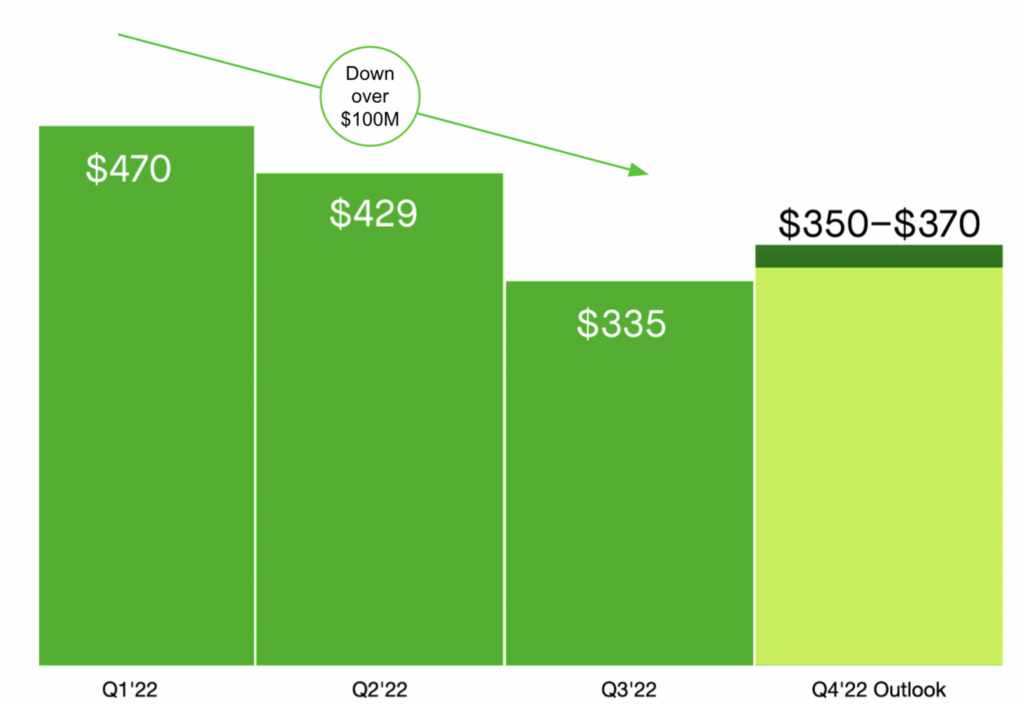

After the market closed yesterday, Robinhood Markets, Inc. (NASDAQ: HOOD) announced 3Q 2022 results which beat analysts’ forecasts on both revenue and earnings (really, losses) per share. The company reported 3Q 2022 revenue and diluted EPS of US$361 million and (US$0.20) versus expectations of US$358 million and (US$0.27), respectively.

The principal reasons for the better performance could be characterized as the opposite of “sexy” for a fintech player which has become a virtual household name: reduced operating costs and higher interest revenue. Its operating expenses before share-based compensation costs and restructuring charges totaled US$335 million in 3Q 2022 versus US$470 million just two quarters ago.

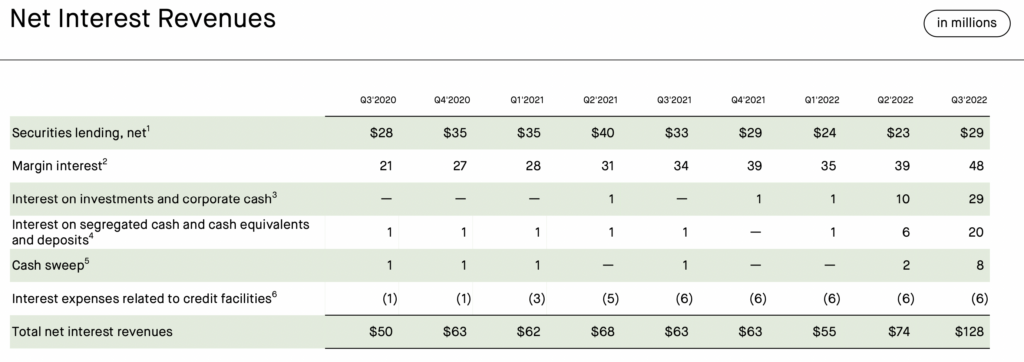

At the same time, Robinhood’s interest income soared US$54 million sequentially in 3Q 2022 as rising interest rates increased the company’s interest earnings on its US$6.2 billion corporate cash balance and on the cash in customers’ accounts. Robinhood was also able to increase the margin interest it charged to its speculative-minded customers.

