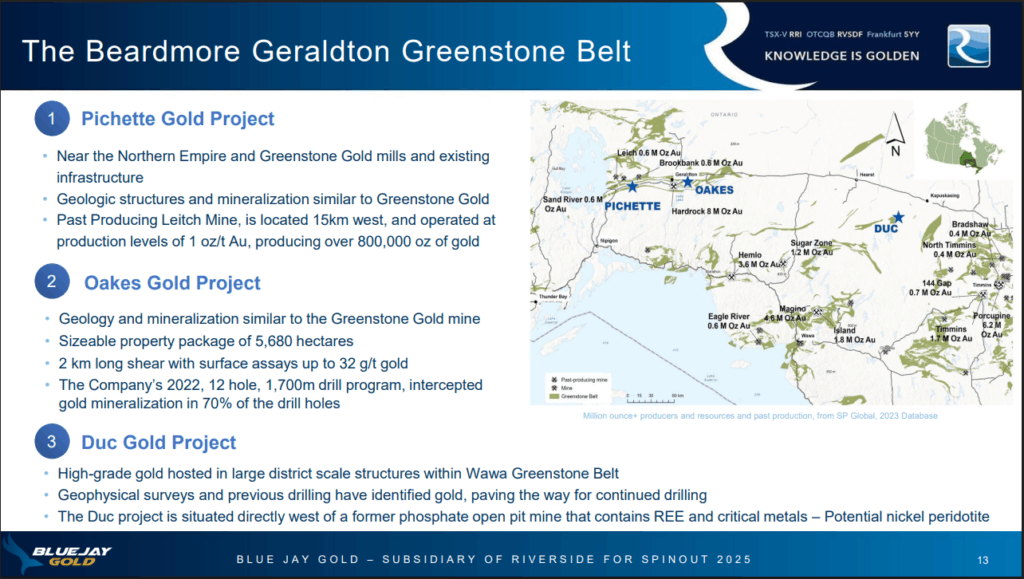

Blue Jay Gold, as part of the spinout from Riverside, will take with it the Pichette-Clist, Oakes, and Duc Gold projects located in northwestern Ontario. Pichette-Clist and Oakes are within proximity to Equinox Gold’s Greenstone Gold Mine, one of the largest open pit mines in Canada, while found on trend with some of the most prolific greenstone belts. The properties are said to be stand-alone assets, which collectively have seen over $8.0 million spent on historical exploration.

“Our initial asset base includes high-quality projects with significant discovery potential and our team brings deep technical expertise, capital markets experience, and a commitment to disciplined exploration. With the strong support of Riverside and our broader shareholder base, we are hitting the ground running, well capitalized and ready to execute,” commented Geordie Mark, CEO of Blue Jay Gold.

Under the terms of the arrangement, shareholders of Riverside will receive one share of Blue Jay for every five shares of Riverside held. Riverside shares are expected to begin trading ex-spinout as of market open on May 26.

Post-spinout, Riverside has indicated that it will continue to focus its efforts on its royalty and project generation model, targeting gold, copper, and rare earths across the Americas.

Riverside Resources last traded at $0.225 on the TSX Venture.

FULL DISCLOSURE: Canacom Group, the parent company of The Deep Dive is long the equity of Riverside Resources. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

One Response

Deep Dive is a great source for news, up to date trends, and key industry information. Thank you to the team of Deep Dive and keep up the good work.