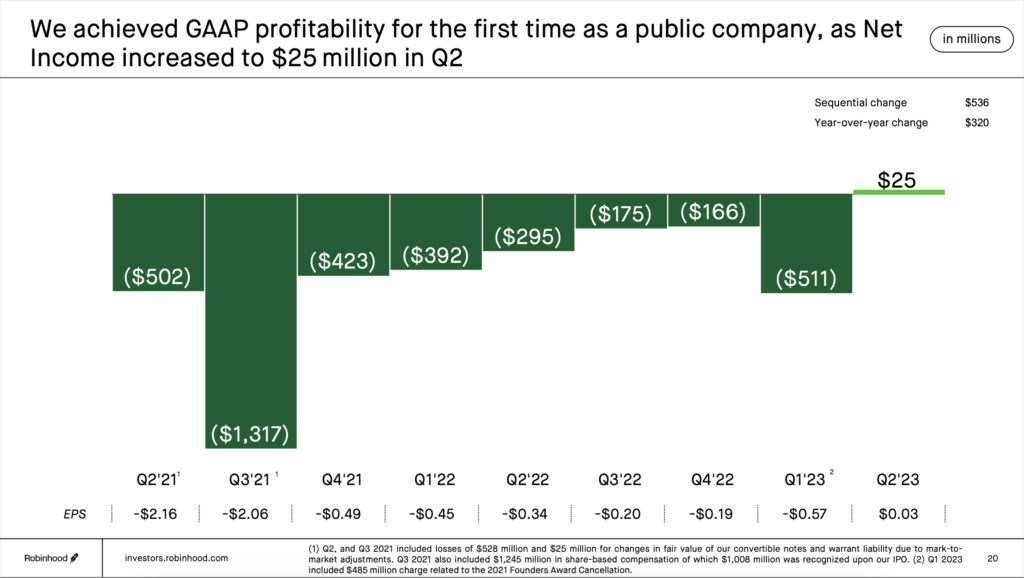

Robinhood Markets Inc. (NASDAQ: HOOD) posted better-than-expected second-quarter earnings on Wednesday, surprising analysts despite a drop in transaction sales and monthly active users. The stock-trading app’s management also revealed plans to cut expenses for the year ahead, which provided a boost to investor confidence.

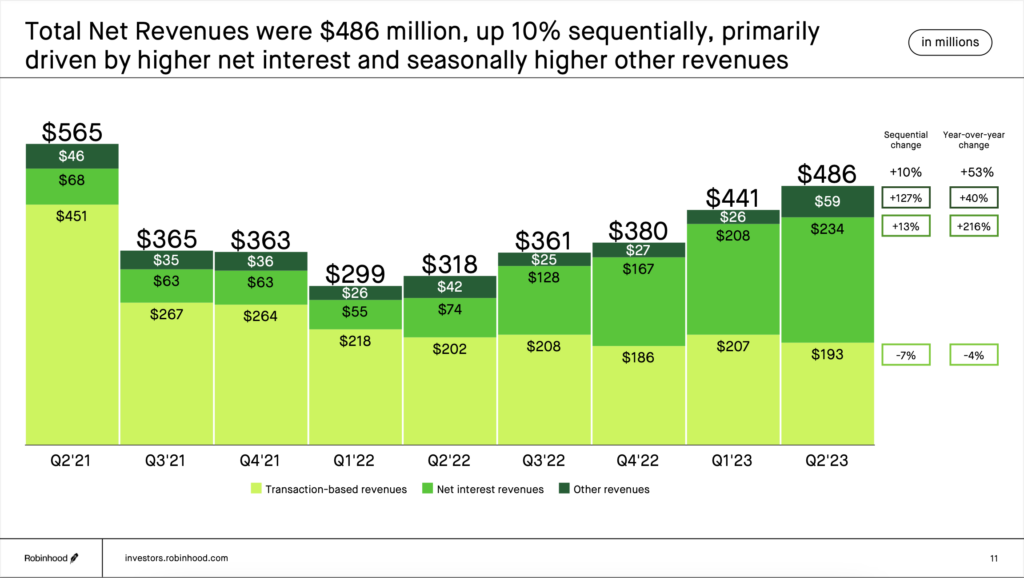

While the company reported a net income of $25 million, or $0.03 per share, in the second quarter, a remarkable turnaround from the loss of $295 million, or $0.34 per share, during the same period last year, the revenue figures were equally impressive. Robinhood’s revenue rose to $486 million, compared to $318 million in the prior-year quarter, exceeding the expectations of analysts polled by FactSet, who had predicted an adjusted loss of $0.01 per share and revenue of $473 million.

