As Robinhood’s fall from grace continues, it appears that the popular trading app has been hit with yet another grievance after a San Francisco federal court filed a class action lawsuit for failing to inform users about back-door commission fees.

Atop a similar complaint filed by securities regulators in Massachusetts regarding the manipulation of inexperienced investors, which was then followed by a $65 million SEC settlement that alleged Robinhood failed to disclose its revenue sources to customers, the trading app is now facing a class action lawsuit in San Francisco that claims the distraught company failed to notify its users it was selling their stock orders to trading firms and then charging them back-door commission fees.

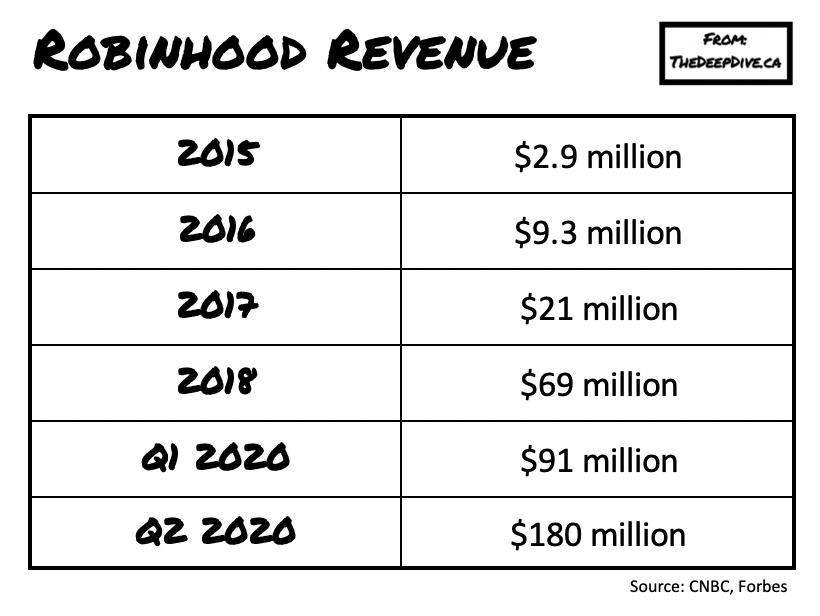

Although Robinhood proclaimed on its platform that all trading is “commission free,” it did not disclose its extensive reliance on “payment for order flow,” where it collected money from market makers in exchange for executing trades. Those fees that were initially passed onto market makers were then transferred to Robinhood’s clients via inferior execution quality– which is the price at which the market orders were executed, alleges the suit.

Robinhood has yet to respond to the suit, but following its previous settlement with the SEC, the trading app agreed to monitoring by an outside consultant in order to ensure it is following the rules. Although Robinhood agreed to the settlement, it did not deny or confirm the regulator’s claims, only noting that it has turned a new leaf and is now fully transparent with its customers.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.