All this translated into Robinhood’s first positive quarterly adjusted EBITDA, US$47 million in 3Q 2022, since 2Q 2021. The company reported a US$80 million adjusted EBITDA loss in 2Q 2022. (Interest revenue is not adjusted out of a fintech’s earnings to calculate EBITDA.) In addition, Robinhood’s corporate cash balance increased to US$6.187 billion as of September 30, 2022, up US$225 million from US$5.962 billion just three months before.

| (in thousands of US dollars, except where otherwise noted) | Twelve Months Ended 9-30-22 | 3Q 2022 | 2Q 2022 | 1Q 2022 | 4Q 2021 |

| Cumulative Funded Accounts (millions) | 22.9 | 22.9 | 22.8 | 22.7 | |

| Sequential Growth | 0.0% | 0.4% | 0.4% | 1.3% | |

| Monthly Active Users (millions) | 12.2 | 14.0 | 15.9 | 17.3 | |

| Sequential Growth | -12.9% | -11.9% | -8.1% | -8.5% | |

| Assets Under Custody (US$ billions): | |||||

| Equities | $51.0 | $51.2 | $68.5 | $72.1 | |

| Options | $0.0 | $0.5 | $1.1 | $2.0 | |

| Cryptocurrencies | $9.0 | $8.6 | $19.7 | $22.0 | |

| Net Cash Held by Users | $4.0 | $3.9 | $3.8 | $2.0 | |

| Assets Under Custody (US$ billions) | $65.0 | $64.2 | $93.1 | $98.1 | |

| Sequential Growth | 1.2% | -31.0% | -5.1% | 3.3% | |

| Trading Volumes: | |||||

| Equity (US$ billions) | $161 | $163 | $189 | $240 | |

| Option Contracts (millions) | 235 | 210 | 237 | 291 | |

| Cryptocurrencies (US$ billions) | $15 | $19 | $23 | $44 | |

| Average Account Balance (US$) | $2,838 | $2,803 | $4,083 | $4,322 | |

| Sequential Growth | 1.2% | -31.3% | -5.5% | 1.9% | |

| Average Revenue Per User (US$) | $63 | $56 | $53 | $64 | |

| Sequential Growth | 12.5% | 5.7% | -17.2% | -1.5% | |

| Options PFOF Revenue | $527,000 | $124,000 | $113,000 | $127,000 | $163,000 |

| Cryptocurrency PFOF-Type Revenue | $211,000 | $51,000 | $58,000 | $54,000 | $48,000 |

| Equities PFOF Revenue | $148,000 | $31,000 | $29,000 | $36,000 | $52,000 |

| Other PFOF Revenue | $6,000 | $2,000 | $2,000 | $1,000 | $1,000 |

| PFOF or PFOF-Type Revenue | $892,000 | $208,000 | $202,000 | $218,000 | $264,000 |

| All Other Revenue | $449,000 | $153,000 | $116,000 | $81,000 | $99,000 |

| Net Revenue | $1,340,713 | $361,000 | $318,000 | $299,000 | $362,713 |

| Sequential Growth | 13.5% | 6.4% | -17.6% | -0.6% | |

| Adjusted EBITDA | ($262,844) | $47,000 | ($80,000) | ($143,000) | ($86,844) |

| Cash | $6,187,000 | $5,962,000 | $6,191,000 | $6,253,477 | |

| Debt – Period End | $160,000 | $154,000 | $203,000 | $151,000 | |

| Shares Outstanding (millions) | 884.8 | 878.3 | 869.8 | 863.9 |

More typical fundamental metrics were far less inspiring. Robinhood’s monthly active users (MAU) plunged 13% to 12.2 million in 3Q 2022 from 14.0 million in 2Q 2022. MAU totaled 21.3 million in 2Q 2021.

The company’s assets under custody inched up to US$65.0 billion from US$64.2 billion a quarter ago, and Robinhood customer’s average account balance at September 30, 2022 was US$2,838, up US$35 from three months before. More constructively, Robinhood’s average revenue per user rose to US$63 in 3Q 2022 from US$56 in 2Q 2022. However, this reading is still far away from the US$112 reported in the happier days of 2Q 2021.

Robinhood’s stock market capitalization is about US$10 billion, US$6 billion of which is supported by its net cash position, making its enterprise value only around US$4 billion. With its cash flow improving in spite of lackluster conventional operating metrics, it would seem prudent, at the least, to consider covering Robinhood short positions.

Robinhood Markets, Inc. last traded at US$12.54 on the NASDAQ.

Information for this briefing was found via the SEC and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.