However, it wasn’t all positive news for Robinhood. The company experienced a drop in transaction revenues and monthly active users from the previous quarter. Transaction-based revenues for options, crypto, and stocks declined, and the monthly active users decreased by 1 million to 10.8 million.

This led to a 7% sequential decrease in transaction revenue, which impacted the company’s stock performance post-earnings announcement. Despite rising 20% in the past month, Robinhood’s shares fell 6% after hours. The stock has experienced a substantial drop of over 60% from its initial public offering price in 2021 due to reduced customer activity following the pandemic-induced stock trading frenzy.

Analysts, such as Third Bridge’s Andrew McGee, expressed concerns about re-engaging users, especially those who left during the GameStop incident, citing a lack of trust in the company.

“MAU’s [monthly active users] were highlighted as the highest-risk area for Robinhood by our specialists due to historical trends demonstrating that when retail traders lose significant amounts of money, they never come back,” he said. “Additionally, the specialists believe the customers that left during the GameStop incident won’t return due to a lack of trust in the company.”

In the second quarter, net interest revenue experienced a remarkable 243% increase, reaching $442 million compared to the same period the previous year. This surge can be attributed to the brokerage’s margin investing business, which profited from the U.S. central bank’s efforts to combat historically high inflation through a monetary policy tightening campaign.

Robinhood now makes much more collecting interest on client cash than from its so-called business.

— zerohedge (@zerohedge) August 2, 2023

This is $234 million that RH's customers should be collecting but they'd rather hand it to Vlad pic.twitter.com/mOQFwLQzwk

Robinhood is also testing a new 24-hour trading feature, which has seen promising results, particularly during earnings season. While specific data on after-hours trading activity and volume were not disclosed, customers can now trade 52 stocks around the clock, five days a week.

Traditionally, Robinhood earned most of its revenue from customer transactions, but with trading slowing down, the company has diversified its revenue streams. Interest on customer deposits and other cash has become an increasingly significant source of revenue, with net interest income rising by 13% sequentially.

Additionally, Robinhood has ventured into the retirement market, attracting over 325,000 customers with its new offering. The company matches 1% of customer deposits in their retirement accounts and now offers a 3% match for its paying gold members.

However, challenges arise from the Securities and Exchange Commission’s (SEC) recent crackdown on cryptocurrencies. Robinhood faces potential risks and opportunities in this regard. In response to the SEC’s actions, the company delisted some coins during the second quarter. CFO Jason Warnick declined to comment on their discussions with the SEC regarding their coin listings, acknowledging the complexities involved.

Despite the challenges, Robinhood remains optimistic about the future. The company expects its total operating expenses for the year to range between $2.33 billion and $2.41 billion, with the midpoint slightly better than earlier projections. Additionally, Robinhood has been proactive in expanding its offerings, including 24-hour trading, five days a week, retirement IRA savings services, and a no-fee credit card platform acquired in July. Moreover, the company is on track to launch brokerage services in the U.K. by year-end.

In relation to its shares, Robinhood is actively pursuing the purchase of 55 million shares bought by Emergent Fidelity Technologies, a company co-founded by FTX founder Sam Bankman-Fried, last year. The discussions are ongoing, and Robinhood will provide updates as necessary.

Despite the mixed performance, Robinhood’s shares have performed well this year, climbing 53.8% year-to-date, outpacing the S&P 500 Index’s 18.1% gain over the same period. As the company continues to navigate challenges and expand its offerings, investors will closely monitor its progress in the coming quarters.

Information for this briefing was found via MarketWatch, Yahoo Finance, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.