Because of the law of unintended consequences (also known as Murphy’s Law), Rivian Automotive, Inc. (NASDAQ: RIVN) may become a political battleground stock in 2022. The company’s proposed US$5 billion electric vehicle manufacturing facility in the U.S. state of Georgia may have become a key issue in a hotly contested campaign for the state’s Tenth Congressional District’s seat in the U.S. House of Representatives.

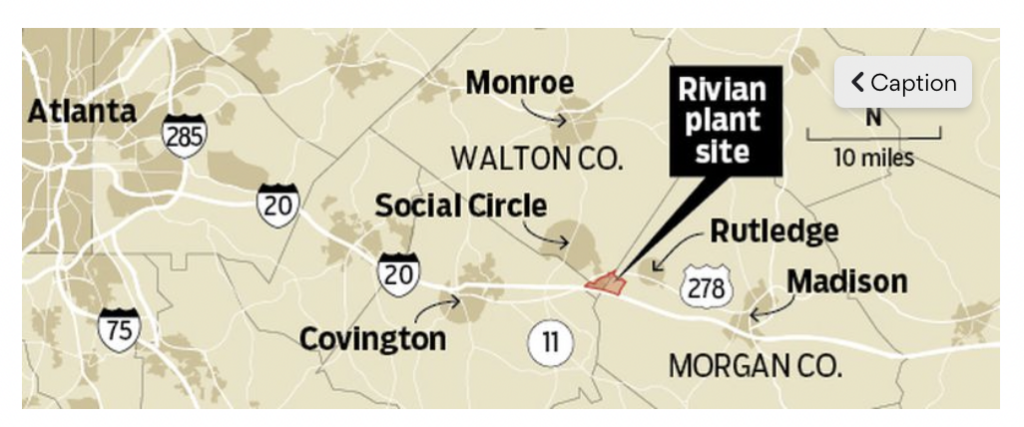

Announced in December 2021, the plant, which will have the capacity to produce up to 400,000 electric vehicles and employ 7,500 people, is considered to be the largest economic development project in Georgia’s history. Construction on the 2,000-acre site is planned to commence this summer, and vehicles may begin rolling off the production line in 2024. The Georgia plant would supplement the manufacturing capacity at Rivian’s existing facility in Normal, Illinois, which has annual capacity of 150,000 units (potentially expandable to 200,000).

The issue is that the predominantly staunch Republican residents in the rural area around the proposed plant fear many aspects of its construction (congestion, dirt, etc.). Many want to stop, or at least delay, the project.

Republicans are seizing on generous, but not-yet fully released incentives that Governor Kemp bestowed on Rivian to secure the deal. Negotiations on some aspects of the agreement are apparently still ongoing; however, some details are leaking out. The governor’s 2022 budget proposal includes US$125 million for the land for the plant and to subsidize training costs for Rivian employees. Overall, media reports suggest the total state and local tax breaks/subsidies will easily surpass US$400 million.

Republican candidates have called the deal “disastrous” and said “the public trust has been violated” given its generous terms.

Separately, and in a testament to the craziness of the markets, Rivian shares this week have jumped about US$7.50, or 12%, primarily on a 13-F filing by billionaire investor George Soros. Mr. Soros bought nearly 20 million Rivian shares in 4Q 2021.

The remarkable aspect of the share price move is that Rivian’s lowest closing price in 4Q 2021 was around US$90 per share, so investors seem to be taking their cues from an investor who, even if he bought all his shares at the US$78.00 IPO price in November 2021, is down a minimum of 15% on his investment in just a few months — if he still owns the shares.

Even if the market were to place no weight on Rivian’s Georgia plant being potentially delayed for political reasons, the stock still looks quite expensive. Its enterprise value is around US$50 billion, yet the company posted a US$776 million operating loss and a US$685 million adjusted EBITDA deficit in 3Q 2021.

Losses are expected to remain very high for many quarters as the company begins the production runs of its vehicles. Rivian likely will be forced to discuss this when it reports its 4Q 2021 earnings on March 10.

Rivian Automotive, Inc. last traded at US$64.50 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.